Metals Exploration’s share price has gone vertical. What’s the key lesson, and which three stocks might be next?

Hungarian stocks – worth a closer look?

Which countries have completely fallen off the radar of investors?

Look no further than Hungary.

The country is controversial politically, and it has serious economic challenges, such as the highest inflation rate of any EU member state. Right now, Hungary is in a deep recession.

Consequently, the Budapest Stock Exchange has barely received any attention of late.

Somewhat surprisingly, Hungarian stocks are easy to trade, though, as most Hungarian blue chips listed on German exchanges back in the 1990s.

Are there some Hungarian stocks that investors should pay attention to?

Could there be any catalysts that will get the entire market moving?

Media prejudice – and the more nuanced reality

Most mainstream media headlines about Hungary centre around:

- A country about to descend into autocracy.

- A political leadership in constant conflict with Brussels.

- An economy beset by fiscal irresponsibility and cronyism.

Leaving these widely known aspects and accusations aside for a moment, I considered which inarguable strengths the country may have.

A list of positives include the following:

-

- Hungary is one of the world's top 20 tourism destinations. Thanks to its architecture, Budapest is known as "the Paris of the East", and the rest of the country is famous for its abundance of thermal spas, the heritage-rich Tokaji wine region, and Lake Balaton for family holidays – to name just a few.

Source: Schengen Visa Info, 3 March 2023.

- Hungary has long been one of the largest producers of electronics in the Central Eastern European region. The country also has had a long-standing – and, potentially surprising – presence in the pharmaceutical industry. Both are owed, no doubt, to Hungary's high level of education.

- 90% of Hungarians own the home they live in, and even the EU admits that the country has done extremely well in eliminating poverty.

Interestingly, finding up-to-date information about Hungary, its economy and its stock market is anything but easy. Since about 2015, the Western world's interest in the country seems to have waned.

Three blue chip firms form an exception, though. There is still a decent amount of research available about MOL (ISIN HU0000153937, BUD:MOL), the state-controlled oil company, Magyar Telekom (ISIN HU0000073507, BUD:MTEL), the national telecoms operator, and OTP Bank (ISIN HU0000061726, BUD:OTPB), Hungary's leading bank.

I had a closer look at MOL to see if the entire subject is worth investigating.

Hungary's leading blue chip

MOL stands for Magyar OLaj-és Gázipari Részvénytársaság, "Hungarian Oil and Gas Public Limited Company". It's a multi-national oil and gas company that also comprises the former state-owned oil and gas companies of Croatia and Slovakia. MOL's revenue is equivalent to an incredible 20% of Hungary's GDP (compared to Gazprom accounting for 5% of Russia's GDP). Globally, MOL ranks among the Fortune 500.

The EU sanctions regime provided a boon for MOL. While the sanctions dramatically reduced the import of Russian oil to EU member states, they excluded crude oil delivered from Russia through the Druzhba pipeline to Hungary, Slovakia and the Czech Republic. As a result, MOL has been able to buy Russian oil with an average discount per barrel of USD 27 compared to the price paid for oil from other regions of the world.

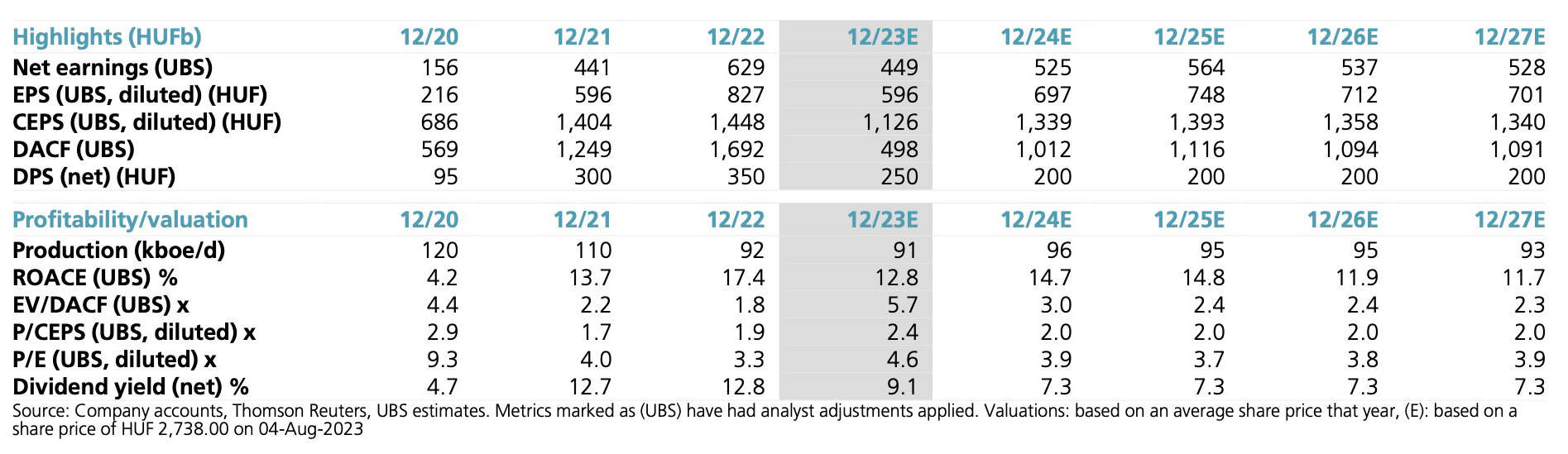

While Hungary and other countries of the region slapped windfall taxes onto oil and gas companies, this didn't stop MOL from registering a record year. In 2022, the company achieved EBITDA of USD 4.7bn, 34% higher than in 2021 and up a whopping 130% compared to 2020. Current estimates for 2023 assume EBITDA of USD 3bn. The windfall tax in Hungary funnels about 40% of the Russian oil discount to the state, but the other 60% stay with the company as additional profit (parts of which then also go to the state via the dividend paid on state-owned shares).

MOL's underlying dynamics are complex to analyse, and the finer details would go beyond the scope of this article. Medium term, the question of whether (and how) the company will replace its purchases of Russian oil is a big unknown. According to the most recent public statements, Hungary has no particular desire to wean itself off cheap Russian energy. Then again, the country also does all sorts of political deals, as demonstrated by its recent acceptance of an EU-backed carbon tax which will now place a EUR 100m burden on MOL.

In the meantime, current indications are that MOL will continue to generate solid earnings over the coming years. The stock is currently trading at a price/earnings ratio of less than 4. Based on EBITDA, it's trading at a multiple of 2. Current projections expect a dividend yield of 8%, although there is a decent possibility that the company will decide to pay a significantly higher dividend.

As Austria's Erste Bank pointed out in a research report in April 2023, the attraction of some Hungarian companies may actually lie in their bonds rather than equity. Relative to its risk rating, bonds issued by MOL were mispriced compared to bonds issued by other European companies – no doubt a result of the country's political standing.

When it comes to MOL's equity, the valuation multiples of its stock are comparable to those of emerging market companies, such as Petrobras (ISIN BRPETRACNPR6, BR:PBR). Hungary does bear some hallmarks of emerging markets, such as a high inflation rate. On the other hand, it is a European country and a member of the EU.

Is MOL an example of why Hungary's market as a whole should re-rate at some point?

Politics, and the country's international perception, will play a major role.

Hungary coming in from the cold?

Hungary's reputation is incredibly polarising.

Under the leadership of Viktor Orbán, the country has turned into THE global model case of a nation run on a sovereigntist world view and traditional conservative policies. Orbán leaves no doubt that he views the nation state as the only effective mechanism to protect its citizens and further their interests. Instead of mass-importing low-qualification foreign labour, he gives unprecedented fiscal incentives to Hungarian families. A Hungarian woman who has had four children does not need to pay income tax for the rest of her life. Couples are offered a EUR 31,000 loan upon marriage, which is forgiven entirely once the fourth child has been born.

Globalist organisations threw everything and the kitchen sink at preventing Orbán from winning a fourth term, but the Hungarian people wouldn't have it: in April 2022, the incumbent won a landslide majority of 53%.

Publications like the New York Times and organisations like the European Union performed contortions to describe the situation. Their terms for Hungary's government include "soft autocracy" and "electoral autocracy" – because autocracies can now be "soft", and electorates can be "autocratic".

My interest in Hungary's stock market is also driven by the question: does anyone take any of this serious anymore?

I never quite understood why Orbán was castigated for pursuing policies that my father – a refugee – held in the 1980s when he was an active member of Germany's governing party, the Christian Democrats:

- Maintaining a border to demonstrate national sovereignty? ✓

- Controlling immigration? ✓

- Putting national interests first? ✓

As it were, it appears that a growing number of Western Europeans are currently returning to these old-fashioned views.

- Italy elected a "far-right" government in September 2022.

- In Spain's July 2023 election, the "far-right" was strong enough to prevent any party from having an easy path to government.

- In the Netherlands, the "far-right" anti-net zero farmer's party has surged.

- In Finland, the globalist posterchild Sanna Marin stepped down as prime minister before voters had a chance to humiliate her at the ballot box. The June 2023 election saw a "far-right" coalition take charge of the country.

- In France, the "far-right" Marine Le Pen is seen as a realistic candidate for winning the next presidential election in 2027.

- Germany's "far-right" Alternative für Deutschland is widely polled to be on the rise to levels not seen before.

Are the people of Western Europe coming together to turn their entire continent into an electoral autocracy, Hungarian-style?

If you hold that view, you might want to sell all your European holdings. The stocks of German, Italian and French companies could decline to the valuation levels seen in Hungary.

The opposite view, of course, is that the entire continent is moving the way of Hungary. If that was the case, shouldn't Hungarian stocks gradually recover from their discounted valuation levels?

It's a question to which I have no definitive answer yet – but one that I find interesting enough to be worthy of further investigation.

Investor trip to Budapest?

To help me shape a view and find potential investment opportunities, I am trying to organise a visit to Budapest from 11-13 October 2023 – and some Undervalued-Shares.com readers could join me.

I suspect that Hungary will offer some surprising finds, such as Kulcs-Soft (ISIN HU0000099387, BUD:KSOFT). The specialist for accounting software listed on the Budapest Stock Exchange in 2009, and has since grown its earnings per share at a compound annual growth rate of 19.1%. Kulcs-Soft has paid out every cent of its profits to shareholders as dividends, and not utilised debt or capital issuance. These are the kinds of companies I would like to learn about.

I already have some meetings with interesting companies lined up, and am currently working to arrange more so that the trip will offer a critical mass of meetings. (Help from readers with contacts inside publicly listed Hungarian companies is welcome!)

Difficult subjects should also be on the trip's agenda. What is it about Hungary's efforts to force some foreign companies to sell their Hungarian operations to the state or to Hungarian oligarchs?

If it goes ahead, this trip will leave no stone unturned.

Public companies are selective in who they are willing to meet with, which is why participants need to have a relevant professional background – fund manager, research analyst, family office employee, journalist, or similar.

If you are interested in joining or feel you have something else to contribute towards organising such a trip, please drop me an email. I'm planning to make a definitive decision soon as to whether the trip will go ahead.

Introducing: bid target with 40% upside

Interested in a takeover target from Switzerland?

The company in my latest research report has come into the crosshairs of one of the best activist investors in Europe.

I expect a bid to come in at least 40% above the current share price over the next 3-12 months – a "quick flip" situation.

Introducing: bid target with 40% upside

Interested in a takeover target from Switzerland?

The company in my latest research report has come into the crosshairs of one of the best activist investors in Europe.

I expect a bid to come in at least 40% above the current share price over the next 3-12 months – a "quick flip" situation.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: