Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Gazprom has gone vertical – which other bombed-out energy stock to look at next?

It's not long ago that Gazprom (ISIN US3682872078) was trading at bargain basement prices. Everyone agreed that the stock was extremely undervalued. However, most investors simply couldn't get themselves to consider the stock. Russia was seen as toxic, Gazprom stock as a value trap.

How times change. For 2021, Gazprom is projected to pay a dividend of USD 1.19 per ADR. That's a five times higher dividend than the company paid four years ago. Now that the stock is throwing off vast amounts of cash, the market simply had to reprice the company.

When I first featured Gazprom in December 2018, it was trading at USD 4.64. Had you invested back then, you'd be set to receive a dividend yield of 28%. That's not even accounting for the other dividend payments you would have received in the meantime, and which would have lowered your entry price. Gazprom has become a veritable money spinner, giving investors both income and capital gains.

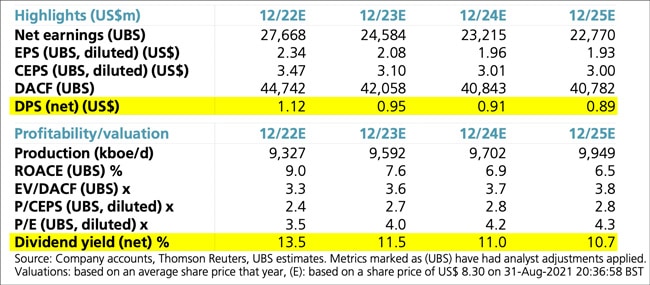

Even at the current price of USD 9.94 per ADR, the stock is projected to pay a dividend yield of 12%. And even better, the dividend windfall is bound to continue. Check out the following estimates from UBS, issued on 1 September 2021.

In retrospect, Gazprom was a no-brainer of an investment. It's simply taken a bit of time because the stock's ascent was interrupted by the pandemic. In the end, the much higher underlying asset value and the company's strong cash generation prevailed.

If you missed out on Gazprom, there is a similar opportunity waiting for you in plain sight.

Once again, you'll have to consider a bombed-out stock in a crisis-ridden country. This may be a stomach-turning thought, but it's how these things go. You have to buy when others are fearful and an investment thesis is controversial. That's when you can get in at the most attractive price.

Thank Western politicians for this opportunity

One country's pain can be another country's gain.

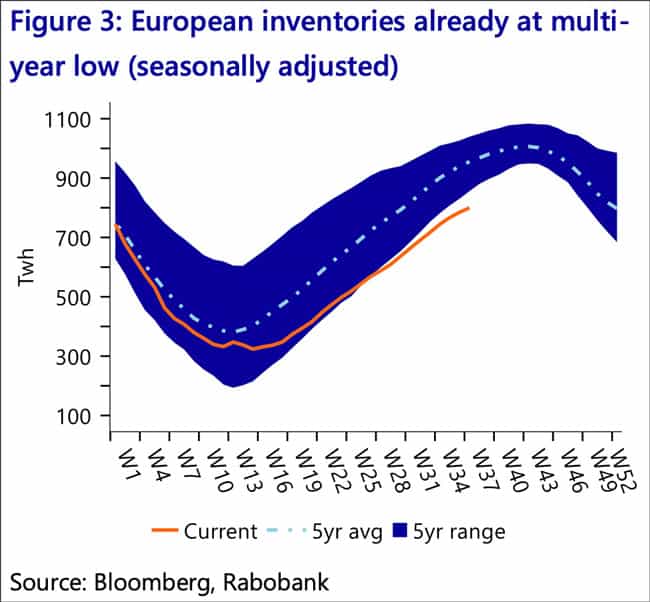

Germany is learning that lesson right now. The country's hasty, politically-motivated exit from nuclear power and fossil fuels has left it dependent on external energy sources. Prices for gas deliveries to Germany and other parts of Western Europe have recently gone parabolic, thanks to years of underinvestment in reliable, proven energy sources. Summer has barely ended yet, but spot prices for gas deliveries to Western Europe are already through the roof (see the following chart). Russia is reaping the benefits. If the coming winter turns out to be a cold one, Gazprom is going to have a blockbuster year.

Source: Bloomberg, 30 September 2021.

One other country is in line for a similar energy shock: the United States. Joe Biden banned the development of further fracking resources in the US, which is indicative of a much broader trend. American energy independence? This concept has been replaced by an outright hostility towards domestically-produced fossil fuels. The US is as dependent on fossil fuels as it has always been, but it will increasingly have to rely on foreign-produced oil and gas. Biden stopped the domestic Keystone pipeline while giving the go-ahead for Russia's Nordstream 2 pipeline.

Whatever you think of these policies and the possible motivations for putting them in place, the results are undeniable. Prices for fossil fuels are way up, and energy shortages are looming on the horizon once again.

One country that will also benefit from these policies and developments is Argentina.

Argentina: a gas giant in the making

The country at the southern tip of Latin America is home to "Vaca Muerta", the world's fourth-largest shale energy field. Most of the energy stored in this particular field comes in the form of gas, which is an advantage given that gas is a cleaner source of fossil fuel. The field's overall size is equivalent to 25% of the entire shale energy reserves found in the US. Vaca Muerta is absolutely massive.

It's also massively underdeveloped. Until recently, a combination of low energy prices and Argentina's never-ending economic crisis had made it difficult to exploit the resource.

This is now set to change, thanks to a confluence of three factors:

- Much of the Western world is working to wind down its fossil fuel production, without sufficient alternative energy sources in place. Demand for fossil fuel-based energy produced elsewhere is only going to go up further.

- American shale energy producers now have idle equipment that can be deployed elsewhere in the world.

- The Argentinean government has recognised the need to prioritise foreign investors in its energy sector. The country is rolling out the red carpet for anyone who can help develop the Vaca Muerta field.

Case in point, even Gazprom has recently started to look at Argentina. Four months ago, the Russian energy company announced its intention to partner with Pampa Energía (ISIN US6976602077), a publicly-listed Argentinean energy company that owns a significant part of Vaca Muerta.

Contrary to Gazprom, Pampa Energía is not controlled by the state. Quite the opposite, it's managed by a group of dynamic entrepreneurs who hold 26% of the company. They are recognised for having built one of the highest-quality companies of the entire region, and the largest electricity company in Argentina. Remarkably, the company's investor relations count among the best in South America.

Since 2009, the stock of Pampa Energía is traded as ADR on the New York Stock Exchange. It hasn't fared particularly well during the past few years, though: after a 20-fold rise between 2013 and 2018, it has lost 85% of its value during Argentina's latest currency and debt crisis.

Right now, the stock's key valuation metric puts it in the top 1% of the cheapest stocks in the world. It's trading at an EV/EBITDA multiple of 2.2 based on the 2022 estimates. This valuation multiple seems almost too good to be true. Yet, it's based on up-to-date estimates and it does account for Argentina's currency situation. Pampa Energía stock is simply dirt cheap.

Not that it would have mattered much of late, given many investors' fear of Argentina as an investment destination.

At this moment in time, Pampa Energía is about where Gazprom was in late 2018:

- An extremely low valuation, based on the company's cash flow projections and thanks to an 85% drop in stock price.

- Ignored by investors, since they are still focussed on the difficult past instead of looking towards the much brighter future.

- A tremendous potential upside, given the sheer size of the assets and the strength of the underlying trends. The stock could rally to several times its current value just to get back to a normal valuation. Never mind its long-term growth potential.

In two to three years, anyone who bought Pampa Energía stock at its current level will likely be a happy camper. Given the new administration in the White House and Western Europe's current obsession with hastily retreating from fossil fuels, Argentina has just been thrown a golden opportunity. The Vaca Muerta field is so large that it could prove a game changer for the entire Argentinean economy. Pampa Energía could produce gas not just for its growing domestic market, but also for export (at good prices) to neighbouring countries or even further afield, in the form of Liquid Natural Gas (LNG).

If you want to play the Argentinean gas story as the next recovery story in the global energy markets, Pampa Energía is the stock to consider.

Both a short-term and long-term play

Now that we have entered October, Europe's winter season is just around the corner. Many Western European countries have low gas inventories, and the next couple of months could see not just rising prices but actual energy shortages.

It has finally started to dawn on investors, too, that betting on a rapid switch to so-called renewable energies didn't consider the amount of time that energy transitions need. Even rich, industrialised Germany didn't manage to advance its energy transition as fast as it had hoped to over the past decade. How are less developed, less committed countries going to fare? The world's next energy transition will take decades and fossil fuels are going to stay with us for a lot longer than has recently been made out – certainly long enough to make bombed-out energy stocks a good investment!

You can research Pampa Energía yourself. It's a transparent company and there is loads of material about the Argentinean energy sector available online.

Alternatively, you can have me do the hardest part of the work for you. Undervalued-Shares.com Lifetime Members already received a 39-page summary of the opportunity from me.

In my research report, I showed:

- How the management of Pampa Energía used the stock's low valuation to buy back an incredible 21% of the outstanding stock.

- Why the company managed to remain solidly financed, despite Argentina's economic crisis.

- Which legendary South American billionaire family has been deploying money in the sector recently, betting on an upcoming recovery.

Pampa Energía was one of the four additional reports that my Lifetime Members receive every year (on top of the usual ten research reports for my Annual Members), and current developments in the energy sector made it worthwhile that I pointed it out once more.

If you are not into Argentina after all, you can still buy Gazprom stock for its dividend yield. Or, invest in one of the many other undervalued oil and gas stocks. Over the next couple of years, they could be among the best investments for private investors, thanks to a combination of low valuations and rising dividend payments.

If the energy policies of the US and Western Europe are currently making you spend more money on energy, you could buy some of these stocks to earn back the money that's been diverted from your pockets. Why not benefit from this trend instead of suffering from it?

Western energy policies have been heading in the wrong direction for years, and we are now facing the prospect of years of suffering from higher energy prices as a result. However, this also makes for multiple opportunities for those who recognise the writing on the wall and act accordingly.

It's a subject that I will write about in more detail in upcoming Weekly Dispatches and research reports. Stay tuned for more.

BAYER: Comeback or further downfall? (German-language video)

What's in store for Bayer AG, the German blue chip? Can it become a highly-valued growth stock again?

Jens Rabe and I take stock of the impact of Bayer's Roundup disaster, and consider the way forward. What are the promising growth areas, and how can they help the company stage a turnaround - similar to Volkswagen?

BAYER: Comeback or further downfall? (German-language video)

What's in store for Bayer AG, the German blue chip? Can it become a highly-valued growth stock again?

Jens Rabe and I take stock of the impact of Bayer's Roundup disaster, and consider the way forward. What are the promising growth areas, and how can they help the company stage a turnaround - similar to Volkswagen?

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: