Image by Sergei Elagin / Shutterstock.com

60m Americans are underbanked or even unbanked.

56% of Americans still take cash with them when leaving the house.

In the world's largest economy, the digitisation of its banking services is still in its infancy. In fact, the entire financial infrastructure of the US is vastly inferior to that of Europe and even most emerging markets. Anyone who has ever tried to make a bank transfer in the US will know as much.

This is a tremendous long-term opportunity for providers of digital payment services.

The stock of digital payment provider Block is now worth a closer look. Despite a recent rally, it's still down 70% since its 2021 high.

Block.

The largest US retailer you have never heard of

San Francisco-based Block (ISIN US8522341036, Nasdaq:SQ) was set up in 2009 to offer small merchants the ability to accept credit card payments using their smartphone or tablet. Originally called Square, the company changed to its current name in 2021. One of the firm's two founders, Jack Dorsey, was also the founder and former CEO of Twitter.

Over time, Block expanded the range of services for merchants, now comprising entire web-store fronts, payroll handling, inventory management, and business loans.

Even though Block mostly caters to smaller merchants with less than USD 0.5m in annual sales, the sheer number of businesses that the firm has signed up by now has made it a formidable player. The 4m merchants that process their sales through Block add up to an annual gross payment volume of USD 200bn, which makes Block the 13th largest retailer in the US.

Processing payments is an inherently low-margin business. Scale is everything, and Block increasingly has the necessary economies of scale – something that competitors cannot build overnight.

More importantly, many other aspects of the business have changed over the past few years, with more changes becoming apparent for the coming two to three years.

Chief among them, the ongoing growth of the firm's Cash App Pay, as well as the overall Cash App ecosystem.

A 60-second primer on digital wallets

Cash App is Block's product for consumers. It allows anyone to make person-to-person money transfers, i.e. you can easily send and receive money. It's similar to PayPal and Venmo – the former being the digital wallet of choice for the baby boomer generation, and the latter appealing strongly to Gen Z.

Even though the Cash App service was already launched in 2013 (then called Square Cash), Block only recently added additional functionalities to the software. Cash App users can now trade stock, invest in crypto, and use a mobile wallet as well as cash card services. Lending has been added as well. Since 2021, you can use Cash App Pay as a fast and simple payment method that lets you pay for purchases either by scanning a simple QR code or by tapping Cash App Pay at checkout.

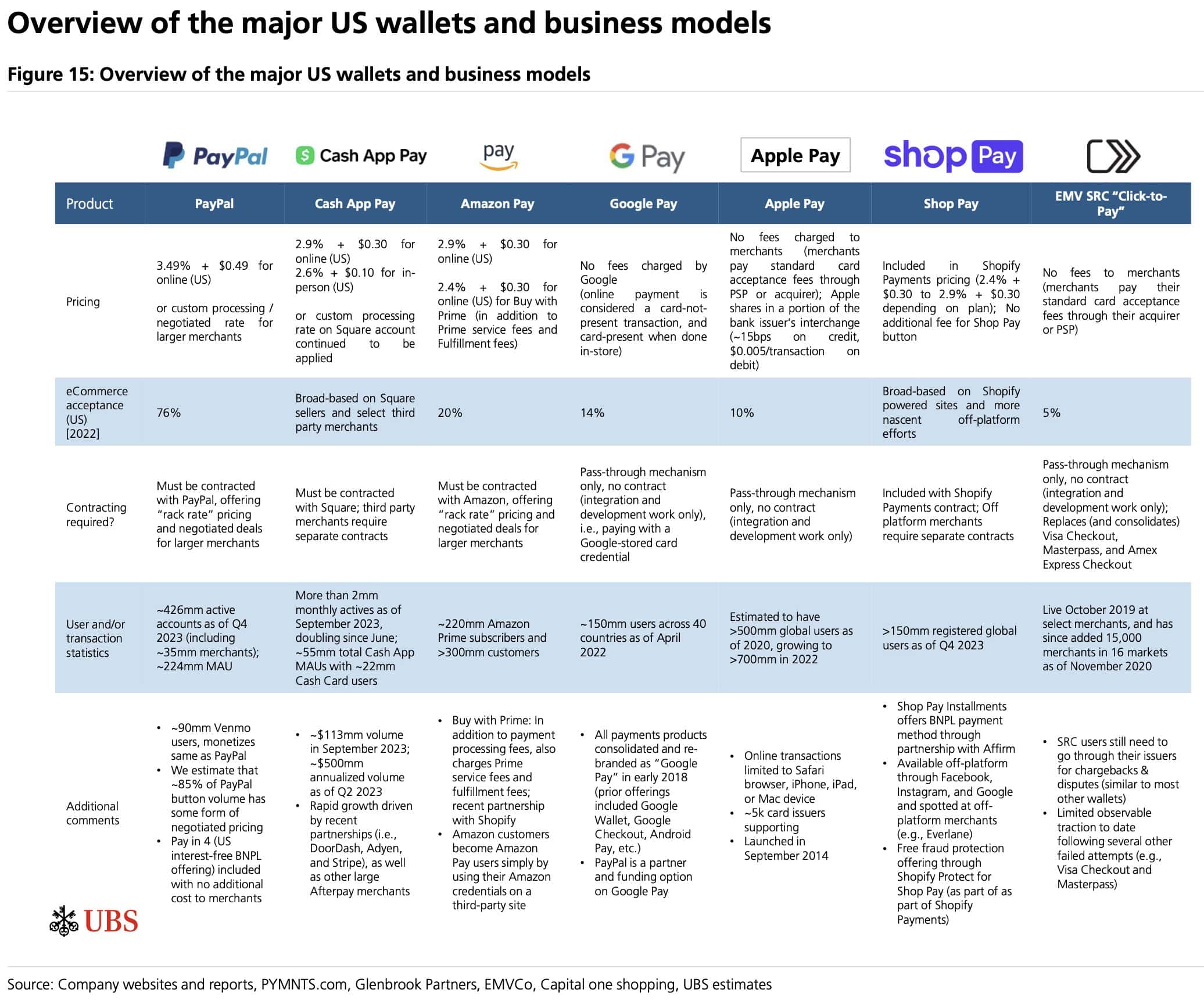

The exact workings and financial ramifications of these payment systems are not easy to understand unless you work in that industry. Three types of digital wallets exist today:

- Pass-through digital wallets, such as Apple Pay or Google Pay: these wallets serve as a "glove" over card credentials and provide another way of delivering card information to the merchant acquirer (a digitised version of a card). The wallet operator is *not* involved in the movement of funds, and no funds are stored by the wallet operator.

- Stored value digital wallets, offered e.g. by Starbucks: these wallets serve as prepaid cards, i.e. customers preload funds before transacting with a seller.

- Staged digital wallets, such as PayPal, Venmo, and Cash App: these wallets allow customers to complete a transaction even if they don't have a sufficient balance in their digital wallet. This "back-to-back funding" entails a live link to a customer's bank account.

The illustration below shows the different business models of the leading digital wallets in more detail (click to enlarge). If you'd like to receive an entire research report that explains this industry in more detail, contact me.

Source: UBS, Cash App Pay Overview & Mechanics, 16 February 2024 (click on image to enlarge).

Cash App Pay is still in its infancy, but growing fast with recent year-on-year growth of 40%. It's a serious contender to eventually become a real headache for Venmo, the US' leading wallet of this type.

Still, the stock market has not been impressed of late. Since 2021, when fintech and online payments were hot subjects, the share price of Block has come down from USD 285 to now USD 78. The stock has been lagging the recent recovery of other US tech stocks.

Block's growth story could soon experience a renaissance, though.

What makes Block unique

Block's business has many competitors – PayPal and Stripe for merchant services, and Venmo and Apple Pay for consumer apps.

Unlike these competitors, however Block, has both parts of the ecosystem: the merchant acquiring business, and a consumer-facing app.

As Block reaches serious scale, transactions will increasingly take place within the company's own technology loop. If a consumer spends money using the Cash App, and the merchant is using Block's payment processing software, no interchange fee will have to be paid. The margins on these internal payments will be significantly higher, putting Block at a competitive advantage.

This is not the only factor that has changed for Block.

The add-on services mentioned above increasingly make for a differentiated and compelling product offering. In the merchant business, in particular, Block now stands a good chance of moving upmarket and signing up larger businesses as customers.

The firm's days of terrible capital allocation also seem to be over. Block was long renowned for making bad management decisions. At a time when the market went crazy over growth, Block went overboard with costly acquisitions.

The company has been making progress of late to finally pull these businesses together, aided by the fact that since his ousting at Twitter, Block founder Jack Dorsey has been able to focus firmly on Block again.

In January 2024, Block announced its first-ever round of lay-offs. The company's employee base had ballooned from less than 4,000 in 2019 to over 13,000 in 2023, and headcount is now being reduced by 1,000. This is just one of many emerging signs of the company's new focus on execution and efficiency.

Before too long, this will show in margins, too.

Gaining momentum and growing margins

During the past four years, Block has grown its revenue by a factor of three.

Due to its former cost control and bloated employee base, this didn't show sufficiently in the company's bottom line, though. Declining valuation multiples in the industry and disappointment over Block's gross profits led to a hammering of the stock price.

The writing is on the wall that over the next few years, margins will likely improve – and potentially, quite significantly.

Block does operate in a business that is commoditised and perpetually low-margin. However, there is a massive opportunity due to the combination of:

- Block getting its costs under control.

- Economies of scale kicking in.

- Transactions not leaving the company's own ecosystem.

- 80% of US financial transactions still running through clunky legacy systems.

As younger consumers vote with their feet and older consumers increasingly become more digitally savvy, Block is likely going to keep growing at double-digit rates.

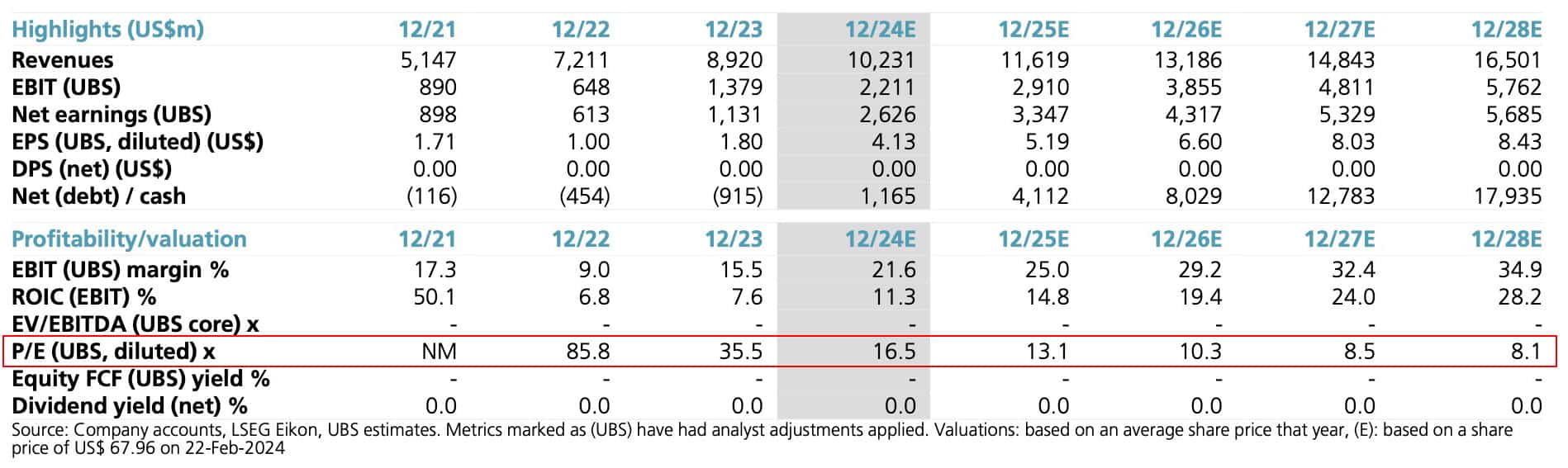

As the fintech sector as a whole is no longer trading at ridiculous valuations, you can now buy into this growth at a reasonable price. See the table below for the current valuation multiples.

Source: UBS, 23 February 2024 (click on image to enlarge).

Block's growth story will likely re-emerge

Even though 56% of Americans still like to leave the house with cash in their pockets, the overall trend is going towards digital payments. According to a Gallup poll published in 2022, six out of ten Americans say they now make only a few or no purchases with cash, which is nearly double the 32% that said the same thing five years prior. 64% of Americans say it is very likely or likely that their country will be a cashless society at some point during their lives. Think of it what you will (and I do LOVE cash), the digitisation of payments will likely advance in Uncle Sam's territory, too.

Block has an opportunity to focus on specific demographics that are open to or in need of such services, and it will likely win merchant business from legacy competitors whose offering is less digitally sophisticated.

Block is basically building a Neo Bank. It is one of the few companies working in this space at scale, and with an increasingly visible competitive edge.

According to industry rumours, Block is going to launch its own credit card during the next 12 months, which would yet again allow it to tap into potential new customer groups. Given the large amounts of data that the firm collects from both merchants and consumers, it will be able to offer a competitively priced credit proposition.

Increasingly, Block can be expected to grow faster than its fintech peers. Its stock, however, is trading at the average industry multiple and at a pretty modest level in absolute terms given its growth prospects. Combine this with management's growing track record for launching and then quickly scaling new products, and you have the potential that results and growth rates will surprise on the upside. The stock has not yet discounted a lot of the things that have recently taken place in the business.

Block is an interesting play on the growth of digital payments, the supreme long-term strength of the US economy in general, and the specific changes likely to take place at the company over the coming 12-24 months.

Taken together with its undemanding relative and absolute valuations, Block stock is bound to catch up over the next year or two.

Formula One Group: moving up a gear

Formula One needs no introduction. Its owner might, though!

Nasdaq-listed Formula One Group is little-understood – even though it is a liquid, easy-to-access investment, which has already attracted the interest of Saudi Arabia's sovereign wealth fund.

Why would the Saudis be so keen on the business, and what makes the stock SO interesting over the coming 12-24 months?

My latest research report investigates.

Formula One Group: moving up a gear

Formula One needs no introduction. Its owner might, though!

Nasdaq-listed Formula One Group is little-understood – even though it is a liquid, easy-to-access investment, which has already attracted the interest of Saudi Arabia's sovereign wealth fund.

Why would the Saudis be so keen on the business, and what makes the stock SO interesting over the coming 12-24 months?

My latest research report investigates.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: