Argentina is one of the world's most out-of-favour stock markets.

As the Wall Street Journal reported recently: "The country's total stock-market valuation has collapsed from USD 350 billion in 2018 to USD 20 billion last year." (Leaving aside Argentinean companies listed in New York.)

Such a collapse is stunning, all the more so at a time of rallying global markets. Based on that one indicator alone, anyone with an interest in crisis investing would naturally take a look at Argentina.

There is now a concrete reason to do so – a potential catalyst to help the country back on its feet.

Since mid-2020, major agricultural price indices have surged by over 40%. Prices are now at their highest level since 2013, and some predict there is more to come.

One of the biggest beneficiaries? Argentina, the country that makes 70% of its export income from agricultural products.

Is now the time to pile into Argentinean assets at vastly discounted prices? I set out to investigate.

A cursed country?

Simon Kuznets, the Nobel prize-winning economist, once joked:

"There are four types of countries.

Developed countries.

Underdeveloped countries.

Japan.

And Argentina!"

Indeed, Argentina is unlike any other country on earth. It quite literally defined its own genre when it comes to its economic performance.

A sparsely populated, poor frontier country in the 18th century, Argentina experienced spectacular economic growth during the late 19th century. By the time of the early 20th century, it had risen to rank among the world's ten richest nations!

These glory days are now only visible in history books and through Buenos Aires' glorious but fading architecture. Argentina's economic and financial performance remains famous to this day, but mostly in a negative way:

- The only country to have gone bankrupt nine times in 200 years.

- The only country to have replaced its currency five times in 100 years.

- The only major country to default on its national debt not once but twice in just 20 years.

Since 1980 alone, Argentina has suspended debt payments five times, and it is currently the #1 debtor of the International Monetary Fund (IMF) with an outstanding USD 45bn. Its income per capita is about a third that of France, and even Greeks enjoy twice the income per capita as Argentineans.

There is no comparable case where a country had become so fabulously wealthy so quickly, only to fall back so far within a hundred years. Indeed, the words "Argentina" and "crisis" are almost interchangeable in the minds of many.

Some of the more recent headlines include:

- Seemingly never-ending negotiations with the IMF over the renewed sovereign debt default of 2018, involving USD 45bn. Negotiations are now in their fourth (!) year.

- The longest coronavirus lockdown of any country on earth, with over 200 days of strict quarantine.

- Economic depression on an unprecedented scale. In 2020, Argentina's GDP decreased by 11.8%, outperforming even the 10.9% decrease in 2002 following the biggest ever external debt default.

However, the country also has a long history of creating a boom after each bust. Now could indeed be the right time to pick up some of the best Argentinean assets at a rock-bottom valuation.

"Argentina is the gift that keeps on giving"

This heading is a quote from one of the panellists at an investment conference that I attended in New York in late 2019.

Robert Koenigsberger is the founder of Gramercy Funds Management, a firm with a decades-long track record of investing in emerging markets. What Koenigsberger is best known for, specifically, is his repeated active involvement with crisis investing in Argentina.

Koenigsberger has latched onto the fact that even in the case of Argentina, a mixture of internal and external factors always leads to an eventual recovery. Sometimes, it's a new government pushing through a few major reforms that actually work. At other times, it's the flow of speculative international investment capital, rising commodity prices or other external factors that come to the country's rescue.

This strategy is really just going back to the roots of contrarian investing. As one of my readers likes to say in his emails to me: "Buy low, sell high." Does an investment case need to be any more complex than that?

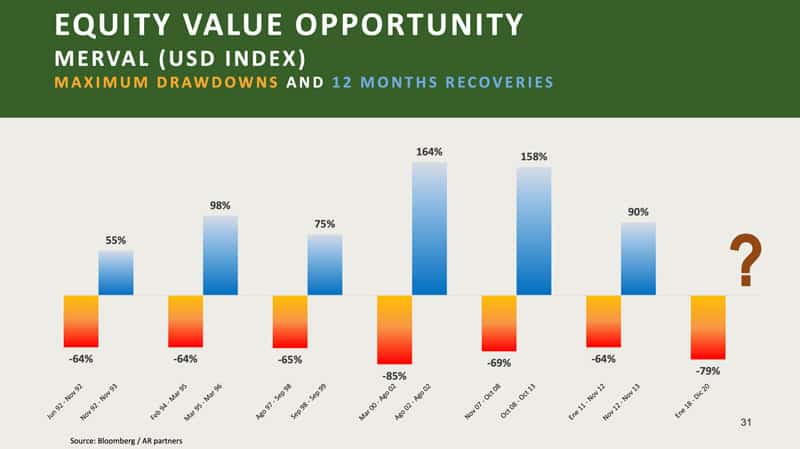

It doesn't, as the following graph shows. Each time the Argentinean stock market was struck by one of the country's infamous crises, it subsequently roared back into life again.

The cyclicality of Argentina's stock market since 1992.

So far, whenever Argentinean assets were given away at fire-sale prices, it paid off to pick up high-quality bargains and wait for the next bounce.

To find the likely trigger for Argentina's next turnaround, you only need to check recent headlines about prices for agricultural products.

A new super-cycle for agricultural products?

Argentina's vast landmass makes it the eighth-largest country on earth. A significant part of it is made up of fertile farmland: Argentina has nearly two times more farmland per capita than the US and nearly three times more than Brazil. The Pampas is one of the world's six most agriculturally productive regions.

Argentina's strong dependence on agricultural exports makes it so interesting to keep an eye on those recent price movements.

Since May 2020, soy is up from USD 8 to now USD 14 (source: Macrotrends).

What has led to the shift in prices?

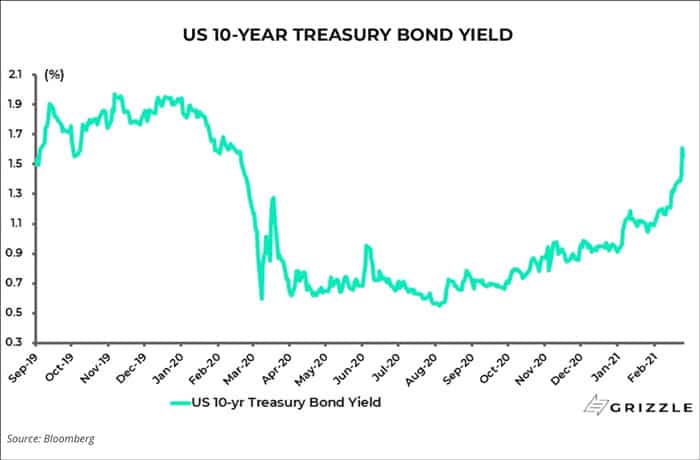

The price of food tends to increase in lockstep with inflation. Historically, as inflation rises, so does the price of food and all related products (such as feed for livestock). Ten-year bond yields in the US have surged since their bottom in August 2020. The market has started to build up expectations for higher inflation, which has now started to feed through to agricultural prices.

US bond yields are on the up (source: Grizzle).

The biggest beneficiary of it all? Argentina!

Word is starting to spread (source: Hellenic Shipping News, 10 March 2021).

The US and Brazil have larger agriculture sectors in absolute terms, but no other major country on earth has tilted its export economy so strongly towards agriculture. Take a country that earns 70% of its export income through agricultural products, and throw in a price increase for individual agricultural products of 30%, 50% or 100%. It can turn into a game changer for the economy's overall constitution, at least by providing that all-important initial spark for getting the country's economic engine going again.

The surge in global food prices can be a powerful catalyst for Argentina, if the trend continues – as many believe it will.

Smart money is once again looking at Argentina

The country may be in a tricky spot right now, but investors with deep pockets are already looking at it.

On 16 March 2021, 18 of the most solvent investors from around the world - Ray Dalio's Bridgewater, Singapore's Temasek Holdings, sovereign wealth funds from the United Arab Emirates, Bahrain and Kuwait, private funds from China, Russia, Japan, Oman, India, and Brazil - dialled into a conference call to learn about opportunities in Argentina.

Are these investors going to bite? It's too early to tell. They did take time out of their busy diaries to dial in, though. Notably, they mostly hailed from countries that once faced (and overcame) similar challenges to those Argentina is facing now.

Crisis investing is not for everyone, and it does require going against well-established narratives. Obviously, few will agree with the thesis right now or have the guts to invest. That's the point.

As one timeless article about contrarian investing summed it up:

"How do you know you are investing well? It turns out that one of the key indicators of successful investing is how much pain you feel. If your investment choices cause gut wrenching pain, this is a really good sign that you're doing something right."

Given the pain I felt last week, I believe I'm onto something. How come? I spent most of last week looking into Argentina! Specifically into a company that owns some of the country's best assets. This company's stock is trading at discount prices, and it even offers a hedge against some of the challenges the world is currently facing, such as rapidly rising food prices, the return of inflation, and political risks in countries that were long perceived to have no political risks.

For all those among you who like to take a contrarian stance, this company might be right up your street. I believe it is one of the smartest ways of betting on a turnaround of Argentina's fortune.

My latest research report - out this weekend for Undervalued-Shares.com Members - has all the details.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Coming up: crisis investing in Argentina

Is Argentina the world's most out-of-favour stock market?

It currently is near historic lows, but there is a good chance for the tide to turn. The surge in global food prices is a powerful catalyst for a country where 70% of exports are agricultural products.

What’s the best way to play this theme?

A company that owns some of the country’s best assets!

It’s a crisis investing opportunity par excellence, and it’ll be revealed in my upcoming research report, out this weekend.