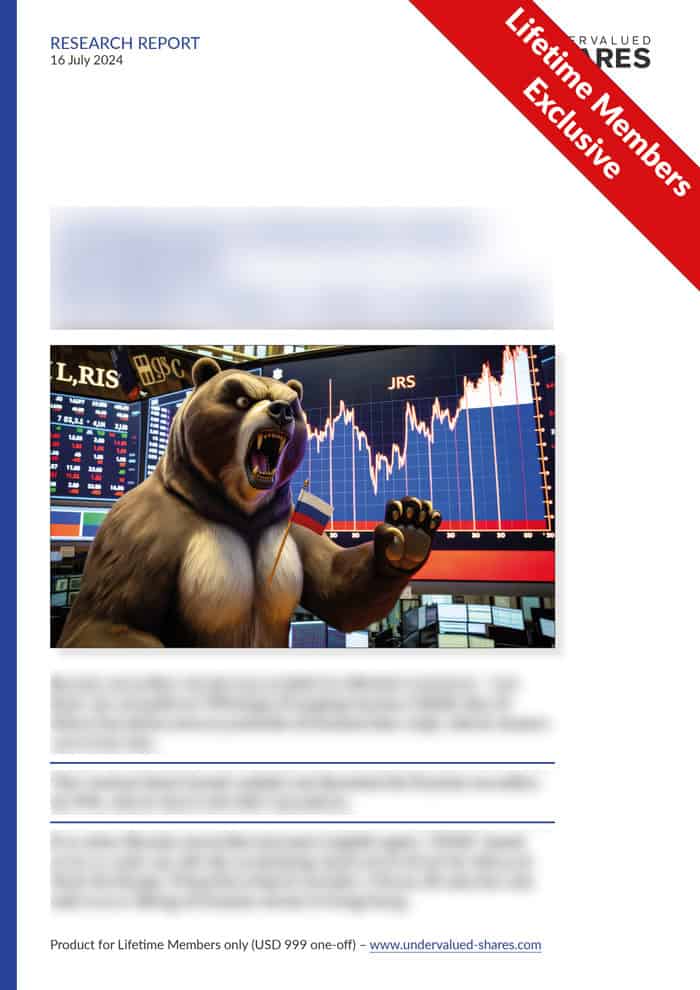

Is the bloodbath in the Nasdaq Composite Index going to end anytime soon?

40% (!) of companies in the tech-heavy index have seen their market cap cut in half (!) compared to their 52-week high.

The index itself is only 17% off its record level, but this is due to the high weighting of a small number of well-performing mega-cap caps. Underneath the top layer is an ocean of red, and that's before we have looked at the performance of SPACs.

Despite the recent sell-off, the Nasdaq Composite's forward price/earnings ratio remains 29% higher than the average of the past decade. It's possible that central banks will increase interest rates, which tends to disproportionally hits stocks with earnings that are far out on the timeline. The culling may yet continue.

I can't predict broader markets, but the indiscriminate selling has already created some bargains in the tech sector.

These bargains include some of my favourite businesses: those running a subscription model.

Repeat payments provide security

Massive sell-offs in tech stocks are nothing new and provide opportunities for investors who can go against the grain. Given how tech is permeating our lives to an ever-increasing degree, the sector will remain a growth area throughout the 2020s. Buying growth stocks on the cheap will remain a good strategy for long-term capital growth.

Timing is difficult, though, and no one will ever manage to catch stocks exactly at the bottom.

However, what you do have full control over is to pick companies that are not at risk of going out of business if the market takes longer to turn around. Also, you can (and should) focus on businesses that have a track record of growing even during periods when financial markets and the broader economy are weak.

That's why I have long been a proponent of companies that run subscription-based business models. Such companies don't start at zero every year. Instead, they can tell you in advance how much baseline revenue they are likely to generate from existing subscribers. The steady cash flow doesn't just enable such companies to weather the storm, but they may also be able to invest in growth during times when others struggle to raise funding. Last but not least, some of them can increase their margins by "upselling" their customers to additional services.

They are also easier to analyse. Subscription-based businesses come with some very convenient and informative metrics, such as the percentage of recurring revenue, the annual retention rate, and the so-called growth efficiency index (= how much new recurring revenue a company gets from a given investment in sales and marketing).

The business of analysing and forecasting is difficult enough. By focussing on businesses with subscription-based models, you take some of the uncertainty and complexity out of the equation. Why make live more difficult than necessary? Keep it simple!

Still, you need to pick the right businesses.

The need to be informed and selective

Operating a business on a subscription-based model is no panacea. Cynics would even say that it's merely new wine in old bottles.

Subscription-based businesses tend to spend more care towards interacting with their existing customers, measuring what services they are using, and delivering to them on their needs. Isn't that merely a variation of what ANY good business should do?

The past few years haven't just seen a fervour for investing in subscription businesses, but there's been endless cheap money looking for such businesses to invest in. This has led to excesses, some of which have recently become exposed.

There is probably no higher-profile example than Netflix (ISIN US64110L1061). The streaming service had seen its stock rise more than almost any other US stock during the past decade, because of its success in locking in customers for repeat payments.

About 65m US households allow Netflix to take USD 10.99 directly from their bank account or credit card every month. An estimated 50% of the country's entire population watches Netflix at least once a month. The pandemic in particular, which forced people to spend more time at home, benefitted Netflix's market penetration as well as usage numbers.

During the past two months, however, Netflix stock lost 45% of its value. It dropped like a rock when the company announced that during the fourth quarter of 2021, it had added the lowest number of new subscribers since 2017. Worse, it projected the first quarter of 2022 to deliver the lowest subscriber growth figures of the past five years. Falling growth rates combined with falling valuation multiples can make for a brutal revaluation of a stock.

What had happened? Thanks to cheap money provided by ultra-lax central bank policies and enthused investors, Netflix had invested record amounts in new content, thus inflating its subscriber growth. Its competitors are doing the same: eight US media companies are going to invest a staggering USD 140bn in content this year alone. There is simply a lot of content out there, and people can only do so much binge watching of the latest series. Customer acquisition has turned more expensive than the market had believed, and customer retention has become more difficult now that people are increasingly allowed to roam free again, spending less time at home.

This shouldn't have come as a surprise to anyone who dug deep into Netflix and some of its underlying metrics. I'm sceptical whether the company is already cheap enough to delve in (though Bill Ackman thinks it is), and a change to interest rates could yet lead to permanently lower multiples applied to growth stocks.

Still, the recent indiscriminate selling has also hurt the stocks of companies with more solid, sustainable subscription-based models in place. As a reader of Undervalued-Shares.com, you will get to benefit from the most promising candidates.

Three new stocks for you

Those of my readers who have known me for longer already know that my insights into subscription-based businesses go back a long way.

In 1998, at the age of 22, I sat on the board of directors of one of the fastest-growing, most profitable German subscription businesses at the time. Ever since, I have been involved with subscription and membership models in some shape or form - including, of course, Undervalued-Shares.com.

Undervalued-Shares.com is a subscription-based business, and one with strong metrics - such as a 97% customer retention rate, which is almost unbelievably high in this industry. I am passionate about metrics surrounding subscription-based business models, and quite discerning about the quality of the subscription businesses that I would invest in.

You will have guessed by now that I am hugely passionate about this sector, and it had long been an ambition of mine to write a series of articles and reports. At long last, valuations have come down and it's a great time to hunt for undervalued shares of subscription-based businesses.

What's in it for you?

This slightly depends on your involvement with Undervalued-Shares.com, but there's something for everyone:

- Next week, readers of the free Weekly Dispatches will learn about a US-based subscription business that perfectly demonstrates and explains how such businesses work and what makes them special.

- Also next week, Lifetime Members will get an exclusive report on a European subscription business that I strongly recommend to keep on your radar. It's a small-cap stock with a market cap of under half a billion euros that has huge growth potential and could multiply over the coming years.

- Annual Members will soon receive a report on a US-based subscription business. Many of you will have come across this company already in real life, but without realising you can buy its stock. As ever, I am passionate about non-mainstream ideas so I'm really looking forward to sharing this one with you.

Whichever way you utilise Undervalued-Shares.com, do expect a report (or two, or three) about subscription-based businesses over the next few weeks.

Stay tuned for more!

Blog series: Subscription businesses

There's more to "Subscription businesses" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

40% share price jump for European gaming and esports company

Amidst the bloodbath of tech-related stocks, there is one company which has seen a dramatic jump in share price this week.

It’s a company that I presented to my Lifetime Members in August 2021. Its latest development is putting both the company and the stock on a good trajectory.

The stock is still fundamentally undervalued. If you aren’t familiar with this story yet, I highly recommend you take a closer look.

40% share price jump for European gaming and esports company

Internet users and investors alike have started to bet on a new generation of social media companies.

Amidst the bloodbath of tech-related stocks, there is one company which has seen a dramatic jump in share price this week.

It’s a company that I presented to my Lifetime Members in August 2021. Its latest development is putting both the company and the stock on a good trajectory.

The stock is still fundamentally undervalued. If you aren’t familiar with this story yet, I highly recommend you take a closer look.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: