How do you generate new investment ideas, and how do you identify catalysts that get a share price moving?

A global asset management firm asked me to answer these two questions in a presentation to their junior analyst staff in Hong Kong next week.

Today's Weekly Dispatch is my warm-up for the lecture. It deals with an investment case that offers the chance of a quick 50%+ profit, but which also comes with lots of useful lessons learned about the questions set out above.

"Know the names"

Last week's Weekly Dispatch caused quite a stir among readers.

It described how the team at Diameter Capital Partners, a credit-focused fund manager renowned for its performance, discovered a stock that went up by a factor of 360x in just seven months.

How did they do it?

Their founder, Scott Goodwin, never stops preaching his mantra "know the names" – i.e. make yourself familiar with as many different companies as you can.

That way, when a piece of news about a company comes your way, you can immediately interpret it based on at least some existing understanding of that company.

It's a different way of saying that you should read a lot, and read widely.

Thanks to the Internet and its flourishing sector of affordable investment media on platforms such as Substack, you can nowadays build up a solid stack of knowledge about companies in the space of just a few years. The web accelerates just about anything these days.

Plus, there is an additional way to rocket-propel your ability to generate VALUABLE investment ideas.

Look where few others are looking

Don't just know the names, but focus your set of names on areas where you are more likely to discover valuable ideas.

Simply focus on countries or sectors that few others are looking at.

To stick to the example of Diameter Capital Partners, the firm was able to land its incredible coup with Signature Bank (ISIN US82669G1040, OTC Expert Market: SBNY) because hardly anyone else would bother to look at the stock of defaulted banks.

Their investigative research and creative approach to stock analysis was impressive but ultimately, they only used publicly available information, just like anyone else. In retrospect, anyone could have found this opportunity and bought stock of Signature Bank when it was trading at 1 cent before going skyward to USD 3.60 within months. It's just that few other eyeballs were set on the sector of defaulted US banks.

This case is so useful because it illustrates that even in the United States – the market with the most analysts and investors looking for opportunities – there are pockets of the stock market that are completely overlooked and compete with few others.

Once you take this approach to a global level, there will always be markets with limited attention and competition:

- Europe is a fertile hunting ground because as a continent with around 30 countries and almost as many languages, few are looking at, for example, Belgian M&A opportunities. Check out this recent case for a real-life example of why this could pay off.

- Hong Kong is about as out-of-favour as it gets, with stocks back at the 1998 level. The meme below illustrates just how frustrated investors in Hong Kong are. There are relatively few investors currently looking for opportunities, which means that your likelihood of finding something useful probably goes up by a multiple.

- In Northern America, relatively few investors are currently looking at oil and gas stocks. If you are focusing on Canadian energy companies rather than red-hot American tech companies, you are more likely to find outlier investment opportunities that the market has not yet latched onto.

How does it look like when you apply these rules and identify a specific idea?

It's never easy and straightforward, but it does lead to investment success eventually, as the following example shows.

Know not just names – but people, too

Besides knowing lots of companies, it helps to also know as many people as possible – and remain in touch with them, at least occasionally.

I happen to know Mark Child, the CEO of gold exploration company Condor Gold. Mark had just moved his personal residence to the island of Sark and thus quite literally became my neighbour.

When a CEO and significant shareholder of a publicly listed company choses to leave the comforts of London's Chelsea behind and move to an island that is infamous for its lack of creature comforts but famous for being light on taxes, my ears perk up.

I had first heard about Condor Gold (ISIN GB00B8225591, UK:CNR) in 2008. I followed the company vaguely ever since, but I did not buy into it yet, even though I had gotten to know its CEO as a trustworthy, upright fella. Condor Gold was developing a multi-million ounce gold district in Nicaragua, and was backed by a self-made billionaire with a history of setting up new mining companies before selling them to larger operators. It was obvious to me that the company was going to be put up for sale eventually, although it was way too early to bet on that when I first heard about it.

Condor Gold's CEO moving to a jurisdiction where he could reap his exit proceeds tax-free is the kind of contextual information that should make any investor pay attention. Legally speaking in the public domain, this information is suitable for giving you an edge.

Admittedly, it depends on knowing either the protagonist or hearing about it from someone. However, that's why you should aim to know as many people as possible, and stay in touch with them at least occasionally. This may seem an unfair advantage, but you do have to make luck come your way somehow.

By knowing not just the names but also the people behind them, you get Inspector Luck and Sergeant Chance to magically appear on your doorstep every now and again. There'll be other ways to achieve the same, but this is the edge I chose to develop for myself in life. You will have to decide on what you want your edge to be, but in any case, I also advise you to….

Be humble and careful

Next up, a word of warning.

Once you have come across such a nugget of information and put it into the context of the accompanying circumstances, it's easy to get carried away.

It happened to me in the case of Condor Gold.

In January 2021, I alerted Undervalued-Shares.com Lifetime Members to this opportunity. Titled "Takeover target", my initial research report analysed why "the company has a significant likelihood of becoming a bid target in the next 12-18 months, at >3 times its current share price."

Little did I know…

Instead of the renaissance of gold miners that I had expected, the entire sector went into ANOTHER leg of its long-running bear market, with a continued brutal sell-off that led to a new low in late 2022. By that point, the stock of Condor Gold had fallen by two-thirds compared to the price it was trading at when my report was released. What seemed cheap before became cheaper still.

I was too early. Which, as any experienced investor knows, will happen to you many times in your investing career. Things will often take longer than you expected, and you need to be prepared for it.

That's where being humble and careful pays off.

In my Condor Gold report, I had also said that one should put just 1-5% of one's portfolio into gold stocks AND diversify across several companies.

By doing so, you allow yourself to…

Build the case – and the position

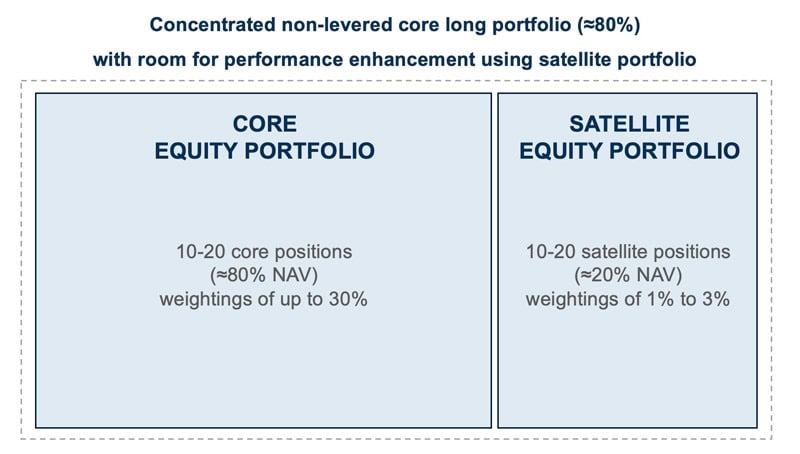

One of the smartest investors I know operates his portfolio on the basis of "core positions" and "satellite positions".

Core positions are the 8-12 stocks that make up 80% of the portfolio. Satellite positions – comprising weightings of at least 10-20% of the overall portfolio – are considered to have a very good risk/reward ratio. These companies have extraordinarily high upside combined with manageable risk, and the hoped-for development should have a high degree of visibility.

Source: Sarnia Asset Management, REMO Fund.

These stocks won't have gotten their higher weighting from the start, though, but "earned" it over time. Once you actually have a position – however small it may be – you get to know it. You can see from the first purchases how the stock behaves, including during different market environments. You develop a real gut feeling for it over time, once you actually own an initial position of the stock. It is vital that you look at it through the lens of actual co-ownership of the business.

Never forget that the world's best investors tend to get the majority (!) of their stock bets wrong – but they make up for it by getting the weighting of their positions right. George Soros and Stan Druckenmiller, for instance, made their fortune on the back of getting the weightings right, which made up for the fact that their ideas were wrong more often than they were right.

You can read more about this in an excellent book that I have been recommending for years: "The Art of Execution – How the world's best investors get it wrong and still make millions" by Lee Freeman-Shor.

Private investors can combine this with….

Using the Internet to spot catalysts

We live in a complex world, and few developments are ever monocausal.

In January 2023, Condor Gold announced that it was putting itself up for sale. If official confirmation was needed to show that my initial investment thesis about a coming takeover bid was correct, this was it.

Amazingly, the Internet even allowed you to identify the most likely bidder for the company: on Stock House, a Canadian stock discussion board, punters were shouting "Fill the mill!".

Their rallying cry was directed at Calibre Mining (ISIN CA13000C2058, CA:CXB), a Canadian gold miner with a CAD 1bn+ market cap.

Among others, Calibre Mining owns a gold mining operation in Nicaragua that it got hold of through the acquisition of publicly listed Canadian firm B2Gold. The "La Libertad" gold mine is situated almost next to the "La India" gold fields that Condor Gold had been exploring at great expense. If being neighbours wasn't enough of a coincidence, the Canadians also happened to own a rock processing mill at La Libertad that has capacity for processing 2.4m tons of rock a year, but which is currently running at just 50% of capacity.

Calibre Mining purchased La Libertad when it was already running low on gold-bearing rock that it could feed into the mill (so-called mill-feed). Only about 10-20% of the rock fed into the mill at La Libertad currently stems from the mine around the plant. To put the remaining large amount of capacity at the La Libertad processing mill to good use, Calibre Mining developed the "hub-and-spoke" model.

It may appear somewhat counter-intuitive, but trucking around tons of rock is actually so affordable that transport costs don't stop you from trucking in mill-feed even from afar. The rocks currently fed into this mill come from as far away as 8h worth of trucking time. Despite covering such a vast area of Nicaragua as radius for sourcing additional mill-feed, Calibre Mining still has 50% of that mill's capacity without use. That's 1.2m tons per year of spare capacity.

As it were, neighbouring Condor Gold could deliver about 900,000 tons of rock per year to the mill – and thus fits like a glove to solve the capex/opex trade-off that Calibre Mining's executives have to weigh up. If Calibre Mining were to acquire Condor Gold, the processing of the additional gold-bearing rock could be bolted onto the existing processing plant at La Libertad. There'd be costs for mobilising trucks and similar, but it'd make perfect economic sense, as far as any outside observer can tell.

Calibre Mining could then proceed much more quickly with generating additional cash flow to pay off the debt it had taken on to fund the acquisition of Marathon Gold.

"Fill the mill!" is the logical conclusion that knowledgeable observers of the sector have drawn, and they are calling on Calibre Mining to gobble up Condor Gold.

All the clues are there, as they say.

To find those elusive potential catalysts, some digging on the Internet is often all you have to do. It takes time, you have to veer off the beaten paths, and you need to consider a lot of contextual information. Still, it's entirely feasible for anyone to do – and it doesn't require a costly Bloomberg terminal.

Although, it also helps to…

Read what is NOT said

It's now been 16 months since Condor Gold announced it was putting itself up for sale.

No bid has taken place yet.

On the surface of it, my 2021 call seems even more off now than it did when the share hit a low in late 2022.

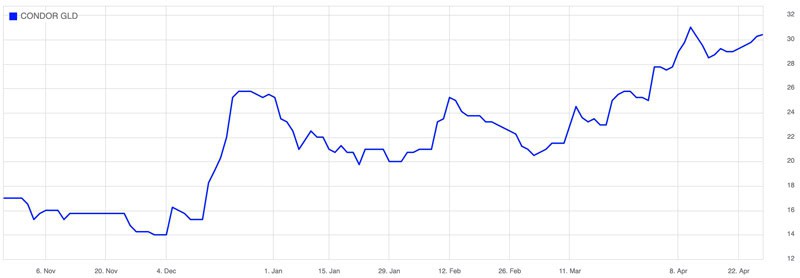

However, the stock has been on the up of late.

Four months ago, I sent some updates to Undervalued-Shares.com Lifetime Members that essentially expressed me going "all in" on this story. Condor Gold stock was trading at 15 pence at the time, and I quite aggressively nailed my colours to the mast. If no bid happened, Condor Gold would be one of the more embarrassing ideas presented on Undervalued-Shares.com

Since then, the stock has doubled to 30 pence.

Condor Gold.

Interestingly, it's now primarily what is NOT said that has prompted other investors to start paying attention.

In December 2023, Condor Gold last provided an update on the sales process, indicating that "the Company is in advanced discussions with 2 gold producers".

Since then… crickets!

In previous years, Condor Gold always published its annual accounts at the end of March. Not this year. It's now the end of April, and no results have been published yet.

In fact, the company has said NOTHING since December.

It's reasonable to speculate that a lot is going on behind the scenes. Does Condor Gold want to finish up its current sales before updating the market? I'd think to.

M&A is complex, and a precise timeline is often driven by lawyers rather than CEOs or boards. Putting all available clues together, I'd say Condor Gold is likely to be acquired by Calibre Mining or another bidder within weeks. After all, the company does need to publish its annual report no later than early June, and it will look to wrap up any deal by then.

Apparently, the market seems to think as much – else, the share price wouldn't be creeping up the way it does.

Although, it also helps to…

Be a bit lucky, occasionally

When I first featured Condor Gold, I was unlucky as the overall market turned against me.

The gold price didn't go anywhere initially, and stocks across the entire sector suffered from continued multiple contraction. My initial report on Condor Gold assumed a potential bid price that, from today's perspective, seemed wildly out of kilter. By late 2023, I had admitted that a bid was only going to come out somewhere between 35-40 pence, which was going to be a huge disappointment for anyone who bought into the stock at 46.5 pence and didn't have the dry powder (or courage) to buy more and average down.

Since then, the market has come my way.

Gold was trading below USD 2,000 in December 2023, and has since been climbing to more than USD 2,300 currently. The entire gold sector suddenly appears in a very different light, given that price increases add disproportionately to the bottom line of gold producers. In an industry with high fixed costs, such a 15% price increase can increase operating margins by 30, 50 or 100%.

With what has happened since, any bid for Condor Gold should come out at no less than 45 pence per share.

Again, it's worth checking what the market signals. Viable bid targets tend to require a premium of 30-50% above the most recent share price. With Condor Gold attracting a fair bit of general market interest rate now at a price around 30 pence, a bid in the 40s could be expected at the very least. If Calibre Mining were the bidder, it would likely use its strong stock as acquisition currency, at least partially. With the stock having risen from CAD 1.25 in January 2024 to now CAD 1.84 (and with an updated analyst price target of USD 3.75), Calibre Mining has the type of acquisition currency that even major shareholders of Condor Gold might gladly accept.

Source: CG Capital Markets, 22 April 2024.

This should even satisfy a Jim Mellon, who with a 24.9% stake in Condor Gold will decide the fate of any takeover bid (as the company's chairman, he's at the top of any discussions with potential acquirers). Mellon correctly predicted the recent rise of the gold price, and he probably didn't become a self-made billionaire by letting go of assets on the cheap. As Condor Gold even put on public record, it could have sold out months ago, but it's been holding out for a better price.

The rising price of both gold and the stock also adds a dose of pressure to a potential bidder: wait further, and it may only get more expensive. Competing bids could also drive up the price. As it just emerged, Nicaragua granted a major mining concession to a Chinese company – which only generates further interest in Condor Gold with a high-quality, well-documented existing mining asset in that country.

Did I do anything to deserve such an improvement in circumstances since December 2023?

I sure didn't. But if sometimes you suffer bad luck with timing and circumstances, you also get lucky occasionally.

One of the inconvenient truths both in life and investing is that luck is a huge, underappreciated part of the equation. It does take skill to pick a stock that produces a doubling, tripling or quintupling over two or three years. But there is also a huge amount of luck involved when it comes to short-term price movements. Legendary investors like Soros and Druckenmiller used their skill to avoid trouble and to stay around long enough to benefit from the positive luck that's bound to come your way every now and again. They maximised luck by increasing their weighting of a stock when their gut feeling and market signals told them to.

Most recently, shareholders of Condor Gold had to remind themselves that in investing, patience can be a virtue. However, the scales may soon be tipping towards a set-up where those Canadians better pay heed and not wait too long – the opportunity outlined above probably won't get better for them than it is now.

Trials and tribulations – and no free lunch

Investing is an art more than a science, and it's a constant striving for making the best out of situations that will never be perfect.

Today's Weekly Dispatch will hopefully have shown that anyone could do it. Finding original ideas and identifying catalysts isn't rocket science. Mostly, it's hard work. A bit of luck is required, too. The more work you put into it and the longer you have done it, the easier it gets. It's never easy, though, and there is never a sure-fire thing. That's why ancillary subjects, such as portfolio weightings, are so important.

It's a feature-length subject, and one that you can never really get to the bottom of.

Hot off the press: new in-depth research report

Money laying on the streets?

A couple of very smart investors have spotted just that and taken control of the company featured in my latest research report – out this week for Lifetime Members only.

They will know that i) a liquidation of the company is going to yield a 2x return for shareholders, ii) recent macro tailwinds could make for an even higher return, and iii) an ongoing litigation case could yield an additional windfall profit.

Hot off the press: new in-depth research report

Money laying on the streets?

A couple of very smart investors have spotted just that and taken control of the company featured in my latest research report – out this week for Lifetime Members only.

They will know that i) a liquidation of the company is going to yield a 2x return for shareholders, ii) recent macro tailwinds could make for an even higher return, and iii) an ongoing litigation case could yield an additional windfall profit.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: