Since the war in Ukraine broke out in February 2022, anyone holding ADRs or GDRs of Russian companies will have had to deal with a complex set of problems.

The same has been true for shareholders of certain non-Russian companies that predominately own Russian assets.

Noteworthy developments have since taken place, few of which will have been covered by the mainstream media.

If you are affected by this issue, today's Weekly Dispatch is a must-read, and it will point you towards experts who can help with individual cases.

(For everyone else, feel free to skip this very technical briefing and check back next week.)

What has happened so far

The entire subject surrounding Russian ADRs and GDRs is almost impossible to cover, not because it's complex and intransparent, but because banks and brokerage firms do not always treat their customers according to the rules.

I've come across numerous cases where banks and brokerage firms:

- Treated individual customers differently, for no apparent reason.

- Refused to deal with the subject at all, because…. Russia!

- Misinterpreted rules or simply weren't aware of finer details and new developments.

In fairness, from the perspective of banks and brokerage firms, the matter must almost be impossible to deal with. The treatment of ADRs and GDRs of Russian firms is:

- Influenced by countless individual factors on a company level, which makes it insanely complex to deal with.

- Subject to repeated rule changes, many of which were difficult to keep on top of in a timely fashion.

- Hindered by practical factors such as language barriers and the general level of bureaucracy that the entire financial sector is caught up in nowadays.

It's simply an administrative nightmare for all parties involved. Banks and brokerage firms have to bear huge costs to help their clients, which will disincentivise some to even dedicate time to it. Hence, many customers feel stranded and left alone.

Many Undervalued-Shares.com readers with Russian ADRs and GDRs got as far as opening a so-called C account with a Russian firm and getting their depository receipts converted into ordinary shares that are now held in the Russian C account (also often called S account). In effect, an S account is a brokerage account with limited functions. You can only hold securities, but you won't be able to buy or sell any securities absent special approval from Russia's Government Commission on Control over Foreign Investments. You can collect dividends, but not generally repatriate the funds. And even these limitations have exceptions. Here is a summary that specifies the list of documents you need to provide to apply for permission to sell Russian assets.

In other cases, companies have decided to take matters into their own hands and get creative. Polymetal is a case that stands out. The firm was Cyprus-based and held 60% of its assets in Russia, with the remainder of the business located in Kazakhstan. In theory, nothing should have stopped investors from buying and selling the stock in London since it's not a Russian firm per se. However, many banks and brokerage firms decided to "voluntarily" stop taking orders for the stock because… Russia! Other banks and brokers decided to only sell the stock, but not take buy orders.

Polymetal recently decided to:

- Delist from the London Stock Exchange.

- Re-domicile from Jersey (Channel Islands) to Kazakhstan.

- Negotiate a sale of the Russian arm, but without the pressure of being under a sanction regime.

- List the stock on the Kazakh stock exchange.

- Offer shareholders to remain invested in the Kazakh operation.

Source: Financial Times, 25 January 2023.

These "solutions" don't always help every shareholder. Someone whose brokerage firm cannot trade in Kazakhstan will not be pleased about this decision, and this turned many Polymetal shareholders into forced sellers ahead of the de-listing. But it's exemplary of the kind of strategies that companies adopt to get out of the bind they have been left in. When politics blocks a route, companies find a way to deal with it – just as water always finds a way to flow.

What other developments can investors expect, and will there be new solutions for those who are still stuck with Russian ADRs and GDRs?

Credit for a significant part of the following information has to go to Roemer Capital (Europe) Limited of Cyprus, a brokerage firm that publishes an informative email newsletter for financial services professionals. They may be a party worth reaching out to if you are affected by this entire issue.

1. A new round of forced conversions

When Western banks and brokerage firms as well as major clearing houses didn't cooperate in converting depository receipts into ordinary shares, the Russian legislator stepped in. Russia created laws that allowed Western owners of these securities to convert them without the support of Western banks and brokerage firms (so-called forced conversions). The collaboration of Western clearing houses also wasn't necessary.

Unfortunately, the possibility to make use of these regulations ended on 10 November 2022.

However, there is now talk of another round of forced conversions coming as early as this fall. Both the Central Bank of the Russian Federation and the Ministry of Finance of the Russian Federation are reportedly lobbying to amend the Russian decree #319.

Anyone who is interested in this path is probably well-advised to prepare by opening a Russian S account. It's not necessary to travel to Russia to open such an account, but it takes time to set up such an account because you need to provide a fair bit of paperwork. Be prepared so that you can take advantage of this route if or when it opens up again.

2. Another round of conversions by Western banks and brokers

At the beginning of this year, a major depository receipt agent, JPMorgan, had already opened its books for standard DR conversion. Another Western bank that acts as a major administrator for Russian depository receipts has also recently re-started the conversion of ADRs and GDRs into local shares: Deutsche Bank, an institution with decades-long strong links to Russian business.

Reportedly, other major Western administrators are likely to follow soon.

This is an indirect result of the forced conversion process carried out last year, which left the books of these administrators somewhat out of balance. They are now forced to re-open the entire process.

To be clear, this may enable you to hold ordinary shares of Russian companies with your Western bank or broker, but only if your bank or broker has a foreign nominee account with the relevant Russian custodian, because Russian underlying shares can be held only within the Russian depository system. If your Western bank or broker does not have a link with the Russian depository system, you will need to open a Type C account in Russia and proceed with standard DR conversion either by yourself or with the help of attorneys.

3. New service providers

The entire situation may yet soften up a bit through factors such as new service providers.

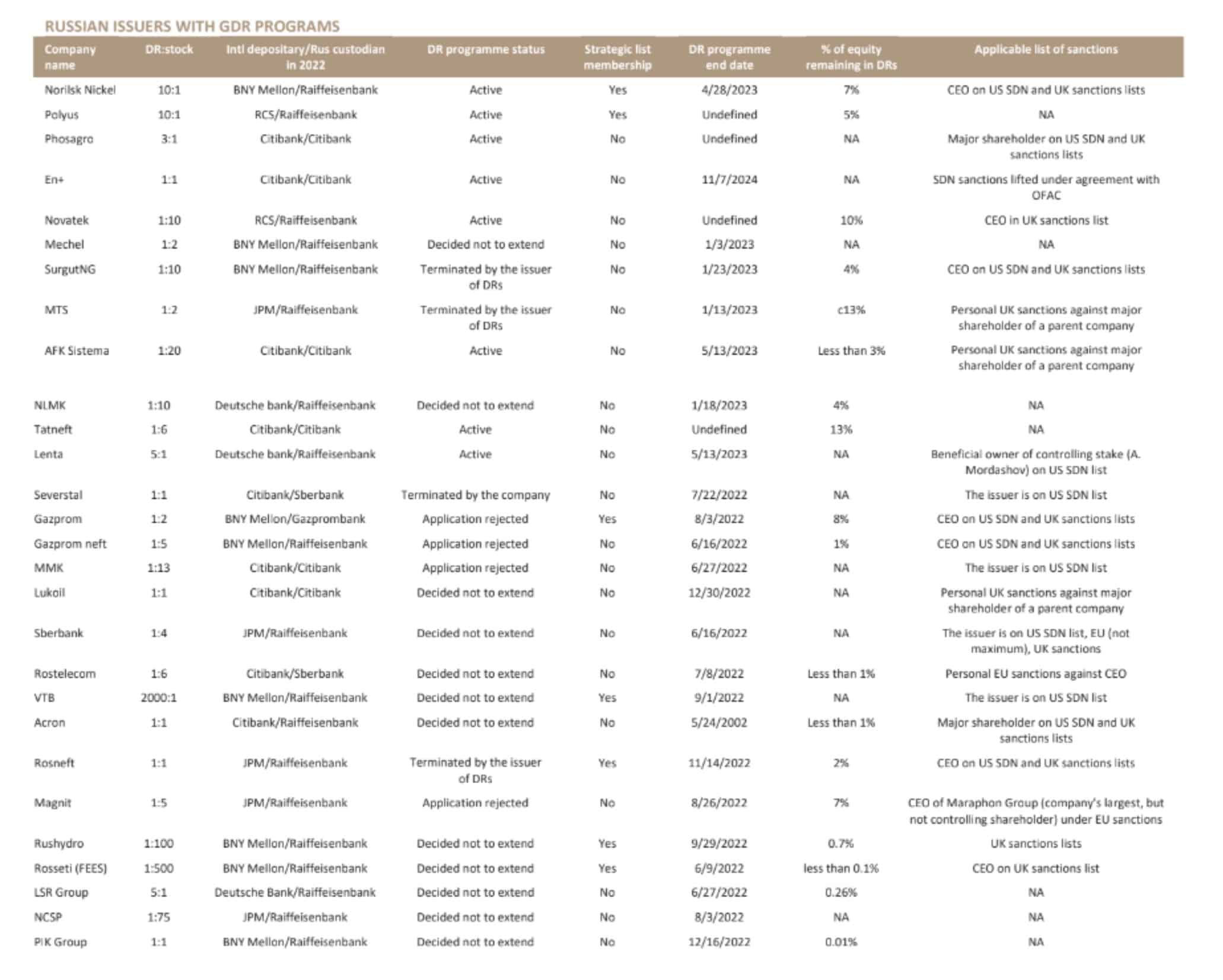

E.g., the Russian legislator allowed a raft of Russian companies to retain their ADR and GDR programmes. This seemed fruitless given that major Western depository administrators such as BNY Mellon and Citibank were terminating their Russian depository receipt programmes. However, some Russian firms have now managed to hire a new, EU-based depository administrator, a firm called RCS Issuer Services in Luxembourg. Firms that reportedly have hired RCS include Novatek, MD Medical, EMC, Etalon and Polyus (prior to being sanctioned so their situation may change yet again). Interestingly, Novatek has managed to retain its GDR programme and even continues to pay dividends to its GDR shareholders. This goes to show how many exceptions there are.

The precise long-term benefit of this activity remains to be seen, given that Western bourses currently do not allow the trading of these ADRs and GDRs. However, for once, it keeps the current structure for holding these securities in place, instead of steps such as forced selling of the shares underlying these depository receipts.

4. Tender offers

We may soon be seeing a wave of tender offers to buy out Western investors at a high discount.

Magnit has published a tender offer to purchase up to 10% of its outstanding capital. This particular buyback is offered at a 50% (!) discount to the price on the Moscow Stock Exchange, such discount is required by Russia's Government Commission on Control over Foreign Investments for any security transaction involving non-residents from so-called unfriendly states. But it does include an interesting twist. Non-resident (i.e. non-Russian) shareholders holding these securities in a Russian C account can not only tender their shares, but are allowed to receive the purchase price in USD, EUR or Chinese renminbi in their bank accounts in Russia or abroad. There'll be a 10% tax on such a sale.

This is the first such offer that I am aware of. I would expect that it will pave the way for other corporations in Russia to publish similar offers. It could also affect how foreign shareholders with securities held in C accounts value their holdings. Plus, as these offers become more prevalent and with all the other developments set out in this article, we may yet see a narrowing of the discounts to something more reasonable (i.e., I would wait for better offers).

5. Corporate restructurings

Polymetal led the way in getting creative about its corporate structure, and other firms are likely to go down the same path.

There is a considerable number of companies that do not fit the conventional criteria of a Russian firm, but which got caught up in the entire situation. This primarily includes firms that hold considerable Russian assets but which are legally domiciled abroad, usually in places such as the Netherlands or Cyprus.

One such firm is Yandex, the Google of Russia, which is trying to split up its business. The firm is currently exploring a restructuring where investors could choose whether to keep a stake in the company's profitable Russian business, take cash or receive a share of its international start-ups. Yandex is not a sanctioned entity, but it was threatened with a de-listing of its stock from the Nasdaq market. Following a successful appeal to the listing authorities, the stock is now allowed to remain on Nasdaq, subject to a restructuring of the company by the end of 2023.

There is a growing list of companies that decide to change their domicile and restructure. This list includes VEON, which agreed to sell its largest Russian subsidiary, Vimpelcom, to the management so that the remaining trading entity has almost no connection with the Russian business anymore. Softline changed its name to Noventiq and listed on Nasdaq. QIWI, the Russian payments provider, is also going to split its business, which should enable the remaining non-Russian operation to remain listed on Nasdaq.

The following table lists all "Russian" companies that are not conventionally based out of Russia, and gives some details of their thinking as per April 2023 (once again, full credit to Roemer Capital for staying on top of these things).

Source: Roemer Capital (Europe) Limited, 7 April 2023 (click on image to enlarge).

6. Intervening politics

Lo and behold, there is a growing chance that Western politics will step in to untangle at least some of the situation.

As the EUobserver reported on 17 May 2023, "EU countries are preparing to help their companies to exit Russia".

As part of the planned 11th sanctions package, the EU is apparently reconsidering its previous ban on European law firms to provide commercial services to Russian clients. The next round of sanctions reportedly aims to relax the ban "in order to help disentangle related EU-Russian joint interests inside Europe."

There are a few other developments that broadly fall into the same category. E.g., Euroclear recently re-opened settlement for a handful of Russian securities, and it is expected to add more in the near future. Following consultations with its lawyers, the EU has admitted that assets of the Bank of Russia frozen in the EU will have to be returned to Russia after the end of the Ukraine war. An outright confiscation would endanger the euro's position as a reserve currency and probably result in endless lawsuits. This realisation makes it much more likely that Russia and the West will eventually agree on an asset swap.

Just during the last few days, Russia's Central Bank considered an option whereby Russian investors with assets frozen abroad could sell those assets to foreign investors at the expense of their funds blocked in the Russian infrastructure on Type C accounts.

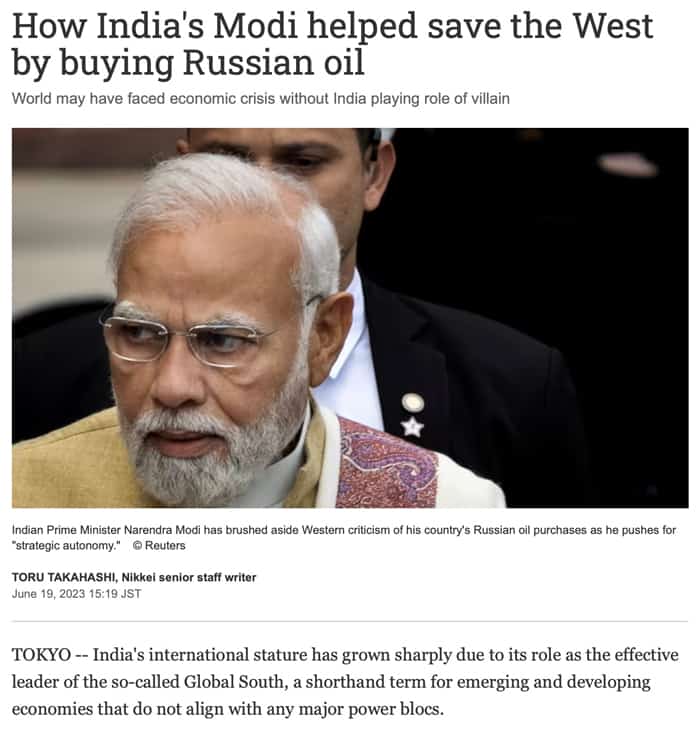

A face-saving political solution could involve a re-emergence of some of these securities through listings on exchanges that are not Western but which Western investors find reasonably easy to trade on, such as Hong Kong (where RUSAL is trading) or Dubai (at a time when Middle Eastern bourses are resurgent thanks to deep local pools of capital). Just like the West now willingly and knowingly buys Russian oil via India, this could offer Western politics a way out of the problem that it created for itself.

Source: Nikkei Asia, 19 June 2023.

Resolutions likely within the next 24 months

How long could the current situation persist?

Sceptics will point to the closure of the Russian stock market in 1917, which lasted until 1992.

However, it seems that we are now seeing movement on several fronts. This comes combined with some Russian companies reporting numbers that were far better than anticipated. Whereas Gazprom has been badly hit by the sanctions, Rosneft just announced exceptionally strong financial results for Q1/2023. Even sanctioned Sberbank announced that consequences for 2022 were not as grave as expected. The Russian economy contracted a mere 2.2% last year, and the bank expects it to grow by 2% this year. Large dividends have continued to flow at many Russian companies, and Russian investors continue to buy domestic stocks – not the least, for lack of alternatives.

Hiding within all this may even be a few interesting special situations. E.g., the business of online bank TCS Group/Tinkoff Group has remained very strong and doubled over the last two years. Non-US and non-EU investors can trade this stock in the over-the-counter market through service providers such as Roemer Capital, and there may be large valuation differentials waiting to be exploited. TCS stock outside of Russia is trading OTC at a ≈65% discount to the price paid on the Moscow Stock Exchange. Yandex stock is also trading OTC outside Russia at 60% discount to the price paid on the Moscow Stock Exchange, and the company may undergo restructuring. These are special situations in the true sense of the word, and their valuations show just how out of whack this entire market still is.

For conventional investors, it could be worth keeping an eye on Central and Eastern Europe Fund, a NYSE-listed entity with a broad portfolio of Russian securities. Undervalued-Shares.com Lifetime Members had already received an in-depth research report on the company, outlining why it might be the best way to exploit the valuation differentials caused by the sanctions. CEE is managed by Deutsche Bank's fund management subsidiary, DWS, and may yet benefit from how close to the action Deutsche Bank is when it comes to finding solutions for this issue.

What are individual investors who are stuck with Russian ADRs and GDRs to do?

My recommendations include the following:

- Regularly check with your bank or broker, as the situation may have changed (if only because you end up speaking to a different employee).

- Open a Russian C account, just so that you have it ready if or when needed. You can do so with Gazprombank or with Freedom Finance Russia.

- If you have a large amount of money invested, it can pay to engage specialised lawyers such as Morgan Lewis in New York (contact Grigory Marinichev), or LEOLEX in Switzerland (contact Roman Kudinov) who also provide extensive advice on converting Russian Eurobonds.

- If you are a German investor, join the Schutzgemeinschaft der Kapitalanleger (SdK), a non-profit organisation that represents private investors and has remained on top of the subject through publications and videos. One of SdK's board members, Dr. Marc Liebscher of lawfirm Späth & Partner in Berlin, is Germany's leading legal expert on the subject matter.

- Read up the excellent 14 March 2023 summary of the issue published by Morgan Lewis.

- If you need to claim dividends from sanctioned entities, this has to be done within three years; lawyers such as Morgan Lewis can also help with this.

I suspect that over the course of 2024 and 2025, much of the mess surrounding ADRs, GDRs and shares of Russian companies (and companies with large Russian exposure) will be cleared up gradually. Investors are unlikely to recover the pre-war full value of their holdings, but they'll get some kind of exit or clarity on how to value their holdings on their books. Some Russian companies also perform much better under the current circumstances than expected, so their stocks may yet recover to a higher degree than previously thought possible.

The latest on Russian ADRs/GDRs (German-language video)

What's the current outlook for owners of Russian ADRs and GDRs, as well as for major companies with assets in Russia?

Dr. Marc Liebscher of SdK Schutzgemeinschaft der Kapitalanleger e.V. and I give a rundown of the latest developments.

If you liked today's Weekly Dispatch (and speak German), you'll certainly enjoy this additional summary!

The latest on Russian ADRs/GDRs (German-language video)

What's the current outlook for owners of Russian ADRs and GDRs, as well as for major companies with assets in Russia?

Dr. Marc Liebscher of SdK Schutzgemeinschaft der Kapitalanleger e.V. and I give a rundown of the latest developments.

If you liked today's Weekly Dispatch (and speak German), you'll certainly enjoy this additional summary!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: