Many investments are described as unique, but Pinelawn Cemetery truly is.

Pinelawn Cemetery is a non-profit cemetery in New York that was formed in 1902 under two obscure New York laws from 1847 and 1895. These laws allowed cemeteries to be financed with quasi-equity securities called "land shares". Land shares were issued by only a handful of New York cemeteries before they were banned in 1949. Pinelawn Cemetery is the US' only remaining cemetery with tradable land shares, and you can invest through the stock market!

There is only one such investment case – and it's utterly fascinating.

It's also potentially very lucrative, if you can get hold of some of these thinly traded securities. The "land share certificates" that are traded on the OTC Market could be worth over 100 times their current value based on potential legal claims, though a range of 2-15 times is more realistic based on the value of the underlying hard assets that could fund payment of those claims. The legal claims wouldn't be the only path towards unlocking a lot more value from these land shares, though, because the land alone could be worth around USD 1bn compared to the current market cap of just USD 60m – making legal claims merely a bonus on top of a value play around land. The additional value is difficult to unlock and it will probably require a small-cap activist to step in – which may happen in the foreseeable future, for reasons this article will reveal.

I have been gagging to write about this case for years. Other investment journalists had tried their luck, but they only managed to scratch the surface. These are mysterious securities, and some of the following will even strike you as outright grotesque.

Get a coffee, sit back, and enjoy a Weekly Dispatch unlike any other you have read before.

A specimen of the Pinelawn Cemetery land share certificate.

What "land share certificates" are about

Incredibly, there once was a start-up boom for… cemeteries!

At the end of the 1800s, the US population grew rapidly as a result of high birth rates and a steady flow of immigrants. Inevitably, with a growing population came the need for additional cemeteries. Like any other operation, cemeteries need upfront investment, if only for the purchase of suitable land.

However, profiting from death was frowned upon by American society at the time. Most states banned for-profit cemeteries, and not just for reasons of morality. The state legislatures were concerned about unscrupulous operators opening cemeteries without an adequate long-term plan for their maintenance (as cemeteries incur maintenance costs for eternity, long after revenue from the last plot sale ends). Deserted cemeteries, sometimes with unfinished graves and corpses left behind, had been an all too common occurrence in the young nation.

Capital market innovation back in those days consisted of so-called land share certificates, a particular type of security created to raise funding for new cemeteries as a quasi-equity security. The shares promised investors 50% of the proceeds from the sale of burial plots, with the other 50% paying for the day-to-day operating costs of the cemetery and securing the burial grounds' long-term upkeep.

The duration of these land share certificates was limited only by the amount of land available for sale, i.e. they were going to keep throwing off a distribution to investors for as long as there were more plots to sell, which could be centuries even. Newspaper ads that touted the investment prospects of these securities sometimes described them "as safe as government bonds" and "producing an income more than ten times greater".

From a technical and legal perspective, these land share certificates resembled equity much more so than debt:

- The pay-out of proceeds from plot sales were called "dividends".

- The certificates granted at least some shareholder-like governance powers.

- There was no fixed end date, fixed payout, or fixed repayment value.

- The price of these securities could rise and fall.

- The certificates were called "shares" in all legal documents, and the owners were commonly referred to as "shareholders".

- The initial marketing prospectus called them "cemetery shares".

- For debt-based financing of new cemeteries, there was another form of security that was actually more similar to debt with a fixed amount of repayment.

For all intents and purposes, these land share certificates were designed to be equity-like instruments for funding start-up cemeteries within the confines of the industry's not-for-profit framework.

Not entirely surprisingly, the land share certificates of Pinelawn Cemetery are listed as "stocks" on the Nasdaq website, and they are included on the equity-focussed website Seeking Alpha.

I received a tip-off about these securities in late 2019 when they were trading around USD 230. Since 2005, they had been trading in a narrow band mostly between USD 200 and USD 300.

Just a cursory look at the sparse available information immediately convinced me that these land share certificates were an incredible investment that was destined to be discovered at some point. Indeed, the securities have since doubled to over USD 500 (peaking at over USD 600), and there is probably plenty more to come. Due to recent changes to SEC regulations on trading in "dark stocks" (= stocks of companies that don't regularly report financial information in a specific format), the shares have become even more difficult to trade with, but it is still possible to buy them. What's more, readers of Undervalued-Shares.com could even play a role in it, as you are about to learn.

Pinelawn Cemetery.

Land – so much land!

When Pinelawn Cemetery was formed, the population of New York City was just 3.4m compared to today's 8.8m, and there was also a lot less urban sprawl. The population of Long Island, where the actual Pinelawn Cemetery is located, was just 130,000 compared to today's 1.3m.

The entrepreneur who founded Pinelawn Cemetery, William H. Locke Jr., was able to purchase large tracts of forest and farmland for his cemetery project. By 1899, he had bought up 2,300 acres (930 hectares). By today's standard, purchasing such a large land bank within a 30-minute train journey from Manhattan is quite difficult to imagine!

While the US is known for plenty of space and suitably large cemeteries, Pinelawn Cemetery is quite simply HUGE (see illustration below). With 839 acres, it is the country's second-largest non-military burial ground, and the wider complex of contiguous burial land (over 2300 acres, 1,400 acres of which Pinelawn Cemetery had sold to neighbouring cemeteries in the 1910s and 1920s to pay off debt) is the largest cemetery complex in the US.

Comparing the size of Pinelawn Cemetery (shown at equal scale).

Even after well over a century of taking in corpses, Pinelawn Cemetery has space left to accommodate many more generations. As of today, it has over 600 acres of reserve land left for an eventual use as burial ground. Historically, the organisation sold land at the pace of about one acre per year. Even when you factor in long-term population growth, there is enough land left for about 500 years of operation. This assumes that the cemetery can't make more dense use of the space with mausoleums, crypts, and niches as the space is filled. It further assumes that none of the old burial grounds are ever recycled, as happens elsewhere on the world (in Germany, for instance, burial grounds are usually re-sold after just 30 years). The president of Pinelawn Cemetery said in 2018 that the remaining land would suffice for over 200 years, but that was probably an understatement. Pinelawn Cemetery has so much reserve land that it could probably keep existing graves for 1,000 years before recycling them and still never run out of space. The entire operation could be an incredible annuity-type forever business. This is a business where customers are dying to get in – literally!

The Pinelawn Cemetery.

So vast are Pinelawn Cemetery's land reserves that it once decided to "temporarily" lease out 225 acres to build a golf course. The operators of the Colonial Springs Golf Club seem to have gotten a real sweetheart deal, which you'll read more about later.

Who made this decision, and how did the owners of the land share certificates benefit from the income generated by the lease?

These questions are at the heart of the investment case, and they are fuelling a growing controversy that has recently started to spring up around Pinelawn Cemetery. An analysis of the organisation and its investment prospects needs to look into a range of complex and opaque but fascinating legal issues. Understanding these issues is immediately relevant for investors in Pinelawn Cemetery land shares.

Decades of underpaying land share owners?

Pinelawn Cemetery was formed in 1902 under the 1895 Membership Corporation Law of the State of New York and building on the 1847 Rural Cemeteries Act. As such, a different sets of governance standards and mechanisms apply to it. This is no ordinary company, and it's not even a "company" in the conventional sense.

Pinelawn Cemetery has 127,850 land share certificates outstanding. In theory, at least, each land share represents one vote at the annual meeting – that's granted by section 1511 of the cemetery code. However, Pinelawn Cemetery was last known to deny owners of land shares these voting rights. How so? Well, the people in charge simply get away with it doing things their way.

Well over a century after the cemetery's founding, the fourth generation of the Locke family still rules over its board. While the board is supposed to represent the interests of all owners of land share certificates, its actual function has been the subject of repeated controversy.

As far back as 1905, a board member (and New York Senator!) resigned in protest over what he felt was gross mismanagement and outright sabotage of governance standards. (In turn, he was accused of the same by the Locke family. They are not throwing cotton balls.)

Even during the early 20th century, there were already issues with paying the owners of land shares what was due to them.

The land share certificates are entitled to 50% of the gross proceeds from land sales. This 50% share is net of direct sales expenses, and there is also a provision (since 1949) for 25% going towards a long-term reserve fund to ensure the cemetery's maintenance. As a rule of thumb, 35-40% of the revenue from selling burial plots should be paid out to the owners of land shares. The choiciest plots in Pinelawn Cemetery nowadays command prices of up to USD 30,000, which would generate USD 10,500-12,000 for land share owners.

Just as originally envisioned, Pinelawn Cemetery does pay a twice-annual dividend to land share owners – most recently, USD 39.45 for the entirety of 2021 and USD 23.90 as the first of two dividends in 2022.

| Year | Distribution |

| 2022 | USD 43.40 |

| 2021 | USD 39.45 |

| 2020 | USD 43.20 |

| 2019 | USD 16.10 |

| 2018 | USD 26.45 |

| 2017 | USD 25.80 |

| 2016 | USD 25.80 |

| 2015 | USD 26.95 |

| 2014 | USD 30.05 |

| 2013 | USD 24.67 |

| 2012 | USD 24.38 |

| 2011 | USD 23.47 |

| 2010 | USD 21.28 |

These distributions make for an attractive yield of currently around 8%, but there is reason to question whether Pinelawn Cemetery has yet delivered what is legally due to the owners of these certificates.

For the time before 1945, sufficient data is available to suggest that Pinelawn Cemetery only paid out about half of what was due during that period.

Since 1946, the publicly available financial and operational data about the organisation is too scant to make a definitive judgment as to whether Pinelawn Cemetery had paid out the right amounts. Indications are, however, that it didn't. It wouldn't have been the first time.

In 1910, an underpaid owner of land share certificates filed and won a lawsuit against Pinelawn Cemetery. The organisation had to pay out a significant amount of money including interest and thus sold 1,400 of its original 2,300 acres to generate the funds. This case and the subsequent payments established an important legal precedent.

New York state law sets out a statutory 9% interest rate for sums due following a breach of contract. If Pinelawn Cemetery owed its owner of land share certificates anywhere near the percentage of proceeds that one can reasonably suspect based on the available financial information and the organisation's history, the sum owed to each of the land share owners would reach a fantastical amount – possibly over USD 50,000 for each certificate, and increasing by thousands of dollars of year given the steep, punitive interest rate that has to be applied across multiple decades. Crucially, there would be no statute of limitations issues given the fiduciary duties owed to shareholders. Owners of land shares could sue for full repayment, with interest, of their underpaid dividends for the past 120 years.

Pinelawn Cemetery wouldn't have the funds to pay out such an amount, even if it sold much of its land tomorrow for the full price of commercial and residential land. However, as the 1910 case and its resolution already demonstrated, Pinelawn Cemetery could sell land to cover the dividends and punitive damages.

What's more, there may actually be several layers of hidden reserves and claims.

The case of the dead land share owners

In theory, Pinelawn Cemetery should have a list of all land share certificate owners and post cheques to them twice a year.

In reality, this is not quite what happens.

The list of land share owners has been guarded by the company almost like the equivalent of the US government's nuclear codes. While there is a legal requirement to file the list with the New York State Division of Cemeteries, Pinelaw Cemetery doesn't comply. As a result, this list is extremely difficult to get hold of; needless to say, Undervalued-Shares.com has found a way to put its paws onto a copy of said list. Using the Internet, it has been easy to establish that the majority of the land share owners are dead – and mostly, had been dead for decades or even more than half a century by the time the list was produced.

There is a high probability that Pinelawn Cemetery isn't able to contact a large number of land share owners. Think about the practicalities. Someone might have bought land shares for a few dollars in the early 20thcentury. Several generations will have received these land shares as an inheritance by now. How many of them will have been forgotten in drawers or even destroyed altogether?

Where an owner isn't contactable, Pinelawn Cemetery should make a reasonable effort and set aside the funds that it wasn't able to pay to the owner. Once it has been established through the passage of a sufficient period of time that the shareholder was truly lost, the land share should have been passed over to the government in a process called "escheat". This escheat process never happens, though, so who is collecting the funds for these land shares and does the recipient have the right to do so?

According to my back-of-the-envelope estimate, half of the land share owners will not have claimed their payments. There should be tens of millions of dollars set aside for them in a trust account, invested with interest payable. However, the funds that Pinelawn Cemetery does put aside flow into an unaudited bank account which is held off balance sheet and not reported on, or consolidated with, the rest of their financials. About a decade ago, Pinelawn Cemetery reported only around USD 3m in such unclaimed funds to regulators. Is my calculation wrong, or is there a lot of loose change falling off the table?

Land share owners urgently need to get clarity on the following:

- How many dead shareholders are there?

- Why is this particular bank account unaudited?

- Where did the money go? Why didn't it end up in the organisation's coffers for redistribution to other land share owners?

If anything, it seems worthy of further investigation.

Decades-long governance failures

For over a century, there have been questions about Pinelawn Cemetery's management and its increasingly valuable assets.

It starts with basic governance questions, e.g. are family members who work for the organisation grossly overpaid? As just one example, not only did the current president of Pinelawn Cemetery receive a rather generous salary of USD 500,000 in 2020, but he also employs his wife who was promoted from office manager to executive vice-president in 2016 and received USD 300,000 in 2020. Are these really market-based salaries for merit-based hirings in a rather small operation?

As long ago as 1949, New York's state attorney general launched an investigation into the state's "non-profit cemetery corporations", as these organisations are legally called. The subsequent report found that many of them suffered grave governance problems such as boards stacked with family members and cronies, excessive salaries for the chosen ones, and assets being misused to enrich individuals at the expense of the organisation. Pinelawn Cemetery was explicitly singled out by the regulators for secretly selling burial plots to insiders at a huge discount, who then resold these plots at a huge profit in the secondary market.

As a result of the investigation, a variety of regulatory changes were introduced that banned the use of land shares to finance the formation of cemeteries. As is customary in such situations, all existing organisations of this type were grandfathered in, i.e. they could continue to operate under the laws and regulations that were valid when they were set up. However, 73 years after the 1949 ban that prevents setting up further New York non-profit cemetery corporations, the remaining ones are now an archaic relic from the past. Only three still have outstanding land share certificates, but two of them have nearly run out of land and only one has its certificates listed on a financial market where anyone with a brokerage account can buy and sell them. This is what makes Pinelawn Cemetery such a unique animal.

Since the 1950s, these operations have been supervised by a regulatory agency, the New York State Cemetery Board. The state's cemeteries are required to publish their prices, file at least rudimentary financial reports, and respect the Cemetery Board's rules. At the time the Cemetery Board was brought in, Pinelawn Cemetery enacted some changes to how it operated, but then largely disappeared off the public's radar for decades – other than being one of THE places in the Greater New York metropolitan area where to bury your relatives. In 1971, the New York Times article "Pinelawn Is a Prosperous City of the Dead" praised the organisation's approach to managing a high-quality, aesthetically pleasing burial ground to serve a city that suffered under many of its other burial grounds rapidly running out of space.

Pinelawn Cemetery's aesthetically pleasing character remains true to this day, and can nowadays also be enjoyed by members of the Colonial Springs Golf Club. This facility was built on land that belongs to Pinelawn Cemetery, and it has the potential to turn into the most egregious case of misappropriating income streams.

A golf course to benefit the Locke family and Pinelawn Cemetery board

Pinelawn Cemetery attracted renewed public interest in the 1990s, when it proposed to use some of its land to open a for-profit golf course.

Given their unique legal status, tax privileges and overall mandate, New York States' non-profit cemetery corporations are generally not encouraged to sell land. They can carry out transactions outside of their normal mandate, though, provided they are shown to benefit the cemetery and get advance approval by the Cemetery Board.

Pinelawn Cemetery's board argued at the time that generating extra income from otherwise unused land would benefit the short-term attractiveness of the cemetery and increase its long-term financial sustainability. They also argued that the transaction would not encroach on the core business, since a lot of reserve land remained available for burial grounds. To avoid mixing the core business with an entirely different line of activity, Pinelawn Cemetery would not operate a golf course itself, but lease out the land and merely receive a leasehold fee. At a later stage, the leased land could revert back to the freeholder and be used as burial ground.

In 1992, Pinelawn Cemetery signed an agreement to rent out 225 acres for an annual fee of less than USD 400,000, which by now will have risen closer to USD 500,000 through an indexation clause. The leaseholder of the land and operator of the golf course was none other than Stephen Locke, at the time also president of Pinelawn Cemetery who signed both sides of the contract. The transaction had been passed by the regulatory agency with the help of some prominent political support from a Senator and a Member of the US House of Representatives, and Pinelawn Cemetery's board approved of the transaction.

Was the annual leasehold fee a good deal for Pinelawn Cemetery? Much depends on the question what zoning the land falls under. The states' cemetery zoning laws are inconsistent, but there is a precedent for burial land being zoned for residential use, and there are some indications that the land used for the golf course partially fell into an area zoned for commercial use. Applying the area's typical commercial value of USD 1.5m per acre to the 225 acres and assuming a 5% cap rate, Pinelawn Cemetery should currently receive around USD 17m in annual rent (rather than less than USD 500,000). This is a back-of-the-envelope calculation, and I accept that one can challenge this figure. The true market rate probably lies somewhere between these two figures. Details aside and taking the shameless self-dealing into account, Pinelawn Cemetery probably didn't get a good deal. Had the land been leased out for a higher price, the annual distributions to land share owners could have been a lot higher.

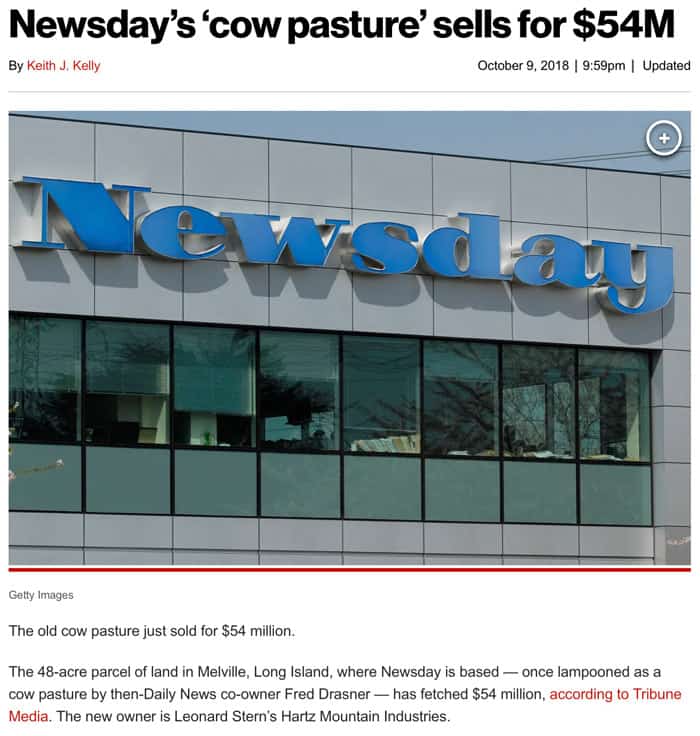

The value of Long Island commercial land right near Pinelawn Cemetery (source: New York Post, 9 October 2018).

One could argue that Pinelawn Cemetery's directors are personally liable for some of this amount, but this could only be established by a professional investigation of more documents. A closer look at the finer details of the operation would also yield more insights into whether or not members of the Locke family personally benefited in undue ways from the leasing of the land for the for-profit golf course. The same holds true for board members, since three board members of Pinelawn Cemetery are known to also be shareholders of the golf club. If these people unfairly benefitted from the golf club lease, this would probably be subject to a separate class action lawsuit by land share owners, and also demand the payment of tens of millions of dollars even before taking potential punitive fines into account.

Unsurprisingly, an investigator working for the Cemetery Board already discovered that Locke had not disclosed crucial information about the transaction, which only adds to the suspicion that the deal was skewed towards the benefit of insiders. In his report, the investigator, Gus Ballard, concluded that "Pinelawn Cemetery has been operated, all along primarily for the private benefit of the management". In 2004, the Attorney General of New York, Eliot Spitzer (who later went from fame to infamy), filed a criminal suit against Locke, Pinelawn Cemetery, and several of its officers and directors. The litany of charges included:

- Misappropriation of cemetery funds to secretly finance the golf course.

- Concealment of the true terms and nature of the golf course lease.

- Siphoning off millions of profits per year from the cemetery to the Locke family.

Not the sort of document you want to be named in.

The suit was settled under mysterious circumstances in 2006. All charges were dropped, and Pinelawn Cemetery's management only got a slap on the wrist. Just how the Locke family got away with its dealings is a question that land share owners can only wonder about. Some conclusions may be drawn from the fact that one year later, the organisation appointed two new board members who were known as political power brokers. Pinelawn Cemetery is, without a doubt, an organisation that enjoys a degree of political influence.

Coming up next – warehouses and offices on cemetery land

Of late, Pinelawn Cemetery has been promoting a scheme to set aside another 100 acres of its reserve land to build offices and warehouses. Needless to say, Pinelawn Cemetery is set within a sprawling urban area where land is valued at a premium. The use of 100 acres of land for real estate development would be worth a fortune.

This scheme is promoted by Justin Locke, the 4th-generation descendant of William Locke and son of Stephen Locke. He took over as Pinelawn Cemetery's president in 2013. In a rare public sighting of a senior member of the Locke family, Justin Locke explained the scheme in this video of a 2018 meeting of the Cemetery Board.

An article published on 25 July 2022 by the investigative reporter, Carson Kessler, in ProPublica reported:

"Four years and one pandemic later, Pinelawn's plans have slowly advanced. The cemetery's representatives shared preliminary documents with the planning department for the town of Babylon, and met with department representatives in January 2022. The plans called for transforming those 100 acres into 'the region's foremost Class-A business Park.' The development, with a budget projected to exceed $175 million, would include nine warehouses and office buildings, totaling 1.6 million square feet, and would be known as the Suffolk Technology Center. Todd McLay, chief financial officer of the developer, the Bristol Group, would not comment on the details of the lease, citing its proprietary status. But he confirmed that the project is actively in the works."

The long-read investigation by ProPublica is a MUST-READ for anyone who has enjoyed this article so far. It is the first in-depth article about Pinelawn Cemetery's questionable dealings in many years, and sets out other juicy details about the past and present looting of the organisation:

"Under the heading 'self-arranged bargains,' Alfred Locke allowed his aunt to buy 40,000 burial plots for 27.5 cents each, which she could then resell for $50 to $100 apiece."

Given ProPublica's focus on "investigative journalism in the public interest", its article doesn't focus on the investment angle of the land share certificates – which is where Undervalued-Shares.com picks up and continues the story.

MUST-READ: the 25 July 2022 ProPublica investigation.

Massive hidden reserves

By now, experienced investors will have guessed what triggered my interest in this investment case.

With just 127,850 land share certificates outstanding and 839 acres of freehold land, each land share represents 286 square feet (26.5 square metres) of land. At a current price of USD 525 for one share, you pay less than USD 2 for a square foot or about USD 20 for a square metre. The land share certificates are currently valued as if each acre of land was worth just USD 80,000. Needless to say, land in Long Island, New York, is worth a high multiple of that. Farmland in the area was recently valued at around USD 150,000 per acre and commercial land around USD 1,500,000 (all based on publicly available records about transactions in recent years).

The use of Pinelawn Cemetery's land is restricted in various ways, and the above-mentioned issue of zoning is unclear, which is why its value cannot be compared like-for-like with ordinary land. However, cutting off 245 acres for a for-profit golf course and potentially utilising another 100 acres for conventional commercial real estate developments goes to show that some of the land reserves should be valued at a price nearer to that of ordinary land. New York state law also allows cemeteries to sell non-burial lands, so the unused land can indeed be monetized.

This is aside from the fact that the ongoing sale of burial plots represents a profitable business. Relative to their size, these tiny patches of land are sold at an enormous price, thanks to the fact that New York doesn't have many other alternatives for burials.

As ProPublica reported:

"During the dark early days of the pandemic, when local cemeteries struggled to keep up with the region's wave of COVID-19 casualties, Pinelawn emerged as a standout; it was able to keep its operations going to meet the needs of grieving families. Pinelawn buried 5,381 people in 2020, up 30% from the year before, according to its filings.

…

During its heroic pandemic efforts in 2020, the cemetery's revenues rose by a third, and as demand soared, Pinelawn raised the prices of its burial plots as much as 47%, with the price of a plot in one coveted location rising from $7,495 in 2020 to $10,995 a year later. And that doesn't count the cost of the bronze grave markers, mandatory at Pinelawn (which bars traditional gravestones in favor of markers that are flush to the ground). In all, the grave markers and a long list of additional fees can add another $7,000 to $10,000 on top of the cost of the plot."

Pinelawn Cemetery's market cap currently stands at just USD 60m. The land alone could be worth USD 1bn. Even if the organisation simply continued operating the cemetery, the total payouts would be multiples of that over the next few hundred years. It's akin to a risk-free bond that grows at 5% p.a. and which currently trades at an 8% yield, but could easily yield over 10% if the organisation paid out what is likely due to land share owners. With that in mind alone, the land shares should be trading for at least twice the current price. The potential claims against board members and the claim for past dividends could add a highly interesting additional angle.

Needless to say, making these riches available to land share owners is not in the interest of the Locke family. If any of these potential developments were going to advance, they'd only happen through pressure from land share owners and a potential renewed investigation of the organisation through public authorities.

Will owners of Pinelawn Cemetery land share certificates ever see accountability?

For now, at least, the organisation remains firmly under control of the Locke family – but this is not guaranteed to last forever.

"The times, they are a-changin'"

On the surface of it all, the Locke family seems to be as firmly in the saddle as it has ever been:

- According to ProPublica, the family owns 51,964 of the 127,850 land share certificates (40.6%).

- The family both chairs and dominates the board (the latter through alleged cronies).

- Through its control of directorships, the board controls the flow of information.

Pinelawn Cemetery looks like a bulwark of the Locke family – and for now, it is.

However, times do change and long-time abusers sometimes have to face new circumstances. Those who'd like to shine some disinfecting sunlight onto the entire matter may also come up with new tools and techniques.

Buying up (or mobilising) a majority of the land share certificates to gain a voting majority at the annual meeting is not a realistic prospect right now. Many of the land share certificates will lay forgotten in peoples' drawers, their owners often unaware of their value after inheriting them from family members. Many may have been destroyed or lost over the decades.

However, a whole combination of factors could start to come into effect and eventually culminate in a changed situation for Pinelawn Cemetery. Here are just some examples:

- New York law knows the instrument of the so-called "mandamus", a lawsuit aimed at compelling a public entity (such as a non-profit) to perform a specific duty which it is required to carry out by law. A holder of land share certificates could bring such a mandamus and force the payment of the right amount of plot share proceeds for the past, and with an accrued interest of 9% p.a. Given how egregious many of these issues seem to be, I judge there to be a high likelihood of directors being personally liable if such a case was won. How large can the annual directorship fees be to justify taking the risk of being held personally liable to an unlimited amount for a deed that others benefitted from? In today's day and age of public shareholder activism and meme stocks, I wouldn't rule out the possibility that someone acquires a land share certificate purely for the purpose of leading such a lawsuit and informing FinTwit about it, if only for shits and giggles.

- The Pinelawn Cemetery land shares are securities. Under SEC regulations, any security with over 300 shareholders has to register with the SEC and disclose its financials publicly. The available Pinelawn Cemetery shareholder list may be out of date, but at last count it showed well over 800 registered shareholders. In the absence of reliable information about a lower number of shareholders, one should assume that failing to disclose this information leaves Pinelawn Cemetery in violation of federal securities law. A shareholder could sue to force disclosure mandated by the SEC, which would shed more light on the operations and possibly set an entire series of events in motion.

- Families tend to split into factions as decades pass. Just take the case of Scotland's Menzies family as an example, where individual family members sold their shares in John Menzies plc, and the century-old company eventually fell prey to a lucrative unsolicited bid. How long until individual members of the Locke family give in to offers for their land share certificates and the bulwark starts to fall apart?

- Is the family even still united, or are there rifts already? Could it be that some family members are screwing other family members over? There may be more to this theory than first meets the eye. After all, why do some of the Locke family members go to such great lengths with self-dealing when the family already owns 40% of the land shares? Couldn't they simply fill their pockets through less convoluted means? Is the golf course the real cash cow within this spider net of activities? Another back-of-the-envelope calculation yields that the club could easily make USD 5m in pre-tax profit per year. Pinelawn Cemetery has 11 board members. According to ProPublica, the golf club currently benefits "three of them, plus Stephen Locke himself, who own a combined 56% of the golf course". What about the other seven board members? Do they not get their "fair share", and do they even realise? (Hey, if you are one of those board members or family members, email me for my mobile number!)

- Pinelawn Cemetery lends itself to another public investigation of its financial circumstances. If the organisation got underpaid for the golf course lease for over two decades and to the tune of millions each year, there'd be another legal case waiting to recover funds from those who benefitted and pay them out to owners of the land shares. An aspiring New York state attorney could generate quite some publicity for themselves by taking on this particular case, and at this particular time. Such an investigation could have a range of potential outcomes, such as Pinelaw Cemetery being obliged to pay out some of its liquidity reserves to board members facing personal financial liability or even serious criminal repercussions. Again, what risks are non-family board members willing to take in exchange for a paltry annual directorship fee? When might the first one of them turn whistleblower to buy themselves immunity? There are many possibilities, and too many people are both in the know and personally exposed. In today's day and age, it will become ever more difficult for the Locke family to keep its alleged pact of silence intact, and a single dissident could get the entire melange into serious trouble. If my suspicions are right, then anyone who remains quiet will have to fear a potential implication by a whistleblower. It only seems to be a game of who blinks first.

- With Pinelawn Cemetery currently asking public authorities for permission to redevelop some of its land, public pressure could grow from a number of sides. Could this even compel the Locke family to one day do an about-turn and clean up its act based on its own decision? There may be a point where coming clean and reforming the organisation will become more lucrative for the family than trying to cling on to its old ways of operating (never mind the overall risk/reward profile of its activities).

How to get this done?

Last but not least, there may well be entirely different ideas as to how to get things moving.

ProPublica's recent article has travelled far and wide: it was the most-read article on the website when it got published, it ended up all over Twitter, and got republished by the local media in Long Island. Everyone who works with Pinelawn Cemetery will have read the article and considered the consequences that further investigations could have for themselves. How long until we see other media outlets starting to report about the matter, and could it even begin to hurt burial plot sales? If any of my readers have contacts to journalists who might want to report on Pinelawn Cemetery (such as the New York Times, Matt Levine, Bloomberg, the Wall Street Journal or similar), then please forward them my article and/or put us in touch.

Of course, there are alternatives.

As it were, raising funding to buy out large blocks of land share certificates or even pay for the acquisition of a majority shouldn't be too much of an obstacle. I am fairly confident that with a well-placed phone call (or two), even I could mobilise investors with an interest in backing such transactions – and there are many others in the finance industry who would be even better placed for this than I am.

The crux of the matter is: how to buy out one or several insiders to get things moving?

Might there be more dirt out there that could be published, and will the ProPublica article have set the wheels in motion for leakers and whistleblowers to do their work?

Might the Locke family have internal rifts that can be exploited? Might one family member have received a larger share of the spoils than another, and feel a need to get even?

Are there prospective heirs who want nothing to do with such dealings and would be prepared to sell out?

Pinelawn Cemetery's shares are valuable for their ongoing 8% yield alone, but the true opportunity rests with acquiring a block of shares and forcing payment of dividends that the shareholders have earned but not yet received – including going after the personal fortunes of board members.

There is a lot more to this story that I haven't even begun to touch on yet, and I may well get back to Pinelawn Cemetery in future articles. As someone who follows stories not just for years but sometimes decades, I have every intention of staying on the ball. There are also two other websites that reported about it in the past (in 2018, to be exact), OddballStocks.com and Elementary Value, albeit with relatively short articles since information is so hard to come by.

For now, I'll leave it to you to digest this unusual case and, potentially, get back to me with your suggestions on how to crack open this gem of an investment.

As you will have read in my recent exclusive interview with Karl Ehlerding and my article about the investment career of Martin Ebner, massive gains can be made through identifying underutilised assets and getting ahead of large structural changes and sticking to them for long enough to see through the eventual changes.

All along, Pinelawn Cemetery land shares have been listed on the OTC Market without anyone suspecting much of this. Trading has always been sporadic, and you'll need to be with a broker that is willing to trade in the OCT Market's so-called "Expert Market". Sometimes, no land shares change hands for months while at other times, surprising numbers change hands in a single transaction. Frustrating as Pinelawn Cemetery's lack of trading liquidity is, it does appear like this will eventually mutate to a case study similar to that of German charitable building societies during the 1980s/90s and Swiss domestic shares at the turn of the century – which is why I know some of you will make an effort to be invested with at least one share, so as to be part of it and have a front-row seat.

To answer the obvious question, it did occur to me that by publishing this article, I might put myself on the line. I just can't help myself!

This all makes for an investment case that has already produced higher gains than anyone would have ever thought possible. Originally, the Pinelawn Cemetery land share certificates were sold at prices as low as USD 1. During the ensuing 120 years, certificate owners who purchased for USD 1 have received an ongoing yield of about 10%, and their principal capital has appreciated over 500 times. That's around a 15% p.a. return over 120 years – not up there with Warren Buffett, but not to be sniffed at either, especially when you consider the remaining hidden reserves and the future potential of this investment. The income generated from the main asset is low-risk (given that people will continue to die), it's a business with high barriers to entry, and it's also an entirely uncorrelated business. If only the payments for the golf course lease were upped to somewhere near the suspected market rate and these funds made it to the owners of land shares as part of the bi-annual distribution, their price could already make a leap forward. There is so much potential. Eventually, these securities will catch up with their much higher potential, one way or another – because these things always do, just like water finds a way to flow through cracks.

When it all happens eventually, remember where you've read it first.

Another gem from the death care industry

Pinelawn Cemetery has what could be an incredible annuity-type forever business. Sooner or later, everyone becomes a customer.

Which makes the death care industry a pretty lucrative one – and crisis-resistant, too.

Around the world, there are about a dozen publicly listed companies that provide funerals, cremations, and related services.

I investigated one that is currently out of favour, but probably for not much longer. It's one of the leading death care companies in Western Europe, and its stock price is currently too low by a factor of 2-3, at least.

By year-end 2022, several catalysts should lead to a re-rating of the stock, followed by many years of growth, increasing market share, and increasing profitability.

An interesting play on both value and growth!

Another gem from the death care industry

Pinelawn Cemetery has what could be an incredible annuity-type forever business. Sooner or later, everyone becomes a customer.

Which makes the death care industry a pretty lucrative one – and crisis-resistant, too.

Around the world, there are about a dozen publicly listed companies that provide funerals, cremations, and related services.

I investigated one that is currently out of favour, but probably for not much longer. It's one of the leading death care companies in Western Europe, and its stock price is currently too low by a factor of 2-3, at least.

By year-end 2022, several catalysts should lead to a re-rating of the stock, followed by many years of growth, increasing market share, and increasing profitability.

An interesting play on both value and growth!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: