You’d be forgiven if “Section 230” didn’t ring any bells.

It’s been in the media a lot recently, but it’s a complex, mind-numbing subject. Never mind that it’s also heavily politicised. There are plenty of good excuses not to spend any of your precious attention on it.

Even yours truly, a self-confessed connoisseur of arcane and impenetrable subjects, struggled to wrap his head around it.

However, it could be of crucial importance for anyone investing in Internet stocks.

Social media networks, publishing companies and even online shopping websites could all be affected by it – and significantly so.

What’s more, it’s indicative of a broader trend that is currently emerging around the world, and which could lead to the creation or redistribution of trillions of wealth.

Does that sound like it’s worth taking a look at?

I've done the heavy lifting for you, so that you can quickly get the gist of it.

Section 230: a 60-second summary

“Section 230” refers to a regulation in the Communications Decency Act that the US government adopted in 1996.

Back then, the Internet was growing rapidly from a tiny base. Who remembers AOL and CompuServe posting millions of free CDs to get people connected? These were the pioneering days of the World Wide Web.

Regulators tried to get their head around the legal issues thrown up by the new medium. The phenomenon of online communication created some obvious societal challenges, such as the easy proliferation of paedophile content. Despite these undesirable excesses, those in power aimed at enabling Internet companies to invest and grow.

Section 230, the regulation created as a result, was widely seen as highly advantageous for Internet companies.

Thanks to Section 230, US companies that operate an Internet platform cannot be held liable for content posted by the platform's users. Unlike newspapers, which can be sued for damages if they knowingly publish erroneous, slanderous information or illegal content, the operators of Internet platforms enjoy immunity against legal claims if the content was created by users rather than the company itself.

Usually, companies that are given such far-reaching legal protection have to deliver something in exchange. However, in the case of the fledgling Internet industry, no such quid pro quo exists.

It’s entirely reasonable to say that without the privileges granted by Section 230, companies like Facebook, YouTube and Twitter would never have risen to their current prominence.

However, some observers fear that their luck may be about to run out – or at the very least, they'd have to adapt to a new situation.

Politicians have latched onto the subject

Social media platforms have become infamous for hosting a mix of objectionable, toxic or outright illegal content. This wouldn’t matter much if these networks were used by a small number of people. However, with 2.7bn people registered on Facebook alone, anything that happens on these platforms nowadays tends to have wider ramifications.

Not that it would ever be easy to decide on the right stance to take. Just what makes content objectionable, toxic or illegal is a matter of different legal systems and cultures. One country’s illegal hate speech is another country’s protected free speech, and something that gets laughed at in one part of the world makes people literally want to chop your head off in another part of the world.

The matter has become quite pressing of late.

We now live in a day and age where user-generated content on the Internet informs and influences major decisions – be that purchasing decisions worth billions, or major elections.

Section 230 is one of the most visible aspects of Internet regulation. Given the money and influence that are at stake, it’s now at the centre of political rows.

Questions that are under discussion include:

- Should the generous legal privileges continue to apply?

- Would it be better to cancel Section 230 altogether?

- Has it become necessary to at least rewrite the regulation to make it fit the requirements of the 2020s?

These are complex questions. Goldman Sachs found that 900 court decisions have touched on Section 230. Navigating through the existing case law alone makes this a difficult undertaking, never mind political persuasions and powerplay, let alone different jurisdictions.

Section 230 is really just one aspect of a much wider debate that is now getting underway in earnest. It all relates to national and digital sovereignty, control of financial resources, and political power. Digital companies that have strong market positions in their home countries or internationally will soon find themselves in a world where invisible borders may be going up across the Internet.

Twitter is at the crossroads of it all

One of the companies at the heart of the Section 230 debate is good ol’ Twitter.

The social media platform has so much toxic content on it that it got dubbed “the Harvey Weinstein of social networks”. Its stock dropped 12% on the day an analyst coined this term.

Twitter is at the centre of political controversy over alleged censorship, voter influencing, and anti-trust abuses.

Politicians the world over would have plenty of reason to contemplate if they wanted to ban Twitter from their territory. Twitter has been credited with having had significant influence on the Arab Spring and the Ukrainian EuroMaidan – never mind countless other grassroots movements that those in power found pesky to deal with. How long until some countries ban Twitter altogether? Oh, wait, that has already happened, in places such as Iran, Turkmenistan, and China.

Is Twitter the world's most politicised Internet stock?

The company is undoubtedly at the crossroads of many of the developments outlined above. Surprisingly, though, Twitter could benefit rather than suffer from new regulations.

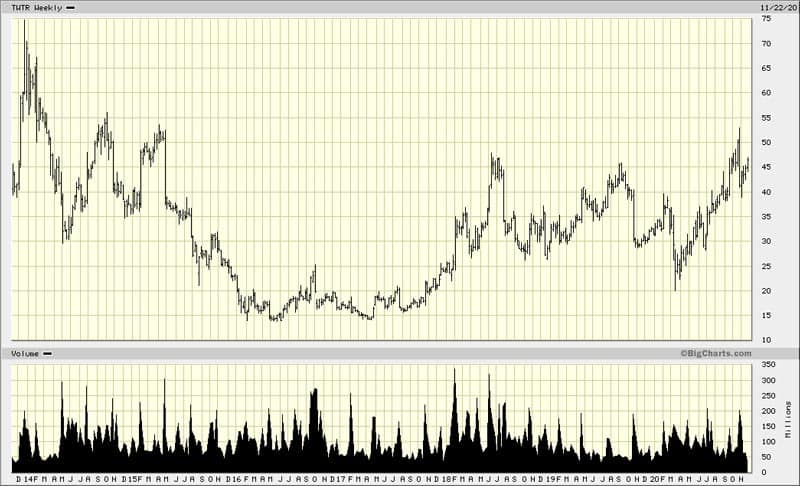

For a long time, Twitter had been a boring laggard among social media companies. Twitter stock hasn’t moved at all since its IPO in 2013.

However, the company has recently been making significant progress in its core business:

- Twitter has successfully redeveloped its advertising model, the so-called “ad stack”. Two thirds of all US companies with over 100 employees now send some of their advertising budgets to Twitter.

- The company is on the brink of throwing off USD 1bn in annual cash flow.

- More good stuff could be in the pipeline and hit the headlines shortly, such as add-on services that involve a subscription fee for users.

Twitter is currently one of the world's lowest-valued stocks among major social media and online advertising companies – and as such, it has attracted one of the world’s most successful activist investors.

Elliott Management has USD 40bn in client assets under management, and purchased a high-profile USD 1bn investment in Twitter in early 2020. Even for an asset manager the size of Elliott Management, the stake in Twitter is a significant overall amount and an investment so visible to the public eye that failure is not an option.

Things could be about to get interesting.

In March 2021, a standstill agreement between Twitter’s management and Elliott Management will come to an end.

That’ll probably coincide with things boiling over on the political front. Think Section 230, national digital champions, and similar developments.

Contrary to what one would expect, these prospects don’t seem to be hurting Twitter’s stock price anymore.

On the day before I published this Weekly Dispatch, the Wall Street Journal prominently displayed an article: “Social Media’s Liability Shield Is Under Assault”.

“The law that enabled the rise of social media and other internet businesses is facing threats unlike anything in its 24-year history, with potentially significant consequences for websites that host user content.”

Sounds ominous, doesn’t it?

That same day, Twitter stock closed up 2.7%.

The stock has been creeping up, despite seemingly adverse circumstances. Often, that is a sign that something surprising is afoot, which only industry insiders have realised yet. A rising stock price when the news suggests otherwise is one of the most reliable signs that there is more than meets the eye.

Twitter might end up as a beneficiary of these developments, because of factors such as:

- More regulation benefitting existing larger companies, and stamping out what little competition there is.

- The next US administration viewing Twitter as one of their national digital champions, and propping it up rather than causing it overly many problems. Silicon Valley is, after all, the single largest lobbying force on Capitol Hill.

- Countries with totalitarian streaks falling in love with Twitter’s experience in censorship, and inviting it to launch controlled versions in their national territories.

There are lots of opportunities, many of which are not obvious yet - which is why the market hasn’t priced them in yet.

I have analysed all of the above in a brand-new research report about Twitter. The stock has been edging upwards since I made the report available to Undervalued-Shares.com Members last week, and I believe this is only the beginning. How come? My report has all the answers.

Stay tuned for more

Data localisation, the balkanised splinternet and digital national champions are all subjects that you should keep on your radar. Investors who are ahead of the curve will be able to make money off them!

I myself have done a lot of reading on those subjects recently. Expect more of my insights very soon…

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Is Fiverr the 'Amazon of freelance'?

Fiverr, the Israeli freelance services marketplace for businesses that I featured in April, is one of this year’s major success stories.

Why should you own Fiverr for the entire 2020s?

Join me and Ash Perera as we take a deep dive into the company. There’s a podcast for those who prefer to just listen in, and a video if you’d like to see us in person!