United Airlines went all in with its announcement. Of the 5,000 new pilots the company intends to train by 2030, at least 50% should be women and people of colour, up from the current 7% and 13%, respectively.

Public reactions to the announcement were divided along the usual fault lines.

The Washington Post celebrated the news: “… it provides opportunities and exposure for individuals who may not have pursued a career in aviation.”

The Daily Wire penned a stinging opinion piece: “United offers passengers exciting opportunity to die in diverse and equitable plane crash.”

If you haven't spent the last few years living under a rock, you will be familiar with the highly charged political and cultural undercurrents of this debate. However, there has not been much public discussion yet about the investment implications:

- If the CEO of a company you are invested in decides to go "woke", will it likely be good or bad for your investment performance?

- Are there particular investment risks or investment opportunities resulting from the woke movement? If so, which ones should you look at more closely?

- Does any of it even matter at all, or can you safely ignore all of it?

These are serious and worthwhile questions to ask!

Many widely-accepted narratives about woke corporate policies are based on dubious assumptions or simply lack data. Today’s article will help you spot the risks and opportunities that come out of it all.

Read on to learn:

- Why to stay well clear of woke companies.

- How to spot woke companies that may still benefit shareholders.

- Why it'll be at least five to ten years before we have good data on the subject – and why, quite possibly, we will never have useful data.

Much of this will stem from the category of inconvenient truths.

My personal journey through the world of "woke"

I first noticed the term “woke” in 2016, i.e. one year before it was added to the Oxford English Dictionary. During the subsequent three to four years, it was mostly people with a deep interest in politics that were aware of the term. The general public's awareness of "wokeism" caught on in early 2021 (judging from the number of searches on Google).

It's disputed what the term stands for exactly, and whether it should be used at all. Definitions and applications will vary depending on who you ask and what their motivations and affiliations are. This article will be based on my very own definition, which you may or may not agree with.

Being woke is obsessing about race, gender, sexual orientation. It's a general-purpose term that refers to an increased awareness of all identity-based injustices. It also describes policies and decisions that previously were not based around the subjects of race, gender and sexual orientation, but which now are (such as the hiring of United Airlines pilots – the airline has "gone woke").

I’ve embraced the concept long before most others did:

- In 2017, I started to notice the broad variety of ill-effects that woke culture causes on a daily basis in London, and it contributed to my decision to move to Sark in the Channel Islands. I prefer to be based in a place where I don't have wokeism constantly rubbed into my face.

- In early 2019, I published an article on my personal website: "10 reasons not to date woke women if you want to be successful in life". It became the single most often read blog article I have published in my entire life – by a very high multiple!

- From early 2020 onwards, I’ve built an archive of wokeism-related material that is relevant from an investment perspective.

I am not the world's leading expert on the subject, and I am not going to expose you to a diatribe of woke-bashing. That would be predictable and boring.

Instead, let's start with….

The bright side of "woke investing"

Undervalued-Shares.com features investment ideas from all walks of life, including those that are diametrically opposed to my personal views.

Even though I’ve been an outspoken fan of the Trump presidency and an early critic of social media cancel culture, I featured Twitter (ISIN US90184L1026) in an in-depth report in November 2020. Wired had already identified in a 24 April 2020 article that "Twitter users are … more woke than the rest of us", and so was its CEO, Jack Dorsey. As a woke company, Twitter had always been at the forefront of cancelling or shadow-banning users who disagreed with woke stances. As such, it wasn't a platform that I would use myself, but Twitter as an investment opportunity did interest me.

I predicted that Twitter was going to throw Trump off its platform and that it was going to be a net-positive for the company. This seemed counter-intuitive, but it proved spot on.

Indeed, Twitter is the perfect example of a lucrative woke company.

In our polarised world, media companies can benefit from taking sides (instead of trying to be neutral reporters of the news or neutral platforms that people can debate on). The financial benefits of taking sides were beautifully captured in "Elite media are becoming clubs", an 11 April 2019 opinion piece in the Financial Times:

"… 'elite media' – publications, especially in English, that sell to metropolitan liberals – are blossoming … In these crazy times, many liberals are turning to elite media to find their own values expressed. Newspapers never previously knew what readers read but in the digital era we found out: currently, they like articles that reaffirm their identities. … For most people, truth is a second-order priority. Identity and entertainment have probably always mattered more."

Twitter simply made a commercial decision. Banning Trump and cancelling the un-woke catered to their primary audience's needs and desires. (If Twitter really cared about extremism, it wouldn't continue to provide a platform for the Taliban. But that's another story.)

And a good business it is! As I have repeatedly pointed out, Twitter is quite possibly the best social media stock to be invested in right now.

There are plenty more companies whose woke management makes for a good investment opportunity. However, I am also acutely aware of the problems and risks that wokery is causing for investors.

Identity-based hiring as a financial risk for long-term investors

As a university drop-out and modern-day Luddite who lives on an island without cars or even paved roads, I struggle with complex financial models and powerful computers. However, I do make up for it by having a pretty darn good network, which provides me with a lot of useful information. When it comes to knowing lots and lots of people from truly diverse background, there are not many who can compete with me.

For the past five years, I have had ever more female friends (including those employed by world-class companies) confide in me along the following lines: "I am getting promoted despite not really being qualified for the new job. There are not enough women in my company and they need to be seen as doing something. Good for me, I'd have to be stupid to turn it down!"

I have also been noticing the flip side of it, as several friends confided in me: "Nowadays I go to interviews where it quickly becomes clear they are not actually looking to potentially hire me. They just can't be seen not to interview white, middle-aged men as that would also expose them to criticism and legal risks. They invited me merely to tick a box."

Female job applications now have a much higher success rate because of companies’ gender balance goals, while hiring white, middle-aged men has become the job market’s proverbial bargain deal. (And SOME companies have already latched onto this opportunity, as you will see at the end of this article.)

“This might be the best report you have written. Excellent.”

“It sounds like a no-brainer to invest in this one!”

“Excellent work as usual, Swen!”

What are my readers on about?

My latest report on Bayer AG - a German blue chip with 100% upside!

If you haven’t read it yet, maybe you should.

“This might be the best report you have written. Excellent.”

“It sounds like a no-brainer to invest in this one!”

“Excellent work as usual, Swen!”

What are my readers on about?

My latest report on Bayer AG - a German blue chip with 100% upside!

If you haven’t read it yet, maybe you should.

Some companies will be affected by a trifecta of factors:

- Promoting staff who are not sufficiently qualified but simply tick minority and victimhood checkboxes.

- Paying more than necessary for some staff because of artificially inflated demand.

- Foregoing the obvious bargain deal for the hiring market’s “unfavoured” staff.

How will all of this impact on the long-term performance of these companies?

Surprisingly, the net-result might still be a good one for investors, at least in some instances.

Some companies with woke policies may end up with more business from woke-supporting consumers. In such cases, some of the negative effects of such policies could be overcompensated by the additional business.

Also, there are other factors at work that are not necessarily obvious. E.g., contrary to the salary situation outlined above, United Airlines will argue the opposite is the case, with its drive to hire women and people of colour as pilots actually delivering a financial bargain to shareholders. Previously barred from entering the profession because of discrimination, these groups now represent an abundant, eager and, therefore, cheap labour pool to tap into – or so they will say.

Are these arguments realistic? While the evidence is still being established, it's entirely reasonable to ask questions and be critical of obvious weaknesses. Personally, I have serious concerns whether United's specific case stacks up - unlike Twitter's target group-based approach, which has proven to work elsewhere in media.

E.g., will an airline really stand a chance of more bookings because of its diversity goals? The airlines business, in particular, is notorious for attracting customers primarily based on price. Using gender and race-based hiring policies to attract business for an airline is a marketing and branding approach that I would first want to see deliver measurable results for. That is, if anyone can even measure it; I don’t think that a survey among customers would receive honest answers, given the current environment.

The evidence also remains murky as to whether so many women actually want to become a pilot. Some professions simply attract more members of one sex than of the other, because men and women don't necessarily tend to have identical interests. 99% of all plumbers are male, and I struggle to see how this could have been due to oppression exerted by the patriarchy, rather than a lack of women wanting to do this kind of work. After all, someone could set up an all-female plumbing business and offer to serve female house owners only, which would receive massive PR and with all likelihood do a roaring trade. To my knowledge, no one has done it yet.

The same could apply to United Airlines – there are simply not enough female candidates around, and those who do hold themselves out for a job can command a scarcity premium. If there was really such a large pool of untapped talent that can be hired on advantageous terms, United should rather forget about the public PR (which will not result in a noticeable increase in bookings) but hover up cheap labour while it's available (instead of alerting competitors to the opportunity).

Obviously, I have picked out just a few aspects of a complex subject. It does illustrate the point, though: I’ve got a healthy dose of scepticism about all of this. Equally, I have no doubt this trend will continue. It is driven by a class of CEOs and other managerial staff who usually don’t own the business they run and thus don’t necessarily have the financial long-term success of their company in mind.

Putting out such policies and press releases will make them feel they are the good guys. It'll get them plenty of likes for their LinkedIn posts, brownie points from their spouses when they come home from work, and generally make their difficult job a bit more pleasant.

Is it good for shareholders, though? One particular part of the finance industry provides some interesting pointers.

The smartest people in the room often disagree

The growing demands for diversity policies and similarly woke governance guidelines are the strongest among publicly-listed companies. Their actions are – quite literally – in the public eye because of their reporting duty to shareholders. If they are not seen to be doing the right thing, activist groups might turn up at the next annual general meeting.

Private companies, on the other hand, can more easily get away with navigating around this topic in an intelligent way.

Once again, my personal network yields an interesting anecdote.

I am familiar with the HR policies of one global, privately-held company that is among the most successful in its industry. The company has risen out of nowhere to be worth many billions. Its owners decided years ago that hiring based on anything but merit was going to endanger the company's future success. With great effort, the company constructed an interviewing and hiring policy that makes it appear like it adheres to woke hiring policies, without actually doing so. Instead, this company continues to hire solely based on merit – a system that it considers a valuable intellectual property.

Could a publicly-listed company ever get away with something like this? It sure couldn't, at least not for long before its policy is leaked to the media.

This unnamed company is a model case for a new trend that I have seen emerge in the financial industry. A growing number of publicly-listed companies that are really good at what they do will go private. Equally, a growing number of companies that are private and would normally go public at some stage, will decide to remain private.

If you don't believe me, take it from the Financial Times, which published the following opinion piece on 19 July 2021:

"Call it Newton’s law of corporate ownership. As listed companies come under increasing investor pressure to act on everything from executive pay to carbon emissions, a reaction against those constraints seems to be fuelling a spate of buyouts by private equity firms. …

More freedom on governance has long been seen as a plus for private companies. As listed company governance has become stricter, so the advantage of private company status has increased. Heads at private equity owned companies relish diminished bureaucracy and the ability to earn more money without critical scrutiny from public company shareholders."

The Daily Telegraph made similar observations in its 21 August 2021 article "Boardroom wokery is driving companies off the stock market":

"Small wonder that so many executives positively prefer the semi-secretive world of private capital. One director with experience of serving on the boards of both public and private companies says that anything up to two thirds of boardroom time is spent on governance issues in publicly quoted enterprises, and only one third on the business itself; it’s the other way around with privately or family-owned companies."

If a private company competes on a 1:1 basis with a public company, which one is likely to be at an advantage and make more money for its investors?

Everything depends on the individual case and its idiosyncrasy, of course. However, it's clear to me that we are in the first inning of a bifurcation of investment markets in the US and Europe (the two current primary homes of wokery):

- Companies that are focussed on financial performance and meritocracy will increasingly avoid a stock market listing.

- Companies that struggle with their financial performance will increasingly try to speak to those investors who place significant emphasis on soft goals. They will primarily find such investors in public markets, and thus aim for an IPO.

This doesn't bode well for public-market investing in general. In a few years, if you don't have several million that you need to invest in the best private equity funds, you'll have to make do with a lot of second-rate companies on the stock market.

How will this impact on the long-term performance of stock markets in the Western world?

Have you properly quantified the risks that these shifts could cause to your long-term investment portfolio?

Might you be missing out on much better investment opportunities outside the realm of severely constrained public companies?

These are difficult-to-answer, but highly important questions for any investor.

It all leads back to the people at the helm of companies – CEOs, board members, and major shareholders.

How to spot wokery among powerful decision-makers

Throughout my career in business and investing, I’ve regularly been astounded by the factors that drive major management decisions.

My favourite example is that of Lord Rothermere, the fourth-generation heir to a media conglomerate which includes the Daily Mail, the UK’s largest newspaper and world's #1 online newspaper.

For a quarter of a century (!), the Daily Mail had been run by Paul Dacre as editor. Even though Dacre had led the paper to an unprecedented level of success, he eventually got defenestrated as a consequence of the UK’s divisive Brexit campaign. During the campaign, Dacre had identified the typical Daily Mail readership as Brexit supporters, and the paper's default position was aggressive support for Britain leaving the European Union.

For Lord Rothermere, who lives the gilded live of a wealthy heir in Notting Hill primarily surrounded by woke media types, his newspaper's stance on Brexit became a problem. In September 2018, he replaced Dacre with Geordie Greig, a "Remainer". Presumably, the move helped him with “being a little less embarrassed at dinner parties”.

At least in the case of Lord Rothermere, it was a significant shareholder making decisions. In the case of most public companies, it's CEOs, managers and board members with no meaningful stake at all. They are often driven by a desire to keep their high-paying jobs and thus avoid a controversial or unorthodox stance that could lead to unwelcome scrutiny by the media and investors, or even agitation from activists.

They include, for instance, Bernard Looney, CEO of British Petroleum (ISIN GB0007980591) who complained in the Sunday Times on 9 August 2020: "My work is socially challenging"

"The new boss of BP has warned that fossil fuels are becoming socially unacceptable and admitted that the industry can be perceived as 'bad'."

He wasn't having much fun at dinner parties either, eh?

A year later, Looney was in The Times again: "Make mental health issues a global priority, says BP chief". Noble as this appears, one has to ask – since when has that been BP's priority? Will the company soon partner with Gwyneth Paltrow's Goop to sell yoga pants?

Indeed, one conclusion from the woke movement infiltrating the corporate landscape is that shareholders and investors need to remain vigilant to companies veering off their proven path. Mission creep for a perceived good cause is still just that – mission creep.

During the past few years, the mainstream media loved celebrating woke managers who came to power. However, the first high-profile casualties of this trend have started to come. These cases provide everyone with an opportunity to become cognisant of a new form of risk entering the realm of public equity investing.

One good example is Emmanuel Faber, (now: former) CEO of Danone (ISIN FR0000120644). Faber had been among the first generation of new-age CEOs celebrated for pursuing a "purpose-driven" approach to management, and was a passionate advocate of what he called a new “humanist” capitalism. As Faber explained in a speech at a university: "without social justice there is no more economy".

During Faber's tenure, Danone's share price performance lagged that of rivals like Nestlé (ISIN CH0038863350) and Unilever (ISIN GB00B10RZP78). Faber had to cut annual profit forecasts three times in seven years, but still found the time to lecture the world about running a business. His reign ended when an influential US-based investment fund called for Faber to be ousted.

Famous is the case of Gillette, a division of Procter & Gamble (ISIN US7427181091), and its woke advertising campaign depicting men as stalkers and sexist pigs. On YouTube, the ad video received ≈900k upvotes and ≈1.6m downvotes, and significant number of men stopped buying the company's products as a result. A data analyst and blogger has written extensively about the case, showing how the company's sales and market share in razors and blades subsequently took a hit. As ever, the evidence is not entirely clear because companies provide limited insight into their accounting. Also, P&G's CEO, Gary Coombe, went on to defend the campaign and told Marketing Week that the loss in revenue was "a price worth paying". Did his shareholders agree? We will never know, but it'll probably go down as one of the exemplary cases of CEOs going woke.

A case study similar to that of Danone (and still ongoing) is that of Emma Walmsley, CEO of GlaxoSmithKline (ISIN GB0009252882), the British pharmaceutical giant. In September 2016, The Guardian published the celebratory headline "GSK makes Emma Walmsley most powerful woman in FTSE 100". HR Magazine was slightly more cautious, and on 18 October 2016 printed "Questions have also been raised about whether the company was pressured into choosing a female candidate..."

Fast-forward five years and the score card is mixed. The stock of GSK is down 15% since the day of Walmsley’s appointment, whereas the FTSE 100 is up 1% and GSK’s arch rival AstraZeneca (ISIN GB0009895292) has risen in value by 55%. In a case of particularly bad optics, GSK was the global leader in vaccine production before the pandemic, but it failed to come up with a vaccine for the coronavirus. AstraZeneca, with almost no prior vaccine experience, successfully launched one of the world's best-selling, earliest vaccines.

Walmsley also became the first female FTSE 100 CEO to end up in the crosshairs of Elliott Management, the world's largest activist fund. Much as the mainstream media loves a "First female CEO…" headline of almost any variety, no one turned that into a headline.

Will anyone ever get to the bottom of whether Walmsley's appointment was as merit-based as it should have been? I doubt shareholders will get clear answers. In the meantime, the readership of the Financial Times seems to have sensed that something is up. The paper’s 15 April 2021 article "Hedge fund Elliott builds multibillion-pound stake in GlaxoSmithKline" elicited a lot of reader comments, including this most-liked one:

"Finally the bungling GSK board will need to come out of its coma. A CEO who is an expert at being woke but knows little about running a drug company even to the point of putting someone in charge of vaccines - who has no background in vaccines. Missed opportunities, bungles all covered up with grand pronouncements that mean nothing to shareholders. … "

Indeed, it does appear that even nowadays, most investors do still care about the return of their investment, first and foremost. It's nice being woke, but losing money when the market is up and your competitor is going gangbusters makes investors wake up eventually – no pun intended.

Speaking of which, how do the overall returns of woke CEOs stake up?

The empirical evidence on woke investing (so far)

Given how the term "woke" only rose to mainstream prominence over the past few years, there is limited data as yet about the performance of companies that have woke CEOs. This is be complicated further by the controversy surrounding what the term actually stands for. Just what constitutes a woke CEO is clear to some, but will remain disputed by others. There'll be arguments about what should be measured, and how.

In my mind, the clearest and best sub-set of data is that about public companies that have embraced the call for enforcing some kind of gender balance on boards.

The results are mixed, and there is a significant level of nuance to the data.

A much-cited source is a 16 March 2021 report from Morgan Stanley: "Why gender diversity may lead to better returns for investors":

"From 2011-2019, an eight-year period, companies with more gender diversity enjoyed a one-year return on equity that was 2% better than companies with low gender diversity. Further, these more diverse companies experienced lower return-on-equity volatility, too."

The Harvard Business Review wrote in its July/August 2018 issue: "Finally, Evidence That Diversity Improves Financial Performance":

"A comprehensive data set of every VC organization and investor in the United States since 1990 shows … Venture capital firms that increased their proportion of female partner hires by 10% saw, on average, a 1.5% spike in overall fund returns each year and had 9.7% more profitable exits (an impressive figure given that only 28.8% of all VC investments have a profitable exit)."

Institutional Investor wrote on 6 March 2019: "Want 20% Higher Returns? Do This.":

"Funds with gender-balanced senior investment teams have generated investment returns that were 10 to 20 percent higher than those with a majority of male or female leaders, according to the study released Thursday by the International Finance Corporation, a member of the World Bank Group, in conjunction with Washington, D.C.-based alternative investment firm RockCreek and investment consultant Oliver Wyman."

The data seems convincing and the narrative is much-repeated in the mainstream media, but does it really hold up to scrutiny? As yet, there are a lot of unanswered questions and apparent weaknesses.

E.g., most studies fail to distinguish between the period before legally mandated women quotas on boards came into force, and after. In California, the legal requirement to have at least one woman on the board of a company only came in 2019. Prior to that point, female board members were recruited based on merit, and possibly against even higher entry barriers than men. As such, these statistics may yet confirm the opposite of woke theories, and speak in favour of purely merit-based hiring. We'll know in a few years.

Indeed, once you start looking closely, the results of these studies are quite diverse – oops, another pun!

A (not publicly available) study of the Japanese market by CLSA found that boards with NO female board members produced a 1.3% p.a. better return on invested capital over five years. But does that say anything about gender at all? Not necessarily. There is a general shortage of good board members in Japan, and even more so among women. The report concluded that good companies refused to participate in tokenism, and that having such principled management resulted in an overall better-run business.

A scientific article published in the Pacific-Basin Finance Journal in November 2015 concluded that "forcing female director appointment or mandating gender quotas can reduce firm performance" in some countries. It's all down to specific circumstances.

A German study published in June 2020 approached this subject in what I believe is the only correct way. It looked at the performance of publicly-listed companies before and after the introduction of a legally mandated 30% board quota for women. Those companies that ignored the quota and went without female board members produced a return of +10.6% p.a. over the subsequent five years, compared to -5% for the DAX index. The companies that went on to have the highest female board representation showed a return of -17% p.a. Ouch!

As everyone knows, it's not difficult to make statistics come out the way you need them to. Most empirical data is, on closer inspection, contrived, cherry-picked, or circular. The German study data was published by a conservative newspaper, so it'll probably be just as biased as something coming out of a woke university campus. Also, all statistics are only ever a snapshot in time, and the underlying factors as well as the methodologies applied will be extremely complex and depend on which part of the economic cycle they were collected in.

"Why Do Women Earn Less Than Men?”, a study published by Harvard University, nicely illustrates the general issue with statistics. Looking at the salary structure of the Massachusetts Bay Transportation Company (MBTC), an equal-pay company, scientists found that its male staff still took home 11% more than their female counterparts. How was such a "gender pay gap" possible? Quite simply, MBTC's female employees were less willing to work higher-paid longer shifts, and they had higher absentee rates.

When the mainstream media and activist groups look to make a point or create clickbaity headlines, such nuances are often forgotten. The prevailing narrative in Western industrial nations deserves critical questioning and pushback. In fact, it can be huge fun to look under the bonnet and expose some of the hypocrisy of the sector.

Would you trust these people?

As you will have gathered by now, I am not one to easily fall in line with activist slogans simply because there is public pressure to do so. If anything, you will find that Undervalued-Shares.com regularly questions well-established narratives, because it's by going against conventional wisdom that you find the most interesting investment opportunities.

There is not a human on earth who doesn't occasionally act in a hypocritical way, including yours truly. However, the sheer brazenness with which it is done in the woke movement does deserve a special mentioning and makes for a few good laughs.

Case in point, last week's Weekly Dispatch analysing The Economist Group. The company prides itself on having a modern corporate diversity policy, and the publication's editorial staff also regularly speak out in favour of such policies. Yet, the four trustees that have god-like power over the company’s governance are 100% British white and 75% British nobility. Presumably, having one non-aristocrat trustee makes for "diversity"?

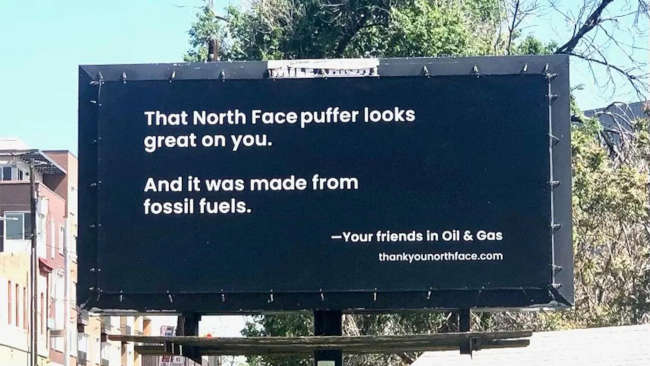

Other examples are even funnier. Super-woke North Face, the outdoor clothes manufacturer which is owned by VF Corporation (ISIN US9182041080), recently jumped on the woke bandwagon of campaigning against fossil fuels. The company refused an order from an oil company simply because it was an oil and gas company. Little did North Face know that over 90% of the materials that make up its products are made from fossil fuels. One oil and gas company subsequently had a field day putting up public displays about the incident close to the North Face headquarter, and launching a website with the salty video message "Thank You, North Face". It's worth watching!

Another telling example is that of Goldman Sachs (ISIN US38141G1040), if only in a very different way. At the uber-woke Davos Economic Forum, the company's CEO announced: "Starting on July 1 in the US and Europe, we’re not going to take a company public unless there’s at least one diverse board candidate, with a focus on women." This was easy for him to say: in July 2019, the last remaining all-male board among S&P 500 companies had appointed a woman. Goldman Sachs made sure to time its announcement in such a way that it was not going to lose any major clients, yet the wokerati that flock to events like Davos clapped like excited seals! Also, Goldman Sachs is not going to apply the policy to the more conservative Asia, where female representation on boards is very: "Sorry, Asian women! We don't care about you."

The case of Goldman Sachs is in line with the Twitter example mentioned at the beginning of this article. Ultimately, with few exceptions, it's all about business. Many of the companies that engage in wokery remind me of conspicuous altruism. This term describes people who, for example, install solar panels not in the direction that gets them the most solar energy, but rather facing the direction that other people can see them.

Companies haven't suddenly become do-gooders. Some have simply spotted an opportunity to create free PR for themselves. Others find that woke messaging mobilises some consumers who like to spend their money on companies they feel portray the right values. Yet others know that by supporting their friends in government, they edge out other favours from those in power. There is a multitude of factors at work, many of them not obvious and some counter-intuitive. Most of them mostly include a means to earn more money and/or amass more power and status.

Much of this was recently discussed in "Woke, Inc." by Vivek Ramaswamy, a successful entrepreneur who exposed many of the fallacies and money-driven motives of the woke movement. The book shot to the Amazon bestseller list, despite a comparatively small number of reviews in the mainstream media – and it inspired me to finally write this article. Apparently, there is a growing audience out there that likes to look beyond the conventional, established narrative that is driving the woke corporate narrative.

"Woke, Inc.", by Vivek Ramaswamy.

Of course, the following question remains: "How to make money off it all?"

Here are some conclusions and ideas.

3 initial lessons to draw from all this

I consider my research of this particular subject to be an ongoing project, and one where I reserve the right to evolve my views. At this stage, there are three conclusions and recommendations that I have a high degree of confidence in:

1. Don't take anyone's narratives at face value

"Diversity is good for investment returns" and similar slogans have become a widely-accepted truism, at least in some parts of the finance industry and primarily in Europe and the US. And who would dare to disagree?

It's all made to sound so positive on the surface. Who's opposed to social harmony instead of a race war? Who wouldn't want women to excel in exciting jobs of their choosing? Few people would want to be labelled a misogynist, racist, or bigot – which is what one gets easily labelled as.

As today's article will hopefully have gotten across, the evidence is much more mixed, nuanced, and complex.

As to specific companies, there are solid arguments for investing in some woke companies. Twitter demonstrated as much, and there'll be others. I'll sure be on the lookout to find other occasions for you to make money off.

Just as much, there are solid arguments for staying well clear of other woke companies. As we have seen, Danone had it coming. Wokenomics can also serve as a smokescreen to distract from mismanagement, greed, and worse. You don't want to get caught up in this.

For other companies and aspects of this debate, the jury is still out. We might have more useful data to look at in five or ten years' time. Until then, I will keep a healthy dose of scepticism with regards to the widely-spun narratives about the benefits of wokenomics. You should do so, too.

Additionally, it might help to decrease your consumption of the mainstream media, a strong wokenomics advocate. Interestingly, the vast majority of people doesn't seem to agree with it anyway. A major survey carried out in Britain recently found that out of ten possible ways for businesses to be "good corporate citizens", only 9% of respondents said that the most important was to "speak out on important social issues that matter in Britain today" – the lowest-ranking point of the ten! Wokery may well be something that history books will classify as an aggressive minority's tyranny, something that Nassim Taleb has written about extensively.

And, quite importantly, don't ever apologise for taking this stance. By taking a 360-degree view of all the available evidence, you'll turn yourself into the intellectual and moral superior of anyone who tries to lecture you about wokery. Tell them where they are wrong, and make them thank you for it. Who knows, maybe some corporate boards will wake up and start to offer premiums for the few remaining people who are still willing to freely speak their mind even when it's about uncomfortable subjects.

2. All-new angles for exciting investment stories

Even if you don't agree with the "Fourth Turning", a popular theory from William Strauss and Neil Howe, it's pretty evident that we are seeing some major shifts in the world. The woke movement has amassed massive power, particularly in the US and Europe.

It will result in investment opportunities that are based on all-new themes. E.g., we are currently seeing the first phase of a massive shift of profits and wealth from Western energy companies to Russian, Middle Eastern and South American oil companies.

The likes of Bernard Looney are switching to so-called green energy (and selling yoga pants) at a time when the Western world is not yet sufficiently prepared for letting go of fossil fuels. The likely winners? Check the current oil and gas price, and the stock price of companies like Gazprom (ISIN US3682872078). Its stock is at an all-time high, and Undervalued-Shares.com Members were in on it right from the start.

As one of my readers commented recently: "If I'm the chairman of Saudi Aramco or Gazprom, I'm funneling money to environmental groups in the US and Europe. These woke policies are an incredible own goal on the part of Western oil companies and will result in massive wealth transferred to Russia and the Middle East."

There'll be similar consequences of other woke policies, and we'll see the emergence of all-new investment themes that let you benefit from it. Count on me to find them. Whatever the woke movement gets up to, I'll be there to find innovative and non-obvious ways to capitalise on it.

3. Invest in places that resist the madness

The following is a sub-aspect of the previous point, but it deserves a mentioning of its own.

As I have shown above, there are companies that will benefit from woke policies. However, on the whole, I see countless risks, mostly involving companies misallocating resources to cater to woke demands or being caught out by competitors that have a sharper focus on performance.

This also holds true at country level. Countries that implement ever-stricter woke regulation will likely fall behind economically. This will trickle through to individual companies, and to their owners and employees. "Go woke, go broke" does carry a lot of truth in it, and it will affect people in the US and Europe.

Will woke policies catch on to the same degree in China as they have in the Western world? I am no expert on China, but I doubt it, based on what I have seen so far. Fun fact: China already seems to be engaging in the kind of "white, middle-aged men" salary arbitrage that I described earlier. Check the 21 December 2020 Reuters article "China Inc. will recycle used white guys":

"As corporations try to make their ranks more ethnically representative, many experienced – if white and older – males will find themselves without a job. Chinese companies, deterred from acquiring U.S. firms with valuable intellectual property, can recruit their discarded human capital instead."

Clever!

To Americans and Europeans, it can appear that the entire world has gone woke. In reality, the scope of views held around the world are still wonderfully diverse, and most people have a much clearer view of the problems that can arise out of woke policies. It should also provide food for thought that much of the Western world's private equity industry is making an effort to stay one degree removed from these policies (while paying lip service to it in the media). Over the past few decades, private equity has provided some of the best investment return available. Ignore their evaluation of the situation at your own peril.

At the very least, I'd make use of the world's diversity to spread my risk – such as investing in countries that pursue the exact opposite of the woke Western approaches. Add to that companies that may be based in the West, but which go public elsewhere to escape the woke policies of stock exchanges like Nasdaq, which recently decided it was in the race and gender quota business.

There may also be an increasing number of options for reducing your portfolio's exposure to woke policies through a new generation of financial services firms. E.g., 2ndVote Advisers is a US firm that collects extensive data about "investment options for the un-woke", as described in an opinion piece in the Wall Street Journal on 16 April 2021:

"I broadly support diversity and inclusion, and I am not advocating only for projects with high returns, but it is important for investors to understand the trade-offs … We focus on profits, not politics. … Companies that value profits over politics are far more ethical and healthy for society."

Their assessment stops short one inch of my position. I believe we have reached a point where there is even an investment case to be made out of investing in companies that the woke movement is trying to defund. Capital receives the highest returns where it's in least supply, so there is definitely an investment aspect to be explored. Also, the woke movement is now trying to defund some companies that do a world of good and whose main crime is not to submit to the woke thought police. There is a strong moral case, too, for supporting these victims of woke insanity.

This is, of course, a subject for another article!

What's your view?

Much as I've just spent the better part of this week writing one of the longest-ever Weekly Dispatches, I feel that I have only looked at 1% of the subject matter at hand.

What's your take? Did I miss out on important subjects? What did I get wrong? Which aspects would you like me to investigate further?

I have never been above admitting my own bullshit when proven wrong so feedback of any kind is welcome!

As ever, I read every single one of your emails and personally reply to each of them.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: