UK real estate stocks are trading at historically low multiples. Will they ever shake off the current doom and gloom?

“Shit” mining companies – the next stellar performers?

Every so often, though, some do come back to life and produce spectacular returns.

Undervalued-Shares.com previously featured one such stock that has risen 500% over the past 26 months.

Get ready for more comeback stories!

Companies that (may) come back from the dead

Of all the publicly listed mining companies that "shat the bed" (American slang to describe a person or thing that failed, often in a complete and irreparable fashion), Bougainville Copper (ISIN PG0008526520, AU:BOC) has to be the bellwether. Like the other companies featured in today's Weekly Dispatch, politics played a major role in its fate.

The Australian company operated the giant Panguna copper mine in Papua New Guinea – once one of the world's largest, and notable for a significant amount of gold.

However, the company's relationship with the indigenous population was anything but smooth. The mine's contentious operation sparked a civil war that lasted ten years and left 20,000 dead. Not since the colonial days of the 19th century had a single company caused so much human suffering. Besides the fighting, the mine also left behind tailings that are still leaking toxins into the groundwater today.

I've been covering this stock one and off since the early 2000s, as one of those early believers who thought the mine could be brought back into operation. The civil war had ended in 1998, and it seemed logical that putting the island's prime economic asset back into production would help its society recover. Rebuilding costs money, after all.

The stock of Bougainville Copper has since seen about ten periods of intense speculation about the mine's potential reopening. Each such instance looked credible in some way, but none of them ever led to a real breakthrough.

Bougainville Copper.

What did advance in the meantime was Bougainville's independence. Though colonial powers had made the island a part of Papua New Guinea, many Bougainvilleans did not feel part of that nation; ethnically, they're closer to the Solomon Islands. The peace agreement signed in 2000 allowed Bougainville to become an autonomous region; in 2019, a non-binding referendum saw over 98% vote in favour of full independence.

Bougainville seems set to become a country in its own right by 1 September 2027.

However, how is this dirt-poor island going to pay its own way?

The obvious answer to the question caused the latest round of speculation. As The Conversation reported in a feature on 2 June 2025:

"Bougainville leaders see the reopening of Panguna mine as key to financing independence. Bougainville Copper Limited, the Rio Tinto subsidiary that once operated the mine, backs this assessment."

It sounds promising, but such articles are set against a quarter century of similarly promising reports on Bougainville Copper. An entire generation of speculators has already been worn out by these repeated false dawns.

Then again, Bougainville Copper still has life in its old bones. Over the past five years, the stock has surged 50, 100, or even 200% several times, often triggered by a single headline. The company has a market cap of AUD 150m, and its stock is very volatile.

Does the chart below not inspire you to simply "buy low and sell high"?

Bougainville Copper.

Bougainville Copper, still owned by Rio Tinto, maintains a claim to the mine – but it's no longer the only player in the game. At least one start-up has tried to secure rights by lobbying Bougainville politicians, and multiple countries have shown interest in Bougainville's strategic resource potential.

In April 2025, the Daily Mail spread a wild story, claiming US president Donald Trump was eying a deal with Bougainvilleans.

Source: Daily Mail, 19 April 2025.

The Chinese are also showing interest – unsurprising, given China's hunger for resources combined with its geopolitical deliberations. Bougainville would give China an outpost with a straight line of sight (of sorts) of the Australian coast.

Source: The Conversation, 2 June 2025.

Whoever takes on these ambitions will need a lot of money, staying power, and a bit of luck.

After all, Bougainville Copper had truly shat the bed – and big time!

Its toxic legacy – paired with the country's extreme underdevelopment – makes for an almost insurmountable challenge.

You'd think the idea of sudden riches and modern development would get a crisis-ridden society like Bougainville to pull together and take steps forward. However, this has not been the case (yet). I wrote about Bougainville Copper and the island's growing prospects for independence in 2020, 2021, and 2022. Whether the stars finally align for both the island and the company remains to be seen. Personally, I remain sceptical. Up to now, Bougainville has proven itself to be deeply dysfunctional.

Given my premature initial optimism in the early 2000s, you can (and probably should) of course ignore my view on anything Bougainville and lean on analysts' views instead. Thankfully, unlike 20 years ago, it's has become fairly easy to research the company. There's no shortage of material online, such as the following superb article.

Source: Owen Analytics, 19 March 2024.

Heck, you could even travel to Bougainville and assess the situation on the ground – something that was not possible in the early 2000s. Things have since changed tremendously. The first intrepid explorers began visiting in the early 2010s, and in 2018, a New Zealand travel blogger had not just toured the island but also the old mine site. His photos and videos show that none of the old mining facilities would have any use today.

Source: Adam Constanza, 1 December 2018.

In some ways, Bougainville's situation did change.

Any serious mining effort, however, would have to start from scratch in terms of capex. Fortunately, mobilising capital could lean on Bougainville Copper's extensive geological knowledge. Back in the early 2000s, I noted that the existing copper and gold mines might not even be Bougainville's only natural assets. Bougainville Copper had explored for other deposits at the time, indicating that Bougainville could rightly be called "treasure island".

Will these ongoing changes ever be enough to get the mine back in operation?

I'd rather not add more fuel to the fire of speculation – there's already plenty of noise out there. What does seem likely, though, is that the stock will continue to provide opportunities for playing volatility and riding short-term hypes.

Good luck to anyone who wants to try their luck!

For everyone who believes such mining rejuvenation plays are best pursued in more mature jurisdictions, there is…

Bougainville Copper's American counterpart

New York-listed Northern Dynasty Minerals (ISIN CA66510M2040, NYSE:NAK) may not have sparked a civil war with thousands of deaths, but it stands as one of the most controversial and fiercely contested mining projects in US history.

The company owns the Pebble project, potentially the world's second-largest combined copper and gold mine. Its copper reserves represent 1.3% of all copper ever discovered or produced in the last 10,000 years. The exceptional ore body comes with "bonus" resources, such as the world's largest deposit of rhenium.

As its detractors claim, Pebble could be one of the worst environmental atrocities ever. The mine sits near a water plate that is a major source of sockeye salmon, and the surrounding ecosystem is crucial to both the local population and native wildlife.

Among those opposing the Pebble mine were:

- Earthjustice, a US-registered environmental NGO.

- WWF, the global environmental NGO.

- National Resources Defense Council, an advocacy organisation.

(The links above lead to specific Pebble mine campaign websites that these organisations have set up).

Supporters claim that the Pebble copper field would take up a relatively small area in an unremarkable spot. Plus, this is the United States – not some stone age island – and any operation would face some of the world's strictest environmental regulations, with multiple safeguards to protect the interests of both nature and the local population.

Who is right, and who is wrong?

In early 2023, Undervalued-Shares.com Lifetime Members received an in-depth research report which questioned whether Northern Dynasty Minerals wasn't actually "a mining project like any other." After all, which large-scale Western mining project ever proceeds without massive opposition and decades-long lawsuits?

I left that judgment to the reader and instead focused on the investment case.

As I wrote at the time:

"Based on current prices, the proven copper and gold reserves alone would have a market value of USD 370bn. You can currently buy that much copper and gold for a paltry USD 120m."

David Ibn, the renowned value investor at Kopernik Global Investors, had ran a back-of-the-envelope calculation on Northern Dynasty Minerals. Even factoring in heavy dilution to fund mine construction, he expected the project "could yield free cash flow of USD 3.8-11.2bn for shareholders. Even if it took another 20 years for this cash flow to materialise, investors would look at a return across this period of 18.1-25.6% p.a."

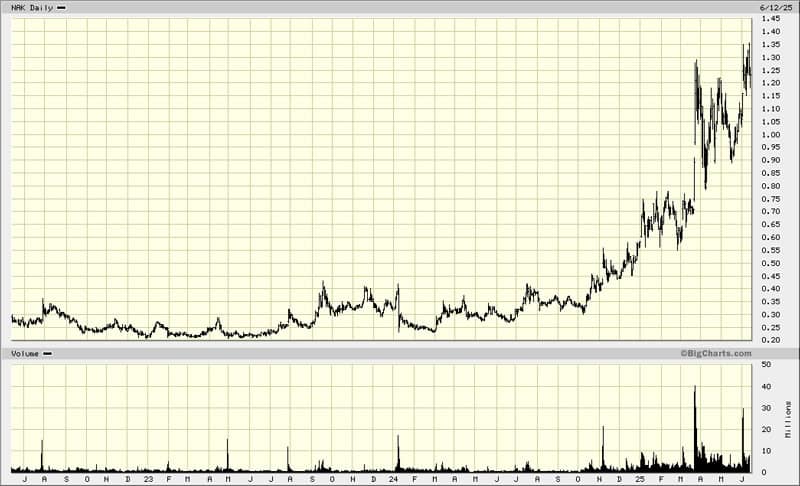

At the time, the stock was trading at 22 cents, down 99% from its peak. Both the company and the stock had been left for dead.

Earlier this week, the stock was trading at USD 1.32, i.e. up 500%.

Northern Dynasty Minerals.

What had changed?

The Trump administration has a clear stance on resource independence, or resource nationalism, as some call it. President Trump wants the US to reduce reliance on foreign nations for its strategic resources. While copper may not be as glamorous as gold, it's one of the world's most important resources.

Copper's importance to modern life is often underestimated:

- Your average family home requires 181kg (400 pounds) of copper. Copper's antimicrobial properties make it an ideal choice for plumbing.

- Your average combustion engine car includes 30kg (65 pounds) of copper.

- Without copper wiring, there would be no electricity grid.

Copper's versatility makes it the third most mined metal in history, outdone only by iron and aluminium.

As recently as 1995, the US imported just 10% of its copper needs; today, this figure has increased to 50%. At current rates, by 2035 the US will rely on foreign sources for 67% of its copper.

Will foreign nations be willing to supply sufficient amounts of copper to the US? At what prices? And will global production satisfy global demand?

These are urgent questions that politics and the public will soon have to face up to.

Who is surprised the Trump administration is pushing to cut US dependance on foreign mines?

The impact of these new policies is already becoming apparent. On 27 May 2025, the Republican-dominated US Supreme Court cleared the path for Rio Tinto's controversial Resolution copper mine in Arizona. As the Financial Times reported:

"The decision is a big win for the mining major and Washington's push to develop a domestic metals industry. The Resolution Copper project, jointly owned with BHP, would be one of the largest copper mines in the world and would meet a quarter of US copper needs once fully developed."

Source: Financial Times, 27 May 2025.

In media coverage about the Trump administration's push for resource independence, Resolution and Pebble are often mentioned together. Earlier this year, the president signed an executive order aimed at cutting down mine permitting times. Northern Dynasty Minerals could now see its project fast-tracked, though its legal situation remains complex, and these types of projects often span multiple presidencies, adding uncertainty.

For now, however, the market is focused on Pebble's potential progress. The Mining.com article on Northern Dynasty Minerals, published on 10 June 2025, provides a lot more detail (link below).

Source: Mining.com, 10 June 2025.

On 13 June 2025, the US justice system is set to release an update on the mine's long-running legal issues. This could see the stock soar, drop, or go sideways – no one knows for sure. A decisive outcome likely won't come before the end of the year. Meanwhile, high-quality analysis on Northern Dynasty Minerals is growing, such as this 4 June 2025 article by Triple S Special Situations Investing. Unlike in spring 2023, when I was a lone voice going on about Northern Dynasty Minerals, this obscure stock is back on the agenda.

Northern Dynasty Minerals' current market cap of USD 600m did rise out of the rubble of a company that had truly shat the bed. Few were interested when I first wrote about it, but it quickly became a multi-bagger. For its current CEO, Ron Thiessen, it proved a good investment despite the long wait. When he bought the mine in 2002, he paid just USD 14m!

Pebble could also become a model case of a mining company making progress thanks to its location in a functioning jurisdiction. Being based in the US is a major bonus, and its current market cap underscores how the value of mining projects depends on operating in a reasonably reliable jurisdiction.

At this point, it's worth noting that I had also written about….

The British jurisdiction that shat the bed

Among my other youthful sins accomplishments is that I wrote the first-ever investment research on oil in the Falkland Islands.

Back in the early 1980s, the Falklands were the site of a hot war between Argentina and the United Kingdom. Even though this involved a remote group of islands with barely 2,000 residents at the time, it led the UK under Maggie Thatcher to consider going nuclear on an Argentinean city.

Source: The Guardian, 22 November 2005.

Why did the conflict about this remote archipelago get so serious?

As I argued back then – against media accusations that I had made it all up – the Falklands basin holds oil reserves that could rival Kuwait.

I even said that future generations of Falklanders could become "the blue-eyed sheiks of the South Atlantic."

It all made for great reading, my report went viral, and a Falkland Islands mini boom ensued. Several new oil explorers listed on the London stock exchange and raised hundreds of millions of pounds.

Sadly, the boom fizzled out when oil prices collapsed during the 2010s. No oil had been produced up to this point, and most of the shares in this sector turned into a bust. In 2020, Bloomberg called Falkland Islands oil projects a "stranded asset".

In 2022, I revisited the story, asking whether there was "A new oil boom in the Falkland Islands". Undervalued-Shares.com Lifetime Members received an in-depth report on Rockhopper Exploration (ISIN GB00B0FVQX23, UK:RKH), then the last remaining Falkland Islands oil explorer still standing and a neglected micro-cap listed on London's AIM.

The prospects for oil exploration in the Falklands remained uncertain in more ways than one, and the company was embroiled in a legal situation. Still, as my report outlined, the stock was "trading at less than its likely cash reserves" and "an unusual, overlooked investment case with a potential multi-bagger return."

Recently, the stock surged to 56 pence, up 400%.

Rockhopper Exploration.

This wasn't just a company, but an entire jurisdiction that had shat the bed. Now it's roaring back to life!

It took time for these developments to unfold, and the stock briefly dipped as low as 9 pence. Still, the subsequent returns made up for the wait and the nerve-wrecking volatility.

I hope that one day, I'll be able to share a similarly positive turnaround about…

Bangladesh's coal company that shat the bed

As you can imagine, timing is incredibly difficult when investing in these convoluted situations.

Even a stock that has already lost 99% of its value can lose another 90%.

That's exactly what happened with GCM Resources (ISIN GB00B00KV284, UK:GCM), a London-listed company that shat the bed in the mid-2000s.

Back then, it traded as "Asia Energy", and was focused on developing one of the largest coal resources in Asia. The Phulbari coal field was discovered in the 1990s by Australian mining company BHP Billiton. With recoverable, proven coal reserves of 527 million tons, it represented 20% of the country's entire coal reserve.

However, BHP Billiton's management ultimately decided the project was not for them and sold it to a group of British, American, and Canadian entrepreneurs. The new owners took the company public on London's AIM to raise funds for developing this massive coal deposit.

Starting with a market cap of GBP 40m, the stock rose 12-fold, and the company became worth GBP 500m. Analysts predicted it could reach GBP 2bn once coal production began.

Unfortunately, in 2006, protests against the mine broke out in parts of Bangladesh. The demonstrations revolved around concerns over resettling local residents and the use of scarce groundwater resources to operate the mine. In August 2006, around 30,000 protestors attempted to storm Asia Energy's local office. Six people were shot dead, and 300 injured. These events triggered nationwide half-day strikes and further protests, which led to more injuries and ultimately forced the entire project to be called off.

Asia Energy has since been trying to get the project back on track.

In 2008, a Canadian mining entrepreneur made a takeover offer that sent the stock soaring from 100 to 300 pence. However, the bid was widely seen as too low and ultimately fell through. Considering the immense value of the coal reserves, investors had driven the share price as high as 350 pence.

It has since plummeted to as low as 1 pence.

GCM Resources.

In March 2025, the stock sprang back to life, climbing from 1 pence to as high as 5.5 pence within weeks. Once again, it seemed the tide may finally be turning for the dormant project. Yet, as before, volatility proved insane.

The stock fell back to 2 pence and is currently trading around 4 pence. Two months ago, the company completed a funding round to mobilise GBP 1m, with investors paying 3 pence to participate in the placement.

GCM Resources.

With 336m shares outstanding, the company currently has a market cap of GBP 14m. Depending on your perspective, that's either GBP 14m too high, or the bargain of the century. It's too high if you believe politics will forever block the development of this resource. It's too low given that GCM Resources sits on coal reserves valued at around GBP 50bn as raw material, even though coal prices are currently rather low. Similar to Northern Dynasty Minerals, more capex would be required, and shareholders should expect dilution. However, this could potentially multiply current investors' stakes many times over.

Stocks that are completely bombed out but could become 100-baggers always attract attention, no matter how speculative their prospects. After all, these are the kind of "intelligent lottery tickets" where a punt of GBP 1,000 (or GBP 5,000) could yield a profit that's large enough to buy a new car (or a cheap apartment).

Back in 2020, Undervalued-Shares.com Lifetime Members received what I like to claim remains the single most informative report ever published on GCM Resources. Unfortunately, my timing was premature, and the stock went down from 12 pence to as low as 1 pence. Still, I am proud of the information and context the report pulled together.

In recent months, my earlier analysis of GCM Resources has gained some new relevance.

Developments in Bangladesh are unfolding in ways that may mirror what is happening in the US. On 16 March 2025, Energy & Power, Bangladesh's magazine for the energy sector, carried the following cover page:

As the magazine's foreword reported: "A recent seminar sparked fresh discussions on whether Bangladesh should mine coal to reduce reliance on expensive Imports. Energy experts stressed that tapping into local coal reserves is essential for energy security."

What had triggered a government-supported seminar to discuss the use of domestic coal?

Bangladesh remains one of the world's poorest and least developed countries. Despite relatively strong recent growth, its GDP per capita stands at just USD 2,500 – well below Vietnam's USD 4,300, Thailand's USD 7,300, and China's USD 14,300. The country also remains energy-poor. While the global average electricity consumption per capita is 3,204 kWh per year, Bangladesh provides only 464 kWh per person (any country supplying less than 1,000 kWh per capita is classified as energy-poor).

In a developing country like Bangladesh, energy poverty is far more than an inconvenience – it can decide over life and death. For most of the population, energy supply is either insufficient, too expensive relative to local incomes – or both! Despite its abundant domestic energy resource, Bangladesh currently imports 40-50% of its energy – and that figure is rising. The country spends valuable foreign currency importing liquefied natural gas (LNG).

It's no wonder that Bangladesh, too, is reconsidering its options.

As a result of these developments, in April 2025 I sent a Special Update to Undervalued-Shares.com Lifetime Members. The 15-page report detailed a number of other developments.

Since then, the news flow has remained interesting:

- "Power and energy crisis in Bangladesh", Centre for Policy Dialogue (31 May 2025)

- "Trump's Coal Comeback Goes Global", OilPrice.com (6 June 2025)

- "India's coal champion reopens dozens of mines", Financial Times (8 June 2025)

Given all that is going on, we could soon see another wave of speculation around Phulbari and GCM Resources. For all its struggles, the company has continued mapping out a potential use of these resources to produce domestic energy. Though a minnow of a company, GCM Resources has Chinese partners waiting in the wings, ready to deploy billions of capex.

Will they, won't they?

The verdict is still out on whether Bangladesh's government will make a decisive push to increase domestic energy production. Even if it does, it's not guaranteed that the controversial Phulbari coal reserve will be used. The government might opt for other coal resources (even though it'll take many more years to develop those), and it could decide to yank GCM Resources' license and give it to someone else (though that'd risk an expensive legal case and scare off investors).

Still, there is a distinct possibility that Bangladesh will choose the quickest and legally safest route to resolve its energy crisis. This could mean granting GCM Resources – and likely relying on the company's existing Chinese joint-venture partners – the role of developing the resource and building the necessary energy infrastructure. When the lights are about to go out, you go with the parties that are best placed to deliver a solution soonest. Earlier estimates suggested Bangladesh could reduce energy costs by around 30% by using domestic instead of imported coal.

What would this mean for GCM Resources shareholders?

It's impossible to say for certain at this stage, but the potential payoff could be huge.

For more details, I recommend checking out the original reports available in the Undervalued-Shares.com Lifetime Members section.

As you've probably noticed, covering what I like to call "mining shit cos" has become something of a specialty in my reporting for Lifetime Members. And I plan to do more of it. There are plenty of mining companies that shat the bed in one way or another, and which could yield stunning gains if they come back to life during a new mining boom.

Alternatively, leave the heavy lifting to someone else…

In my latest report, I reveal a rare opportunity in a sector that is ripe with frauds and hypes: a smart, low-risk gateway into mining that is backed by industry insiders with decades of experience.

Even better: this investment vehicle is currently trading at an unusually steep discount – and has an interesting "bonus" thrown in for good measure.

If you are looking for VC-type potential returns with a team you can trust, this is worth a serious look.

Alternatively, leave the heavy lifting to someone else…

In my latest report, I reveal a rare opportunity in a sector that is ripe with frauds and hypes: a smart, low-risk gateway into mining that is backed by industry insiders with decades of experience.

Even better: this investment vehicle is currently trading at an unusually steep discount – and has an interesting "bonus" thrown in for good measure.

If you are looking for VC-type potential returns with a team you can trust, this is worth a serious look.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: