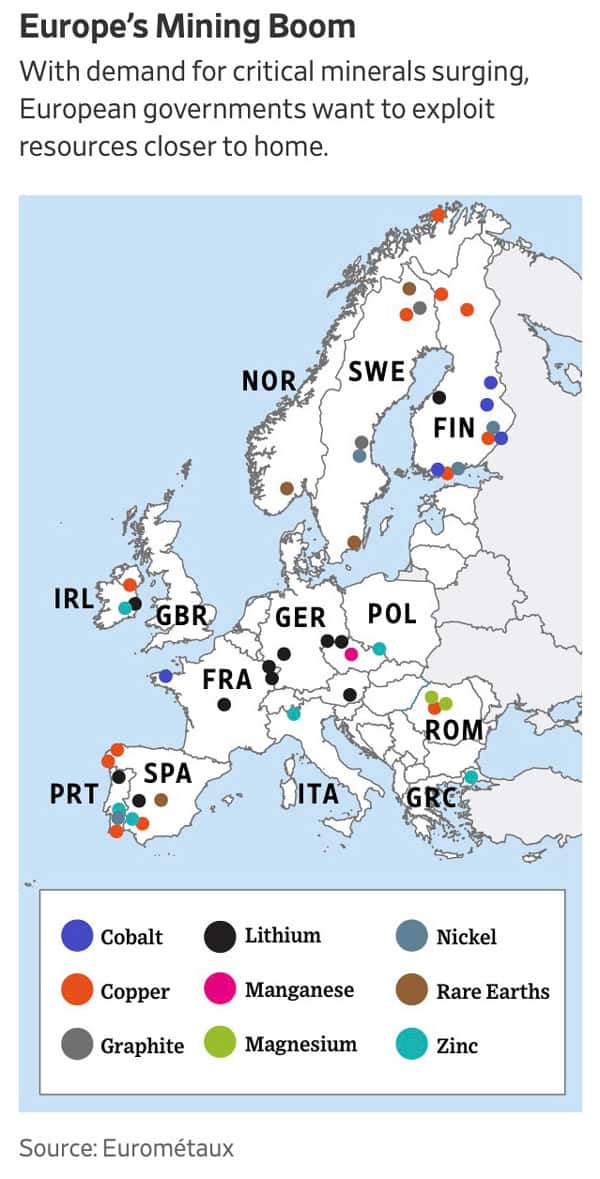

Promising an electrification of their economies, they forgot to take into account the sheer amount of resources needed to do so – copper and lithium prominently among them.

The potential demand for the so-called green energy revolution only adds to the general rising demand for commodities that is caused by a growing world population and rising living standards.

This brings the stocks of dormant, long-forgotten mining projects back into focus.

Many of these stocks are trading 95% or even 99% below their previous high, and they could multiply in price if their projects got revived.

Undervalued-Shares.com has looked at these broader developments. Today's Weekly Dispatch names a few specific opportunities.

Brussels is changing its stance on mining

The Wall Street Journal couldn't have been clearer:

"Tucked away in the mountains of northern Portugal, about two hours northeast from the country's second-largest city of Porto, sits this idyllic farming village. It is home to under 200 people, most over the age of 60. … Covas is set to play host to the green-energy transition in its rawest form. Just a third of a mile away from the houses of Covas do Barroso is one of Europe's richest lithium deposits – the silvery metal used in electric-vehicle batteries – and a planned mining operation to dig out the mineral.

…

Locals are worried about the environmental impact as well as the blight on the village presented by the mine. Speaking to locals, the word 'mina' often draws a cringe, and a protest is scheduled later this month.

…

Governments and companies around the world are scrambling to find new sources of critical materials – and in doing so they are easing the approval process for projects that once took years or sometimes more than a decade to get off the ground. Additional supplies of metals like copper, nickel and lithium are going to be crucial to meet the growing demand for the energy transition – with the wiring, magnets, motors and battery cells used in green technologies such as electric vehicles, wind turbines and batteries for storage all requiring mined minerals.

'No doubt there is a real demand story,' said Alex Gorman, mining analyst at U.K. investment bank Peel Hunt. 'We are talking about a 35-fold increase in lithium demand and we do not have any large-scale lithium mines in Europe. It's a massive problem.'"

Source: Wall Street Journal, 10 August 2023.

Such government U-turns make for extraordinary opportunities for investors.

Over the past few years, we have seen not one but several truly extraordinary U-turns:

- Energy shortages? Overnight, the German "Greens" agree to nuclear, and the nation even goes back to digging for lignite. The uranium price is on the move.

- A serious threat of war? Overnight, investing in defence is all the rage again and even seen as a positive. Stocks of defence companies have become top performers.

- A new global virus? Overnight, the EU closes its famously open borders. Several new investment trends have emerged, such as the increasing on-shoring of supply chains.

Each of these U-turns has led to a revaluation of entire sectors. Those who positioned their investments in the right way have made a fortune.

Needless to say, each such U-turn has also led to public controversy, and even upset. Mining, in particular, affects local populations. Anyone who faces the threat of having a mile-wide hole dug in their backyard will likely object, and understandingly so.

Unsurprisingly, this brings a special focus back to dormant mining projects located a bit further afield.

Pakistan's poor, dangerous frontier

The Financial Times also just lifted attention to this entire subject when it published "Miners' hunt for copper takes Barrick to Pakistan's western frontier

For three decades, international mining companies have tussled with officials and locals over a patch of desert around an extinct volcano in Pakistan's neglected, insurgent-prone western province of Balochistan.

Now, after resolving years of legal disputes, Barrick Gold wants to invest $7bn to revive the mining project, Reko Diq, which experts believe contains one of the world's largest untapped reserves of copper and gold. Barrick and Pakistani authorities say Reko Diq will not only be Pakistan's largest foreign fixed investment but a vital source of copper – a key component for the world's energy transition – at a time when global supplies are barely likely to meet demand.

'Reko Diq is one of the bigger copper-gold undeveloped projects in the world,' said Mark Bristow, chief executive of Barrick, which aims to start mining in 2028 subject to an ongoing feasibility study. 'It's a very big deal. Any copper mine right now is a big deal.'"

It's a stunning reversal for a mining resource that had been known for over a generation but which no one had managed to make any use of so far.

In its quest to fix the world's looming commodity shortages, Rio Tinto (ISIN GB0007188757, UK:RIO) is venturing into an area that comes with its very own set of problems:

"Pakistan's repeated political and economic crises have scared away all but the most determined foreign investors, and local authorities had blocked an earlier attempt involving Barrick to mine Reko Diq.

Balochistan, Pakistan's poorest province, borders Afghanistan and Iran and is suffering a brutal, simmering conflict with separatist militants motivated in part by alleged exploitation of the region's mineral wealth.

….

The project's chequered history has become emblematic of the difficulties for foreign investors in Pakistan. Australia's BHP first struck a deal to explore the site in 1993, before a joint venture between Barrick and UK-listed Antofagasta, which runs copper mines in Chile, eventually took on the project.

Authorities in 2011 blocked their request to start development, citing community opposition, leading to nearly a decade of international arbitration. In 2019 the World Bank's dispute resolution arm ruled against Pakistan, ordering it to pay the companies $5.8bn in damages – a sum that would have bankrupted the country.

…

The security situation has deteriorated since the Taliban took power in neighbouring Afghanistan in 2021, with terrorist attacks in 2022 rising 27 per cent from a year earlier, according to the Pak Institute for Peace Studies think-tank. Reko Diq 'is 50 miles from Afghanistan and 40 miles from Iran', one person involved with the project said. 'So it will be a target.' For support, Barrick has turned to Pakistan's powerful army, which helps control the country's politics and helped negotiate last year's deal to revive the project, according to a person involved. Pakistan's army chief also this month attended a local mining conference alongside Bristow. 'The military are a steadying hand,' Bristow said. 'They are absolutely essential on the security side.'"

In Pakistan, the problem isn't nimbyism but security.

Last year, the country suffered a 27% increase in terrorist attacks, also due to the Taliban's takeover of Afghanistan in 2021. The Reko Diq mine is 50 miles from Afghanistan and 40 miles from Iran. It doesn't take much to figure out that the mine will be a target, and this can put supplies at risk.

One country that is keenly aware of such risks is the United States.

Biden wants to "Buy American"

As recently as 1995, the US imported just 10% of the copper it needed. This has increased to 50% today. At current rates, by 2035, the US will be dependent on foreign producers for 67% of its copper consumption.

Will foreign nations even be willing to supply sufficient amounts of copper to the US?

These are questions that Western politics and the public will have to face up to in the very foreseeable future.

The government of US president Joe Biden has made it a priority to "decarbonise" the economy by turning everything electric, especially cars. The aimed-for electrification of the US economy will require unprecedented amounts of mineral resources of different kinds (see the 27 January 2023 Weekly Dispatch "Copper – a looming shortage?" for more details). Electrifying an economy requires copper, and lots of it. Unfortunately, after decades of nimbyism that prevented new mines from being built, the US is currently reliant on others to make its plan a reality. Dependency on other nations for strategic resources is never a good thing.

The US government reacted faster than the governments of Europe.

Its "Inflation Reduction Act" approved in August 2022 implies a desire to reduce inflation. The inner workings have a considerable element of "Buy American", though, pushing to secure supply chains. Following the events of the past few years, national security in the more traditional sense has started to creep back on the agenda. The emerging new mindset is geared towards a domestic production of essential goods, stockpiling, and continuation plans.

With a hot war raging in Europe and potential trouble spots brewing elsewhere, the US has taken significant steps towards breaking its dependence on foreign supplies – in some industries, at least. On 24 February 2021, the Biden administration issued Executive Order 14017 to deal with the country's supply chains: "The United States needs resilient, diverse, and secure supply chains to ensure our economic prosperity and national security. Pandemics and other biological threats, cyber-attacks, climate shocks and extreme weather events, terrorist attacks, geopolitical and economic competition, and other conditions can reduce critical manufacturing capacity and the availability and integrity of critical goods, products, and services. Resilient American supply chains will revitalize and rebuild domestic manufacturing capacity, maintain America's competitive edge in research and development, and create well-paying jobs."

Following Biden's edict, a raft of federal departments have published policies aimed at securing the nation's supply chains:

- The Department of Defense wants to invest in strengthening the defence industrial base, especially related to lithium batteries.

- The Department of Energy allocated USD 62bn to supply chain resiliency.

- The Department of Commerce and the Department of Homeland Security vowed to increase tech funding through the CHIPS ACT (USD 52bn) and the USICA/COMPETES Act (USD 250bn, including CHIPS).

- The Department of Agriculture made an initial USD 215m available to better insulate US food production against external shocks.

Suddenly, not just oil but a swathe of other commodities and products have become a national priority.

We are about to enter a period where an entire range of seemingly mundane goods and resources will be deemed to have strategic, national importance – as otherwise, entire economies could grind to a halt.

When needs must

As ever, these developments aren't progressing in a linear fashion. While the US has made a real push to become less dependent on microchips from Asia, it refused to tap the country's fossil fuel reserves to decrease dependence on nations like Saudi Arabia and even Venezuela. For now, at least, the US government remains perfectly happy to leave some domestic resources dormant while relying on supplies from foreign, often hostile suppliers.

Overall, it looks like nations are waking up to the fact that for an economy to function and thrive during an age of geopolitical blocks, it requires its own access to strategic mineral resources.

Ideally, you'd want them to be delivered reliably and at not too steep a cost.

The obvious question for a resource-rich nation like the US is: why not produce these resources domestically and at lower prices? The country has already recognised as much for certain rare earths, but this should only prove the first step. Once the looming copper shortage starts to bite, the rust-coloured metal that our daily life depends on will likely be added to the list of strategic resources that nation states will want to secure for themselves.

Which brings certain dormant, long-forgotten mining projects back into the crosshairs of investors.

A giant copper reserve right at home

Asking "When will needs must?", earlier this year I introduced Undervalued-Shares.com Lifetime Members to what must be one of the most controversial stocks currently listed in the US.

Northern Dynasty Minerals (ISIN CA66510M2040, NYSE:NAK) is a mining exploration and development company operating in Alaska. The company owns the Pebble project, which could be the world's second-largest combined copper and gold mine. Its copper reserves are equivalent to ≈1.3% of all copper metal ever discovered or produced in the past 10,000 years. The exceptional ore body comes with "bonus" resources, such as the world's largest deposit of rhenium.

While Northern Dynasty already had mining giants Rio Tinto, Anglo American, and First Quantum Minerals as joint venture partners to develop the Pebble project, environmental advocacy organisations and the US federal government have prevented the mine from happening – so far.

Up to this point, successive generations of investors and corporate partners have poured nearly USD 1bn into developing this resource. Northern Dynasty has reportedly spent more money studying the environment surrounding Pebble than any other mineral development project in the world.

Despite these upfront investments, Northern Dynasty had lost 99% of its value when I published my report. Since then, the stock is already up 41% – and it may get a lot higher shortly.

Northern Dynasty Minerals.

With recent features such as the ones published by the Wall Street Journal and the Financial Times, the entire subject of reviving dormant mining projects will move up a level (or two) in the awareness of investors.

The management of Northern Dynasty, too, seems to have that sense.

Two days prior to this Weekly Dispatch, Northern Dynasty unveiled a new feasibility study. While this is not the first such study, it does seem apt to publish an independent review of the project with cost estimates that reflect current (changed) economic realities.

Of course, even though the study was written by independent experts, there is an element of PR and obvious self-promotion:

"'The proposed mine for the Pebble Project would provide good-paying, year-round employment for thousands of Alaskans, something desperately needed in Southwest Alaska,' said Ron Thiessen, President and CEO of Northern Dynasty. 'The mine would mean substantial tax revenues for Alaska, including contributions to the Alaska Permanent Fund, which will be important for the future economic sustainability of the region. New infrastructure developed to support the proposed project would offer the additional benefit of potentially lowering energy costs for the region. The July 2020 Environmental Impact Statement of the Pebble Project (the 'FEIS') states that the proposed mine can be developed and operated without harming the fishery, and so, with Alaska's excellent track record of managing all its resources for the benefit of its people, it can have BOTH the mine AND the fishery.'"

Self-promotion it may be, but it's increasingly starting to hit the zeitgeist.

The reality is that most consumers (and voters) only care about issues for as long as they don't hurt their wallet and don't inconvenience them. Once they do, virtue-signalling and opposition go out the window and, instead, necessary actions can be taken by politicians.

When needs must, the nasty stuff gets done after all.

If my hunch is anything to go by, Northern Dynasty will soon feature on the list of dormant, valuable mining projects in the Western hemisphere that investors will get interested in again. The timing seems ripe for it. Digging out dormant mining stocks could become a hot new trend on the stock market.

Right now, Northern Dynasty is a beaten-down penny stock and a controversial, maligned company. Billions of dollars of capital expenditure are necessary to develop the copper resource, and shareholders will see dilution along the way. Still, as my in-depth research report spells out in more detail, for longer-term investors, it's a realistic opportunity to generate a potentially life-changing multiplier on their investment. You can turn it as you like, the stock of Northern Dynasty could multiply in value if the project was actually undertaken.

Of course, for shorter-term investors, there may simply be an opportunity to bet on a new speculative run-up once politics indicates a potential change of its position on this particular mining project. The upcoming US election cycle could play into this, too.

And Northern Dynasty is just one example from a swathe of similar companies listed around the world.

Plenty of choice for investors

Bougainville Copper (ISIN PG0008526520, AU:BOC), an Australian company with a dormant, controversial copper resource in the semi-autonomous Bougainville province of Papua New Guinea, is another such example.

I first reported on the company in the early 2000s, and summarised the entire investment case once more in March 2020 ("Riches among ruins (part 3): Bougainville Copper, or the treasure island that won't go away"), followed by further updates in April 2021 and April 2022.

Bougainville Copper has experienced several speculative run-ups over the past two decades, but it never quite achieved a lasting breakthrough. The stock has been good to traders, but it has not paid off for long-term investors – yet?

Bougainville Copper.

London-listed Petrel Resources (ISIN IE0001340177, UK:PET) is another example. Back in the 2000s, I pointed out the company as the first publicly listed play on a potential revival of the Iraqi oil industry. Once the second Iraq War was over, the stock rallied by a factor of 100. It became the counter-example to Bougainville Copper, demonstrating the wide range of potential outcomes.

Indeed, the more recent history of this kind of speculative mining stock is mixed.

In April 2020, I introduced Undervalued-Shares.com Lifetime Members to GCM Resources (ISIN GB00B00KV284, UK:GCM), a London-listed company that holds the title to a controversial coal mine in Bangladesh. Even though the government of Bangladesh has made moves to become less dependent on foreign energy sources, the stock is currently down 80% since I wrote about it. Success isn't guaranteed for any of these ventures, and even a stock that has already fallen by 99% can lose an investor their entire investment.

In October 2022, I featured another such stock in a report dubbed "multi-bagger from the Falkland Islands". The company in question kept its ownership of potential oil reserves in the Falklands during a decade when such an asset was considered worthless. It has won an arbitration award in a separate commercial matter, and stands to collect a double-digit amount of cash from the Italian government if the appeal against the award is thrown out by a judge (which seems highly likely). The stock's current price would then be less than the company's cash reserves, with all other assets thrown in for free. Such valuations are what attracts me to this kind of situation in the first place.

Most recently, in March 2023, I pointed Undervalued-Shares.com Lifetime Members to Gold Reserve (ISIN CA38068N3067, US:GDRZF). The company owns a massive gold resource in Venezuela, albeit one with a disputed property title, and its stock has more than doubled during the past few months.

In the end, it all comes down to timing. The goal needs to be to catch the market when it is about to experience another wave of speculation.

Such a renewed wave of interest may well happen soon for this kind of project, given how the mainstream media have started to catch up.

At least, that's not an unreasonable stance to take.

Northern Dynasty: still worth looking at

The stock of the US mining company is up 41% since February 2023 – and it may get a lot higher shortly.

For longer-term investors, it's a realistic opportunity to generate a potentially life-changing multiplier on their investment.

For shorter-term investors, it could present an opportunity to bet on a new speculative run-up.

The timing seems ripe for dormant, valuable mining projects such as this one.

Northern Dynasty: still worth looking at

The stock of the US mining company is up 41% since February 2023 – and it may get a lot higher shortly.

For longer-term investors, it's a realistic opportunity to generate a potentially life-changing multiplier on their investment.

For shorter-term investors, it could present an opportunity to bet on a new speculative run-up.

The timing seems ripe for dormant, valuable mining projects such as this one.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: