Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Distressed assets (part 3): The unique opportunity of Latin America

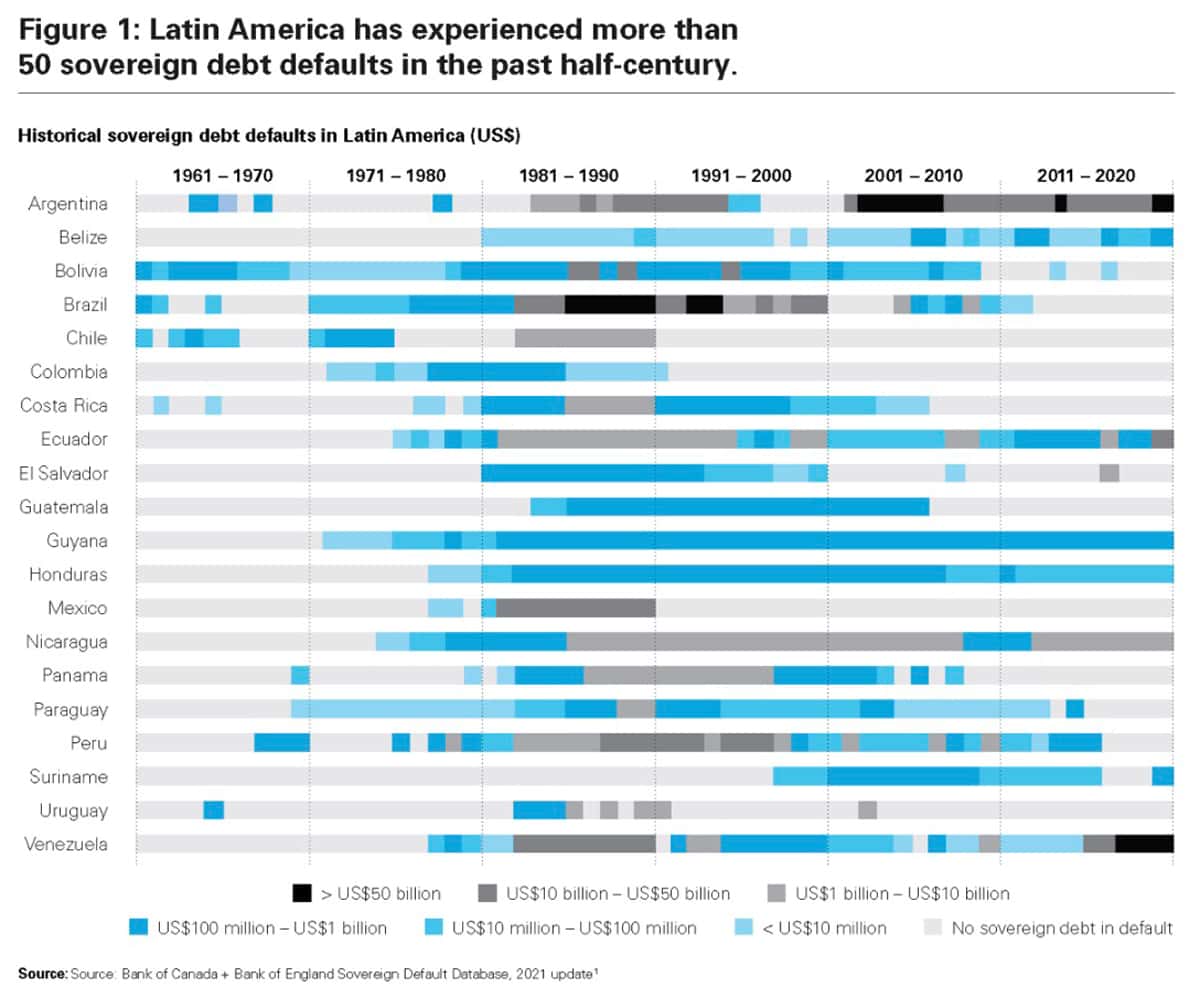

Over the past 50 years alone, the Latin American and Caribbean region has experienced at least 50 sovereign debt restructurings.

However, the region has also evolved and progressed. As a result of these changes, there are some surprising metrics that investors should pay attention to.

Latin America makes for a compelling investment environment for anyone who likes distressed assets.

Venezuela and Argentina show the way

Undervalued-Shares.com has long had a soft spot for investing in Latin America. This included investing in truly distressed assets, such as Venezuela and Argentina.

Distressed Venezuelan debt has been in the news lately because of the legal developments surrounding a USD 20bn asset that the country's government owns in the US, refinery and petrol station company Citgo. Following years of legal wrangling, some of the holders of Venezuela's USD 150bn defaulted debt managed to get a court order to have the highly profitable US asset seized and sold off for the benefit of creditors.

The looming confiscation of their valuable US asset got the Venezuelan government back to the negotiating table, and prices for distressed Venezuelan debt claims skyrocketed as a result. I had first reported about this possibility in my 26 August 2022 Weekly Dispatch "Venezuela – a multi-bagger recovery play?". The article featured Rusoro Mining (ISIN CA7822271028, CA:RML), a dormant Canadian company with claims totalling USD 1.7bn and a relatively illiquid stock. The share price rallied as much as 628% of late, thanks to the Citgo case.

Undervalued-Shares.com Lifetime Members also got to read about Gold Reserve Inc. (ISIN CA38068N3067, US OTC:GDRZF, CA TSX:GRZ), another Canadian company with a more liquid stock. The report was released just in time for Lifetime Members to hover up stocks for a few weeks before the price got moving. It's currently up 198% (and could have further to go due to its little-known legal claims to a massive Venezuelan gold deposit).

Gold Reserve Inc.

Venezuelan debt claims were a little-known asset class. I am convinced that during the second half of 2022, a few specialised investors had a strong hunch that the Citgo legal case was going to bring about game-changing developments, and loaded up before the wider market got wind of it. Because this asset class is so opaque, a few clever investors with deep ties in the region will have enjoyed a real edge.

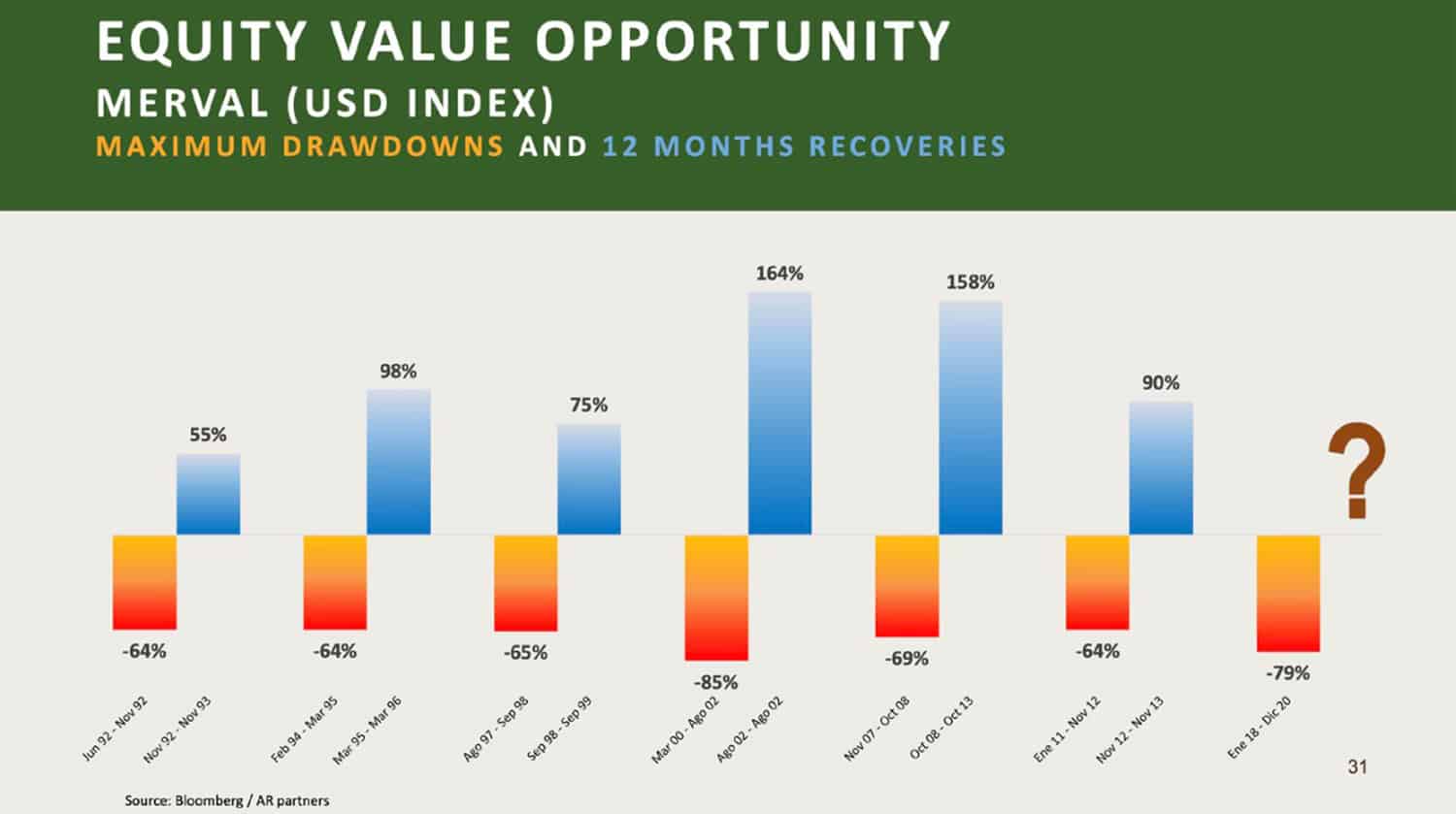

A more conventional distressed asset play was my delving into Argentinean equity in spring 2021. The country at the southern tip of Latin America is one of the world's best-known serial bankrupts, and Argentinean equities were trading at real sell-out prices. I latched onto it at the time because I knew that for all its past faults and repeated fiscal failures, Argentina's stock market reliably recovered after each mega-crisis, as the following graph nicely illustrates.

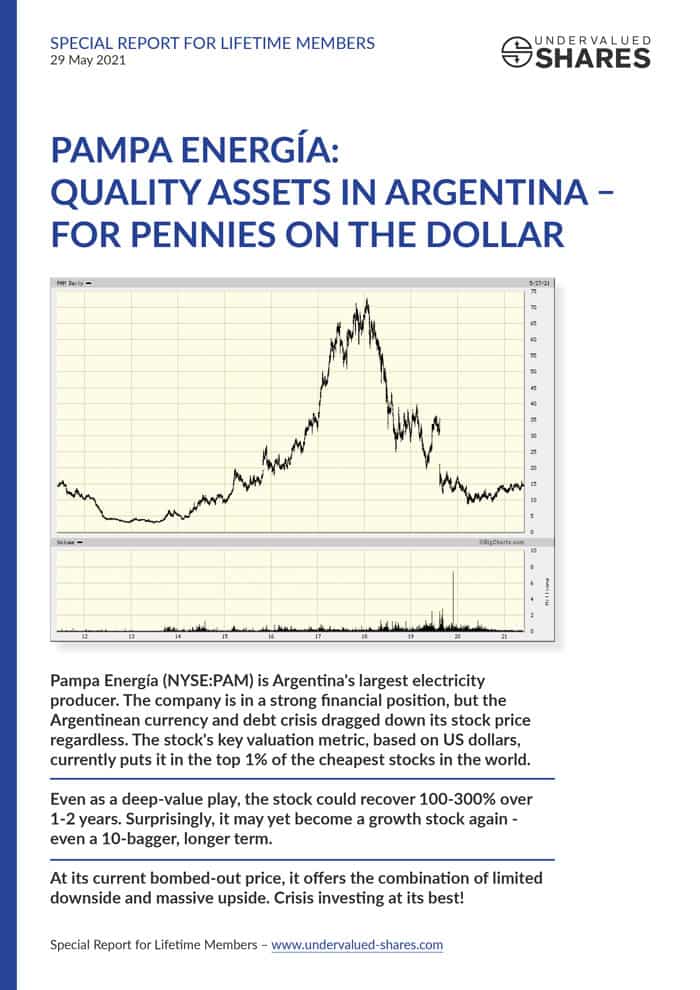

In May 2021, I had pointed Undervalued-Shares.com Lifetime Members towards Pampa Energía (ISIN US6976602077, NYSE:PAM), Argentina's largest electricity producer which provides 12% of the country's energy needs. Because of a quirk in the country's energy laws, the company was generating a large chunk of its income in US dollars rather than Argentinean pesos. At the time, the stock was trading at just 2.2 times EV/EBITDA, which put it in the top 1% of the cheapest stocks in the world. This was a liquid stock to invest in via the New York Stock Exchange, and it's now up 200%.

What didn't do quite as well as hoped was CRESUD (ISIN US2264061068, NYSE:CRESY), a company that owns both vast amounts of Argentinean farmland and a lot of prime real estate. I pointed out the company as a combined proxy of the bombed-out Argentinean economy and a hedge against rising food prices. My April 2021 report for Undervalued-Shares.com Members featured the stock at a price of USD 4.64, and it did in fact rally to as high as USD 9.50 in the meantime. However, it subsequently fell back to USD 4.50, and it's currently trading at USD 7.72. While this is a nice gain, it's way below the hopes and expectations that I had for this gem of a company when we picked it up at a highly distressed level.

Overall, distressed assets in Latin America are something I have done well in. In many ways, it ticks many of the boxes that readers of Undervalued-Shares.com are typically interested in:

- Many individual countries, political systems, and legal systems. Such diversity inevitably creates a fertile hunting ground for finding ideas that others have overlooked.

Over the past 50 years, Latin America has experienced more than 50 sovereign debt defaults (click on image to enlarge).

- Underresearched equities, due to underdeveloped, often smaller markets.

- Easy enough to get exposure to, because there are many companies listed in the US or Canada that are either based in or have strong exposure to the region.

Part 1 of this series summarised why Rebecca Pacholder of Snowcat Capital expects a new super-cycle for distressed asset investing in the US, while part 2 showed why António Batista of Caius Capital sees manifold opportunities in Europe.

Where will the next set of opportunities in Latin America come from, and how can investors take advantage of them?

The case for high-yield investing

Venezuelan debt claims and bombed-out Argentinean companies will be too speculative for many investors. Indeed, there is an interesting alternative for those who are either more conservative or who simply cannot make the time to research and manage such niche opportunities.

High-yield investing refers to investing in lower-grade bonds and other interest-paying securities, such as corporate loans backed by the borrower's assets ("secured notes") and other private credit instruments.

A lot has been written recently that Western countries have become more like emerging markets in some aspects. Vice versa, many emerging markets have become a bit more like developed markets over the past two decades, at least in some respects.

Source: Financial Times, 3 August 2023.

Indeed, Latin American companies tend to have much more prudent balance sheets and tighter lending standards than an outside observer would expect based on the region's volatile financial history.

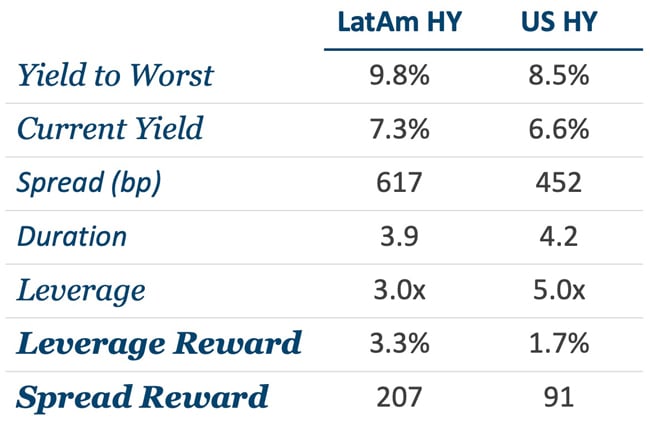

This has led to an interesting mispricing in the market. When you compare Latin American and US companies, it emerges that – relatively speaking – Latin American debt offers a more attractive combination of yields, corporate debt leverage, and debt duration. Put another way, if you go for corporate high-yield instruments, you may well want to look to Latin America rather than the US. The following table summarises the bigger picture (while the underlying data is of 30 April 2023 and will have changed somewhat, the figures are still directionally accurate).

Source: Moneda Asset Management.

The counter-argument is of course to point towards Latin America's complexities, vagaries, and rogueries. The region is rife with political instability, left-wing ideology, corruption, and other idiosyncratic risks. Analysing investment opportunities in its 12 countries requires someone to stay on top of often fast-moving developments. From my own time of working in Ecuador for four years, I can tell a tale (or two) of how being part of a country's elite will put you in a true insider position – one where you have advance knowledge of major political developments, sometimes weeks or even months before the story breaks publicly. If you dip your toes into this region, you will be up against the members of such well-informed elites. Latin America may have underdeveloped capital markets, but it's competitive nonetheless.

As shown during the first two parts of this series, private investors also have the option to get exposure to distressed assets through funds, rather than try and manage these investments themselves.

During my research, I found one fund that has repeatedly demonstrated that Latin America is a region where experienced, well-connected fund managers can gain an edge and beat the market: the Moneda Latin American Corporate Debt Fund (ISIN KYG620101066), managed by Moneda Asset Management in Chile. Throughout its 23-year history, the fund has had a 10.8% p.a. net annual return. During the same time, its benchmark, the Bloomberg Global High Yield index, has generated a 6.6% p.a. net return. The Moneda Latin American Corporate Debt Fund is solely focused on exploiting the inefficiencies of the Latin American distressed debt market, and its return has been very attractive both in absolute and relative terms.

How did they do it?

Moneda's CIO of LatAm Fixed Income Strategies, Fernando Tisné, has created a USD 3bn operation that is capable of structuring large and complex transactions. In short, they dig deeper and can go where there is less competition. As a mere example, less sophisticated players in this market may simply buy the bonds of leading corporations, such as Cemex in Mexico. More sophisticated players, on the other hand, will look into opportunities such as lending to a supplier of Cemex. This could bring a significantly higher yield and better terms on collateral, while effectively investing in the same underlying business.

Private investors would struggle to ever get exposure to such opportunities. Undervalued-Shares.com primarily reports about equities, but there are occasions when going through a fund is the better option (and, certainly, less time-consuming). The Moneda Latin American Corporate Debt Fund is available as a Cayman Island offshore fund with a minimum investment of USD 100,000; further information is available through the company's website, where accredited investors can ask for a copy of the firm's investor presentation (which in itself is a highly interesting document).

However, as yet another alternative and one that some equity investors will take a stronger liking to, you could also simply invest into the manager itself, Moneda Asset Management. While the company itself isn't listed on the stock market, the company that now owns this manager is!

A backdoor route to investing in LatAm distressed assets

Anyone who invests in funds should always consider if investing in the fund manager isn't actually the more interesting option.

Case in point, the stock of Blackstone (ISIN US09260D1072, NYSE:BX), now one of the world's largest fund managers. In 2009, it was trading at USD 5. Following the massive growth of alternative asset classes during the 2010s, it is now trading at USD 100. It's up 20 times, which (to my knowledge) beats the performance of any of the funds managed by Blackstone. Why be a client, if you can align yourself with the principal? To this day, the vast majority of investors don't seem to fully understand the difference between a fund manager (= charging fees on client monies) and funds (= entities that manage client monies).

Blackstone.

Investing in high-yield products in Latin America is interesting in its own right, but may be even more interesting if you latch onto fund managers that charge fees on client monies invested in these markets. Case in point, Patria Investments (ISIN KYG694511059, Nasdaq:PAX), a fund manager that is focused on Latin America and manages funds in private equity, infrastructure, real estate, and credit. Their portfolio of funds includes investments in distressed assets.

The firm has about USD 30bn in client assets under management, which includes the ≈USD 10bn of client assets managed by Moneda Asset Management, a significant part of which is in the distressed sector or benefits from Latin America's status as a less-developed financial market where issuers are forced to offer higher yields.

In late 2021, Patria Investments acquired 100% of Moneda Asset Management. With its current base of client assets, Patria Investments is one of the largest such firms in Latin America, but it's still relatively small compared to the overall size of its home markets and their growth dynamics.

Latin America currently represents 6% of global GDP, but its share in private market financial products is only 1%. Some will argue that Latin America is where the US was a bit over a decade ago, and that's an argument that Undervalued-Shares.com has a lot of sympathy for. This website previously featured MercadoLibre (ISIN US58733R1023, Nasdaq:MELI), a leading Latin American e-commerce company that benefits from the region's market penetration of e-commerce basically being where the US was around 2010.

Does Latin America offer the equivalent to travelling back in time and investing in stocks like Amazon and Blackstone at 2010 prices?

To be realistic, the region will never catch up with the US in key aspects, such as the security of legal systems or the scale of the domestic market. However, Latin America does have demographics and other factors working to its favour, such as its rich resource reserves, its relative geopolitical stability, and the new trend of moving manufacturing back from Asia to places like Mexico. In the current political climate, in particular, it's noteworthy that Latin America is one of the few places on the planet that generally doesn't get involved in global conflict.

Since its IPO in January 2021, the stock of Patria Investments has trended downwards. This shows that operating in a large, underexploited market isn't sufficient for a company to be an attractive investment case. Patria Investments, too, has been affected by the changing interest rate environment, and it recently cut its dividend payment. However, the firm does come with the benefit of management owning 60% of the stock, which provides a very strong alignment of interest between insiders and minority investors. Also, Blackstone continues to own 12%, which is an indication that the big guys in the US recognise the catch-up potential of the region that lies to the south.

I haven't done a conclusive analysis of Patria Investments, but it's a prime example of the kind of opportunity that exists in Latin America in general – and a potentially clever backdoor route to benefit from the ongoing opportunities in the region's distressed asset sector.

Outside of all this, no article about distressed assets in Latin America would be complete without touching on…

The latest Argentinean opportunity

Over the next couple of months, the next big opportunity in Latin American distressed assets that private investors can take advantage of is Argentina. Much as many Argentinean stocks have doubled or tripled from their lows, they still mostly remain 50-80% below their 2017 highs.

CRESUD.

I don't have much to write about the economic woes of Argentina, given how well documented they are across the popular media. The country would have all the necessary ingredients to make for a prosperous, happy nation, such as resources, youth, and a location far away from the world's political trouble spots and wars. However, its people again and again voted for socialists to run their country, and this led to the developments that inevitable happen when you put left-wing do-gooders into a position of power. They eventually run out of other peoples' money and the entire system comes to a standstill.

Massive change could be on the horizon, though, which is something that I had fabulated about in my March 2021 report on CRESUD:

"You could say Argentineans aren't all the different from everyone else, but merely ahead of other countries by a decade or two. In Argentina, no one trusts politicians anymore. Everyone realises that serious change will only take place once you replace the semi-permanent class of politicians and bureaucrats. By now, most Argentineans will instinctively know that resetting the financial and political system from scratch will be the only way to achieve a sustainable turnaround.

Could Argentina be a country where something new emerges, ahead of other countries? … Given the country's troubles, I have long wondered if the Argentineans will eventually pull off a surprise move."

That surprise move has now appeared in the shape of Javier Milei, a libertarian candidate for the country's presidency. After appearing out of nowhere, he is currently leading the presidential race.

A 14 August 2023 research note by Latin Securities summarised just how stunning Milei's first electoral victory was:

"Libertarian leader Javier Milei, aka 'the lion', secured 30% of the votes, exceeding all predictions. He not only individually defeated all the candidates, but his party, LLA, outperformed JxC (28%) and UPP (27%). Furthermore, he was the most-voted candidate in 16 of the 24 provinces, even where JxC or UPP were historically considered 'invincible.' Milei's achievement is even more remarkable considering that he lacks a political structure like his opponents and did not have competitive candidates in the recent provincial elections. He also lacked the endorsement of polls, which on average estimated him to receive just under 20% of the votes, which assumed he would have been the second-most voted candidate behind SM. His speech against politicians, heavy taxation, excessive fiscal spending, rampant monetary printing, and his proposal for dollarization had a more significant impact than expected by pollsters."

Obviously, a libertarian who wants to scorch the deep state is not news that would be welcomed by all. When it emerged that Milei had won the primaries, the Argentinean stock market initially plunged by 3.7%. The mainstream media were aflutter about the dangers that the presidential candidate allegedly posed, and comparisons to Donald Trump did not stop at Milei's quirky hairstyle.

Milei's programme is very much about re-booting the entire system, and it includes promises to:

- Fire most government employees.

- Privatise state-owned enterprises.

- Eliminate the central bank.

Many of you might instinctively wonder: "If these are his promises, why didn't the market RALLY instead of plunging?". It seems like an oxymoron to say that asset prices have fallen because a free-market guy has won.

Undervalued-Shares.com would ask exactly the same question, and point towards the US market's initial fall of 4% upon Trump's 2016 win, before delivering the best four-year performance under any Republican president during the preceding 96 years.

Politics is a polarising subject, and there'll be strongly divergent views of Milei's likely effect on the Argentinean stock market should he win. Besides, there is the aspect that Milei will have everything and the kitchen sink thrown at him to prevent him from winning. Is his taking office even a real prospect at all?

Still, the Argentinean market has been put back in play by his winning the primaries, and there'll be a lot of attention focused on this market between now and the 25 October election. In a market where many assets continue to trade at distressed valuation, this makes for an interesting mix to keep an eye on. Notably, after the initial plunge of 3.7%, the stock market closed the day up 3.3%.

Both CRESUD and Pampa Energía remain stocks worth looking at. They continue to be significantly undervalued, albeit for different reasons and with Argentina's current political backdrop only being a part of the attraction. Thanks to their US listings, both stocks are also well-known among international investors. If Argentina sees a wave of speculative buying ahead of the election, CRESUD and Pampa Energía should do well in their role as proxy for the entire market.

Although permanently distressed in some shape or form, Argentinean stocks regularly make for stunning outperformance (as demonstrated by the graph of the market's cycles further above).

So many opportunities

As I was researching today's Weekly Dispatch, I was struck by just how large and diverse the distressed asset opportunity of Latin America is. Whether it's high-yielding loans tied to major corporations or quirky niche assets such as Venezuelan debt, there are many sub-themes to be exploited. As stated at the outset of this series, distressed assets are not something that most private investors would be overly familiar with, and this lack of interest only further aides my point.

Latin America's economies and financial markets have matured to an extent, as seen by the much-improved balance sheets and leverage ratios mentioned above. However, the region hasn't matured to a degree where those dislocations won't occur anymore. Many investors also continue to have misconceptions, such as that liquid bonds of major corporations are the best ways to get exposure, when actually there are even more interesting alternatives for those who have boots on the ground and highly specialised expertise.

Someone else should set up a blog that focuses on nothing else but this sector. They'd never run out of opportunities for exciting research and content.

Blog series: Distressed assets

There's more to "Distressed assets" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Pampa Energía: still worth looking at

The stock of Argentina's largest electricity producer is up 200% since May 2021 – and it continues to be significantly undervalued.

Argentina's political backdrop is only part of the stock's attraction. However, if the country sees a wave of speculative buying ahead of the election, Pampa Energía should do well in its role as proxy for the entire market.

With listings on multiple exchanges (including on the New York Stock Exchange), this stock is easily accessible for international investors.

Pampa Energía: still worth looking at

The stock of Argentina's largest electricity producer is up 200% since May 2021 – and it continues to be significantly undervalued.

Argentina's political backdrop is only part of the stock's attraction. However, if the country sees a wave of speculative buying ahead of the election, Pampa Energía should do well in its role as proxy for the entire market.

With listings on multiple exchanges (including on the New York Stock Exchange), this stock is easily accessible for international investors.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: