Image by Majority World CIC / Alamy Stock Photo

Going from 43 taxes to just three?

Nigeria's telecoms sector could be about to experience just that. The country's new president, Bola Tinubu, is aiming for a radical reform of the sector's tax code.

Ditto for Nigerian manufacturers, which suffer from 197 different taxes, levies, and fees. Tinubu has identified that just ten of them bring 97% of tax revenue. Guess what he is thinking of doing with the other 187.

The West African country's new leader got elected in March 2023, and he has moved faster than anyone expected. Without even consulting his cabinet, Tinubu announced the cutting of fuel subsidies – one of Nigeria's biggest and most contentious issues – during his inauguration speech. The following day, he had a former central bank governor arrested.

Javier Milei is getting a lot of media coverage right now, but he has yet to deliver on his promises. In some ways, Nigeria's Tinubu is ahead of him.

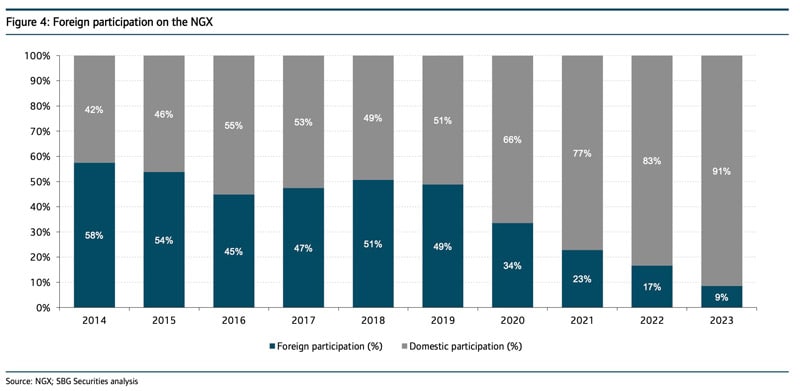

Despite this progress, few other countries experience such a degree of investor negativity. Over the past ten years, foreign ownership of Nigerian equities has dropped from 50% to just 9%.

Given the dramatic reforms underway, could the Nigerian market be approaching an inflection point?

Nigeria = hell on Earth

In my personal history, Nigeria has its own unique position.

It's the only country that I've ever fled from, fearing for my personal safety.

This was back in 2007, when I was touring eight African countries to research opportunities in residential property.

Nigeria held a unique promise at the time, which had attracted me. Anyone who was able to develop residential property to Western standards stood to earn a 50% p.a. rental yield and could ask for two years of rent in advance. Of course, the issue was that Nigeria was an incredibly difficult country to get anything done, least of all build Western-quality housing.

Ahead of my visit to the country, I had studied a seminal profile of the commercial capital, Lagos. As "The Megacity", published in the November 2006 issue of The New Yorker, pointed out, only 0.4% of the city's 15m inhabitants had access to a toilet that was connected to a sewer system. Everywhere I looked, I saw people shitting by the roadside.

Lagos felt like "Mad Max", but in real life.

Image by Luvin Yash / Shutterstock.com.

After 48h, I decided to make a beeline.

Fast-forward to 2023, and Nigeria still holds a reputation as one of the world's worst places to live in. The country is in long-standing competition with India for the largest number of people living in absolute poverty. For the past seven years, Nigeria has consistently held the appalling title of the poverty capital of the world, according to the World Bank.

It's also widely regarded as one of the world's most corrupt nations. On the annual Corruption Perceptions Index, Nigeria ranks 150th, meaning it's worse even than Russia which ranks 137th. Back in the 1990s, development circles bandied around claims that the amount of money embezzled over three decades from Nigeria's oil industry surpassed the amount of all Western aid paid to the entire continent of Africa since the end of the Second World War. I doubt anyone could actually verify these figures, but they were widely accepted as directionally accurate. And it still goes on. Back in 2022, Shell briefly stopped all production in Nigeria as the industrial scale pilfering of oil from its pipelines had made continuing to produce uneconomic.

Just about everything about Nigeria is extreme. The country is made up of over 250 ethnic groups that speak 500 languages and dialects, making it one of the worst examples of colonial powers trying to turn a patchwork of ethnicities into a single nation by drawing arbitrary borders on a map.

Then there is population growth. 100 years ago, Nigeria had 16m inhabitants. Today, it is estimated to have 220m, although no one has a precise figure. Population growth hasn't just been rampant, but it's projected to continue. Even though Nigeria has one of the world's highest child mortality rates with 117 out of 1,000 children not making it to the age of five, the population is expected to increase to 263m in 2030 and 401m in 2050. Nigeria is just one of 54 African nations and its landmass makes up just 3.1% of the continent, but it single-handedly contributes 16% of Africa's population.

What does this large mass of people live off?

Very little, actually.

Despite its vast agricultural hinterland and enormous rural population, Nigeria cannot feed itself. Malnutrition is a major issue and responsible for nearly half of the child mortality rate.

Nigeria will have changed significantly since my last visit 16 years ago. Still, despite my natural curiosity, it's one of the few places on Earth that I don't currently fancy visiting. It's a hot mess, and that's putting it diplomatically.

Somehow, though, the country seems to get by.

One major contributing factor is oil.

Oil – blessing and curse

Nigeria harbours the world's 11th largest oil reserves. In terms of oil production, it's 15th globally, ranking just behind Qatar, Norway, and Venezuela.

Despite its oil wealth, the country also suffers ongoing fuel shortages. With its combination of government instability and corruption, Nigeria doesn't have enough of its own refinery capacity. Perversely, Nigeria sells oil to buyers abroad and is forced to use its precious foreign currency income to purchase petrol fuel for reimport. Combine this expensive way of procuring fuel with low local incomes, and you get to appreciate that for the residents of this extremely oil-rich country, purchasing fuel has long been an expensive luxury.

To deal with the situation, previous governments decided to subsidise fuel. In 2022, the corresponding cost ate up a higher percentage of the government's overall budget than the allocation for health and education combined. Rampant smuggling of subsidized Nigerian petrol across its porous borders made matters worse.

The outflow of foreign currency to purchase fuel was one of the factors weighing on the state finances, and it also affected the country's national currency, the naira.

In 2015, the Central Bank of Nigeria (CBN) had no choice but to peg the currency against the US dollar at a rate of 197 naira for 1 dollar. Whenever such a peg comes into play, it's usually a sign that problems have already been left for too long. When the peg came into being, the actual exchange rate on the black market was already 370:1.

During the subsequent years, the CBN went through all sorts of contortions to keep its artificial currency system alive. Companies and individuals that wanted to exchange naira for dollars had to request the exchange and were forced to wait for months before they got to the front of the queue. Naturally, such a rationing system also gave CBN-favoured parties access to the valuable foreign exchange ahead of others, most likely in return for kickbacks, paid from the profits they got reselling the foreign exchange on the "parallel" market.

This stopped most Nigerian manufacturers and importers from purchasing raw materials from outside the country, just as much as it kept Nigerian parents from paying their children's tuition fees abroad. Airlines operating flights to and from Nigeria had more of their ticket revenues tied up in the Nigerian currency control system than in any other country on Earth.

Given the difficulty of getting money out of the country, it was no surprise that foreign investors decided it was not worth the effort. Even investment firms specialised in African markets have mostly stopped investing in Nigeria and sold their existing holdings.

Of late, the currency situation was so dire that some high-net-worth investors engaged in a peculiar type of arbitrage: they bought the stocks of Airtel Africa (ISN GB00BKDRYJ47, UK:AAF) and Seplat Energy (ISIN NGSEPLAT0008, UK:SEPL), both of which are listed in London, then transferred custody of the shares to Lagos and sold them there, usually to someone who wanted to have their money go the other way. I am reliably informed this is still done to this day. For most investors, though, this is not a viable route for investing – if anyone can even still follow the logic of these dealings.

Against this entire backdrop, Nigerian equity markets had long fallen out favour – even before the death knell that came in autumn 2023.

The cancelling of Nigeria's equity market

Following years of Nigeria's deeper descent into economic crises, the Lagos Stock Exchange was altogether dropped off the list of investible markets in early November 2023.

Morgan Stanley Capital International (MSCI), a provider of benchmark indexes, reclassified Nigeria from "Frontier Market" to "Standalone Market Status". This is the stock market equivalent of getting cancelled on social media. In effect, it meant that MSCI deleted all Nigerian securities from the MSCI Frontier Markets Indexes at a price of zero.

Two months earlier, FTSE Russell had also updated Nigeria's country classification to "unclassified". This status is designed to be a warning to the investing public that whoever brings money to Nigeria will be on their own due to persistent foreign exchange liquidity issues and the difficulty in repatriating investments.

The CBN tried to counter by issuing an assurance that foreign investors would be able to repatriate their funds, but these assurances came too late and bore too little credibility.

As recently as 2018, just over half of outstanding Nigerian equities were in foreign ownership. Over the past years, this has dropped to now just 9%. It's fair to say that foreign investors have completely deserted the Lagos Stock Exchange.

For contrarian investors, though, these changes to Nigeria's status could be a valuable and powerful signal. How much lower could the reputation of the Nigerian equity market possibly sink?

Often, this sort of development marks the end of the bottoming process.

Why, though, would anyone be interested in investing in Nigeria?

Ground-floor opportunities

What does make Nigeria quite interesting is how visibly underserved its market is:

- 80% of Nigerians don't have a bank account.

- 80% of Nigerian businesses don't have a website.

- 80% of Nigerians don't have a smartphone.

- 96% of Nigeria's small and medium businesses don't have access to loans.

- 97% of Nigerians don't have any insurance.

This is a Ground Zero situation for companies that offer the basic necessities of life – consumer goods, financial services, telecoms connectivity, or infrastructure and housing.

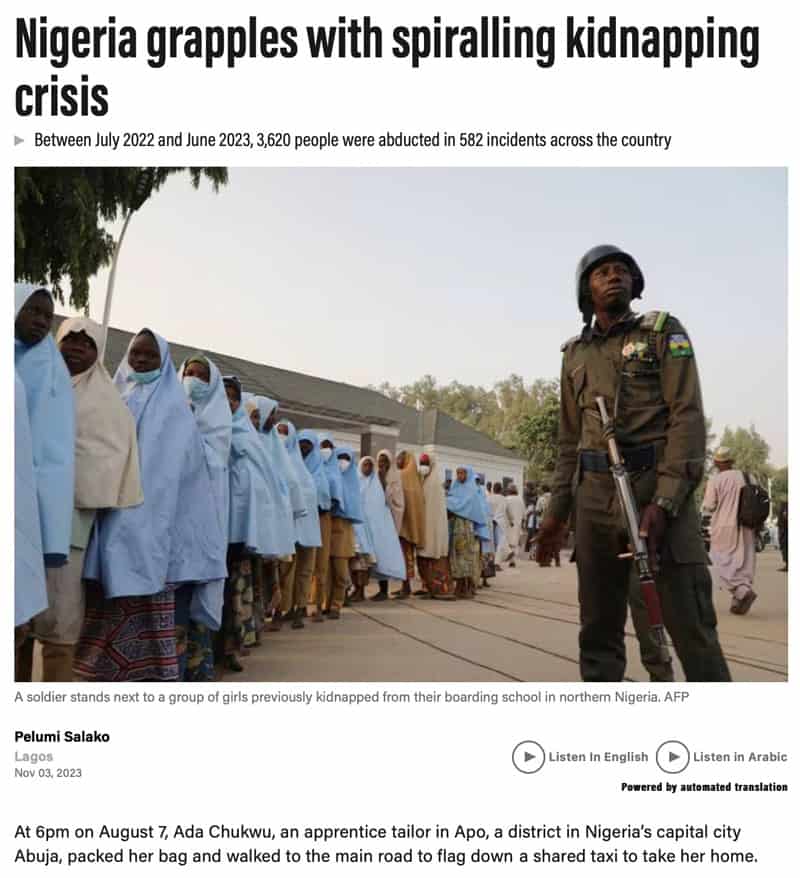

To be clear, I am far from being bullish on Nigeria. Right now, the Nigerian government cannot even perform the basics, such as protecting life and property. Banditry, kidnappings, and terrorism are par for the course in the country.

Source: The National, 3 November 2023.

Given just how deep a mess Nigeria is in, it'd be too optimistic to assume that a single person can pull the country forward. The kind of suboptimal structural conditions that exist in Nigeria are more likely to grind to dust even the most skilful of leaders. The odds aren't stacked in favour of Tinubu.

Then again, maybe a bit of cautious optimism is justified. History does occasionally cough up the right leader at the right time, and Nigeria's new president may be that exceptional case of someone who can alter the future trajectory of an entire nation. What will work in Tinubu's favour is a little-known feature: Nigeria's governance is highly centralised, with the federal government effectively controlling everything and states having limited authority over their governance. This may give Tinubu the necessary sway to have real impact.

Using the power of the central government, Tinubu has already abandoned the currency peg. This prompted the biggest single-day fall in the history of Nigeria's currency, but it also established Tinubu's credibility as a potentially serious reformer. The currency is now trading freely, and the CBN is trying to clear the backlog of currency transactions by connecting willing buyers and sellers. This is a major step away from the interventionism of the past.

Tinubu has also had some success in reining in the oil mafia. Nigeria's daily production has risen dramatically in recent months, and with now 1.7mn barrels a day it is above the country's official OPEC quota.

Even Nigeria experts don't know for sure where the journey will go from here. However, no one is currently expecting any good news from Nigeria, which provides a lot of room for surprises on the upside.

To get a better handle of the situation on the ground and to show private investors a path towards getting exposure to this situation, I spoke to the manager of a top-performing African frontier market fund.

Asking an expert

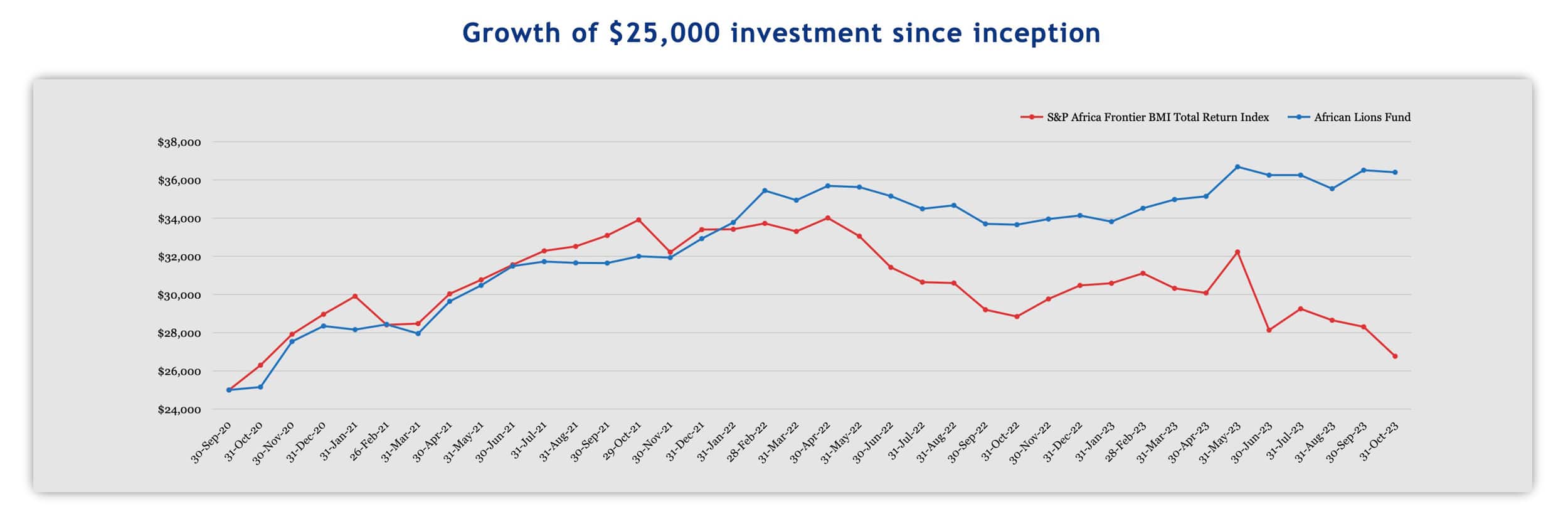

Tim Staermose is an old colleague from the world of investment newsletters and blogs. He has been managing African frontier market fund African Lions Fund since 2020. The fund started with just USD 3.7m of Tim's own money and that of about three dozen investors from his network. During the ensuing four years, it has grown to now USD 21.5m.

Tim visited Nigeria just last month. Not only does this make him a much braver man than myself, but it also indicates that smart money has started to sniff around the country.

I asked Tim for his up-to-date assessment:

"Nigeria is of interest to us because, even though it remains a very poor country, the sheer size of the population means there is still an emerging middle class of consumers. For instance, one of the companies we have invested in is the world's largest pasta producer already.

That said, right now the operating conditions for most businesses in Nigeria remain very difficult. But, things have started to impove from a very low base. Foreign exchange market liberalisation with the new 'willing buyer, willing seller' principle to clear the market is a massive step in the right direction. What remains is to get sufficient dollars flowing back into the country, to give the foreign exchange market the necessary depth, liquidity, and stability.

For now, wild gyrations intra-day on the naira / dollar exchange rate still make it tough to commit money. But as oil revenues ramp up, foreign exchange transaction backlogs are cleared, and more money gets pledged in foreign direct investment, I believe a new platform for growth can be set in Nigeria.

President Tinubu and his teams of advisors and technocrats are saying and doing most of the right things. But as ever it will come down to execution. Vested interests will fight tooth and nail not to lose their current privileges. We will be watching closely how things play out over the next 6 to 12 months."

African Lions Fund has already built two defensive investment positions in Nigeria's food and beverage sector, and Tim is looking to allocate more capital to the country over the coming 12 months.

Additional finance research also indicates an increased sentiment of cautious optimism among government stakeholders, consumers, banks, and industrial companies in Nigeria. Tinubu's government is believed by many to have a real chance to demonstrate its ability to execute reforms, particularly in addressing the currency and liquidity situation as well as the insane tax system. Tinubu is no hardcore libertarian in the conventional sense, and he does want to use the simplification of the tax code to increase the percentage of taxes collected. However, there are similarities in how he intends to shake things up to deal with his nation perpetually teetering on the brink of collapse. Also, increasing the government's tax income by LOWERING taxes is straight from the playbook of Ronald Reagan.

You could argue that Tinubu has streaks of a free market advocate, and equally, that he is merely looking to pursue an orthodox economic playbook. Either way, during his first few months in office, he managed to put Nigeria onto a trajectory that may pass an important inflection point.

Given all that, who'd be surprised if foreign equity participation started to recover from its record-low 9%? I wouldn't. There is a lot of money going around the region, including the USD 25bn in remittances that the vast Nigerian diaspora is sending back each year. There are only three Nigerian companies with a market cap in excess of USD 5bn, and the entire market barely reaches a USD 50bn market cap. Relative to their highest ever market cap measured in US dollar, many Nigerian companies are currently trading at their lowest point in 40 years. A billion or two of net inflows could move the needle rather a lot.

It does beg the question, how can investors with an appetite for this type of situation get exposure?

Basic industries as a way in

One of the surprising facts about Nigeria is that its telecoms industry is the third-largest contributor to GDP, accounting for a staggering 19%. The sector still has massive room to grow, given the large percentage of the population without a smartphone.

Imagine what this means for long-term growth of data traffic. Nigeria currently has 50,000 mobile phone towers, but it needs another 70,000 if estimates of the country's telecoms regulator are correct. The leading operator of such towers in Nigeria is IHS (ISIN KYG4701H1092, NYSE:IS), which is listed on the New York Stock Exchange. Its stock IPOed at USD 17 in 2021, and it has since fallen to below USD 5. IHS is the kind of stock that illustrates how even for the most screwed-up situations, you usually find a proxy listed somewhere on a Western exchange.

IHS.

Another operator that ordinary investors can get exposure to is Airtel Africa (ISIN GB00BKDRYJ47, UK:AAF), the Indian majority-owned telecoms company listed on the London Stock Exchange. The subsidiary, Airtel Nigeria, is the country's third-largest operator with a 27% market share and 50m customers. South Africa's MTN Group (ISIN ZAE000042164, JSE:MTN) is also majorly active in Nigeria, and its Nigerian subsidiary is the market leader.

Investors in countries like Nigeria should look out for basic industries that will benefit from consumers gaining more purchasing power. Companies whose name will make immediate sense to anyone include Guinness Nigeria (ISIN NGGUINNESS07, NGX:GUINNESS), Unilever Nigeria (ISIN NGUNILEVER07, NGX:UNILEVER), Nestlé Nigeria (ISIN NGNESTLE0006, NGX:NESTLE), and Lafarge Africa (ISIN NGWAPCO00002, NGX:WAPCO). These are all local subsidiaries of large Western companies, and their stocks are listed on the Lagos Stock Exchange.

Other companies have names that will appeal to anyone who has seen how such frontier markets build basic infrastructure. Dangote Cement (ISIN NGDANGCEM008, NGX:DANGCEM) is one such name, and one that is associated with Aliko Dangote, who sometimes gets ranked as Africa's richest man.

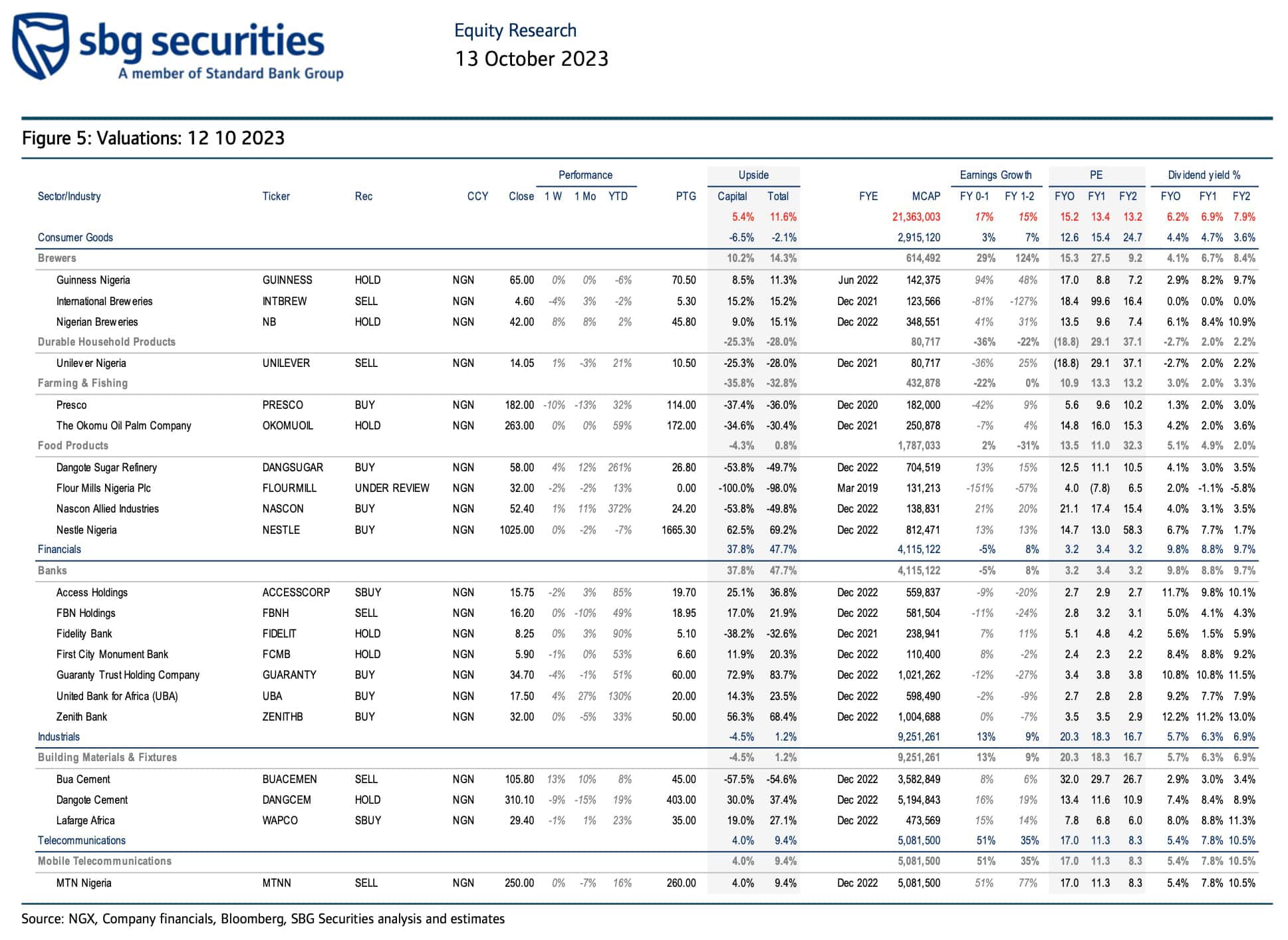

How can private investors research such domestically listed companies?

Realistically, you'll have to work with a local brokerage firm. SBG Securities is one such firm, and publishes valuation overviews such as the one below. International investors can also contact Auerbach Grayson & Company in New York, a global broker specialised in providing institutional investors with access to frontier markets.

Source: SBG Securities, 13 October 2023 (click on image to enlarge).

Funds – and possibly other opportunities?

You can of course also simply let a fund manager do the heavy lifting for you. In fact, with a difficult-to-access market like Nigeria, the fund route is often the most sensible one.

Until earlier this year, investors could get exposure by buying into the Nigeria ETF listed on the New York Stock Exchange. However, with the downgrading of Nigeria's status, the managers of the fund decided to put the investment vehicle into liquidation.

This leaves Tim Staermose's African Lions Fund as an alternative, and one that is accessible for a minimum investment of USD 25,000.

Source: African Lions Fund (click on image to enlarge).

More exceptional investments with a Nigeria angle could be hiding on the world's stock markets. There are over 100,000 publicly listed companies worldwide, with well over half trading on markets that most Western investors can access. London is a market that, traditionally, is home to many companies which operate their business in markets further afield. Oil companies are a prime suspect for offering exposure to Nigeria's economy, and Seplat is only one such company already listed in London.

Rest assured, Undervalued-Shares.com will be on the lookout for more such cases.

Much as Nigeria is currently more of a peculiar oddity among investment markets and not practical for most investors, it is an interesting case study and potentially a place where pioneer-type investment gains are waiting for you.

After all, Africa's population boom WILL change the world. By 2050, one in four people on the planet will be African. Today's median age on the African continent is 19 years, compared to 38 in the United States and 42 in the UK. The long-term implications of this "African youthquake" have yet to become apparent, and they will create long-term investment opportunities (see this related article by the New York Times).

Nigeria, for better or worse, will be part of this trend. Who knows, I might even visit again.

Transformation ahead for this UK high-street retailer

If you had bought into this company in 2010, you'd by now have gotten all of your money back through dividends, and retain a stake in a business that is worth 2.5x more than what you invested originally.

In the UK, this company is the most profitable in its sector. Crucially, it's now also turning into a growth play.

You will know the brand name, but you are unlikely to have heard about this new investment thesis before.

Transformation ahead for this UK high-street retailer

If you had bought into this company in 2010, you'd by now have gotten all of your money back through dividends, and retain a stake in a business that is worth 2.5x more than what you invested originally.

In the UK, this company is the most profitable in its sector. Crucially, it's now also turning into a growth play.

You will know the brand name, but you are unlikely to have heard about this new investment thesis before.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: