It will have a profound impact on any asset classes, countries, or sectors you are investing in - even if somehow a peace deal was agreed upon next week. This is a structural geopolitical change, of the kind we last saw when 9/11 happened.

Today's Weekly Dispatch is not going to discuss the situation in Ukraine per se. There are a million other sources of information for that, written by people who know much more about the subject than I do.

The focus of Undervalued-Shares.com is to uncover the non-obvious investment-related information that you would struggle to find elsewhere. Here is what I have concluded from the entire situation so far, and what you can expect from this website over the coming weeks (and months).

The view of the world – from Sark!

For readers new and old, I do need to frame this article with a bit of personal background.

Many of you will know that I reside on a tiny, self-governing island. Sark has 550 residents, and it has been independent since 1565. The island has a long-established way of doing things differently, and not giving in to short-term pressures from the outside world. It has no political parties, the government is legally prohibited from going into debt, and there are no employment laws. Your average career politician, government bureaucrat or social justice warrior from elsewhere will see Sark as a stone age place that urgently has to be brought in line, yet the island doggedly sticks to its unique way of life and independence. I've always seen that as a great quality, and it's part of what attracted me to this place.

In 2017, I moved here full-time from London because I felt trouble was coming to the Western world. While I didn't foresee the pandemic, nor the current developments in Ukraine, it's been blatantly obvious to me for years that in the Western world (primarily: Europe and the US), many long-standing issues were coming to a head.

Even though I don't mention it often, I have long been a fan of the "Fourth Turning", also known as the Strauss–Howe generational theory. According to this theory, every four generations (or about every 80 years), society experiences a breakdown of the existing institutions, and they are replaced by something new. Based on the Fourth Turning, the time to expect such a generational turning is right about now.

I spoke about this in a 2019 interview with my friend Jens Rabe, where I summarised the book's thesis by asking the question "Are we facing a re-booting of the system?"

Yours truly speaking about the Fourth Turning in 2019 (starts at 23 min 35 sec; in German).

I love big cities, and I'd typically reside in the likes of London or New York. However, I had a strong gut feeling that it was preferable to base myself outside of urban centres. Even though I didn't know what exactly was heading our way, I figured it'd be better to face up to a period of potential turmoil and far-paced change in a place where I am not exposed to:

- The suffocating group think that runs rampant among "metropolitan liberals".

- The tantalising distractions that inevitably come with city life, which prevent you from focussing on work.

- The tendency of a conventional place leading you to have conventional thoughts.

If you have been following Undervalued-Shares.com for a while, you'll know that I try to focus on ideas and opportunities that you would not typically find elsewhere.

Moving from a city of 8m to an island of 550 wasn't an easy choice. On the whole, though, I now believe this was the right decision to take. Crucially, it has made my investment research stronger and more interesting.

I did get caught out by Gazprom, a stock that I've followed since 2018 and which is currently banned from trading and listed in brokerage accounts with a zero value.

However, I also reported on:

- The world's need to invest in fracking to make up for the misguided energy policies of the EU and the US' Biden administration. Pampa Energía (ISIN US6976602077), an Argentinean fracking play, is up 63% since I featured it in a May 2021 report for my Lifetime Members.

- The Argentinean agriculture company, CRESUD (ISIN US2264061068), as "a hedge against inflation and rising food prices". The stock has nearly doubled since I featured it in a March 2021 report for my Members.

- Petrobras (ISIN BRPETRACNPR6), a Brazilian oil company that I specifically featured because "Brazil is a politically neutral country and Petrobras operates its own fleet of 131 oil tankers, which enables the company to deliver to literally anywhere in the world". It's up nicely since my December 2021 report but should have a lot further to run, given that it can now make up for missing Russian oil deliveries.

Had I written about these opportunities had I been based in London or New York? I doubt it.

Peer pressure and group think are strong in large parts of the Western world. Until recently, suggesting to invest in fossil fuels expelled you from polite society. Today, more than ever before, it's important to be able to freely address inconvenient truths – and to do so ahead of time.

On 3 July 2021, I emailed a friend in New York the following as personal advice:

"Inflation is picking up and it's entirely feasible that 2022 will see a massive jump in costs of living (possibly 10%-20% primarily driven by rent and food)."

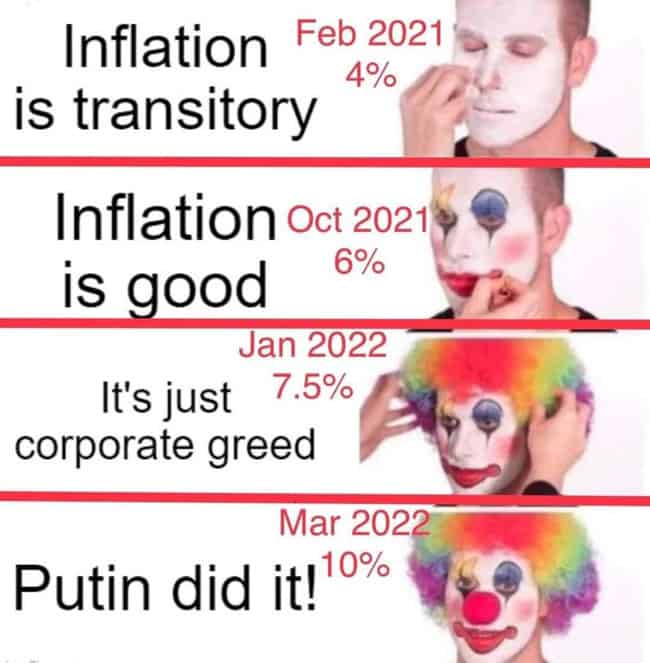

Needless to say, my friend didn't want to hear about it. Back in the days, inflation was described by central banks as something "transitory". Only conspiracy theorists droned on about the debasement of our money through monetary policies that have more similarities with a heroin addiction than prudent governance (but which the government-funded drones that populate Western academia celebrate as "Modern Monetary Theory").

Being based on a small island where no one interferes with my research and where I don't have to worry about being disinvited from the cocktail party circuit, I have a lot more freedom to say things that others would be too afraid to say.

I have every intention to do even more of that, from here onwards.

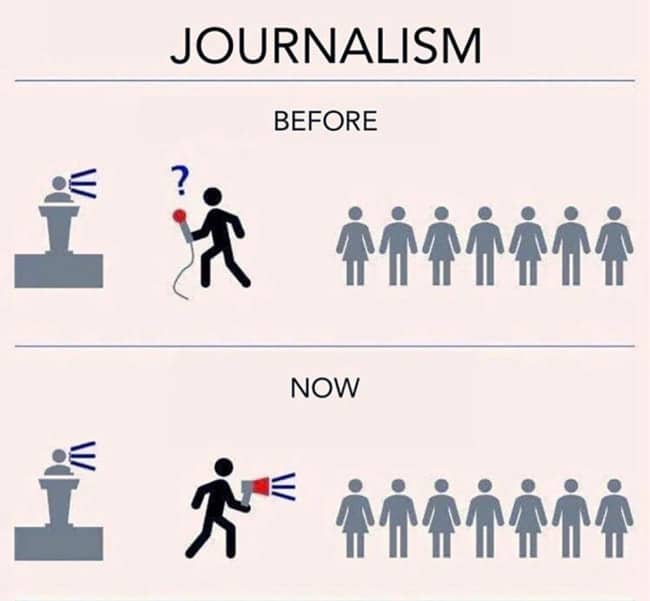

Corporate media are making my life easy

Operating a blog currently feels like shooting fish in a barrel, as far as attracting new readers is concerned. Independent content creators have readers coming their ways in droves. Corporate media always had their faults, but I doubt they ever did as much to drive away their clientele than they are doing now.

We are living through a period of extraordinary madness and delusion. Much of it perpetuated through a corporate media sector that is parroting whatever government, the permanent bureaucracy, and academia want them to say.

Take New Zealand as an example - a country that was celebrated for its handling of the pandemic based on "the science". Yet, it's also a country where academics faced disciplinary action for saying that the indigenous peoples' "way of knowing" was not science. The country's school system is considering to put the Maori's "way of knowing" on the same level as science, and we all know that in Jacinda Ardern's New Zealand, this decision is near-certain to go ahead. You can now wait for that Maori-heritage Minister (who will probably got into the position through minority quotas) dictating policies to the country based on their "way of knowing". Funny as it all seems on some level, this is the sort of stuff that will have a profound effect on your life, your investments, and the future of your family – to the point of deciding which countries and sectors you are allowed to invest in, or whether you may be locked up in your own home for months on end. Corporate media are mostly in on the act, rather than point out what madness this is.

A growing number of people see right through corporate media.

We have a United States government that leaves its Southern border wide open to illegal immigrants, yet it immediately gets involved with far-away Ukraine defending its borders. Needless to say, pointing out these two blatantly obvious facts is something that most newspapers and news outlets nowadays spend zero time on. If you said as much at a dinner party in New York or London, you'd run the risk of not getting invited again. I picked it as an example on purpose and using exactly the way I described it, because I know that it will make the small number of "woke" readers that I've got unsubscribe from my newsletter – bye!

The world over, it had become fashionable to actively destroy a well-established, affordable industry (fossil fuels), and replace it with an experimental, expensive solution (so-called "renewable" energy). Anyone who pointed this out in an investment context will have received emails about their role in the coming death of humanity – I did!

All the while, our politicians are using monetary policies that try to defy the laws of nature. No matter what you call it – Modern Monetary Theory or something else – you still cannot print your way to prosperity. Anyone who claims otherwise should get their head examined.

This is a period of crazy, and the crazy train only seems to be picking up speed with each year that passes instead of slowing down. If you thought 2016 was crazy, what are you making of 2022 – and how will 2024 look like?

Yet, you are not supposed to speak or write about it. Much of the corporate media have become a tame, submissive mouthpiece of the special interest groups who are driving this nonsense. Or maybe they always were, and we simply noticed it less at the time.

In any case, stuff like this is driving their readers away and towards independent content creators such as myself. CNN, The Times, and Der Spiegel – many thanks for helping me build my content business!

Needless to say, this also has implications for investing. The bigger the delusions driven by some parts of society, the more interesting, fun and financially rewarding it is to go against the grain!

Ideas outside of the mainstream

Over the coming weeks and months, I will be exploring the following key question:

What are the NON-OBVIOUS trends and conclusions that investors should pay attention to following recent developments?

I already touched on some of the blatantly obvious conclusions, e.g.:

- Invest in energy stocks.

- Consider investing in that long-forgotten and much-maligned sector, defence companies.

- Investigate if it's worthwhile to pick up distressed Russian assets. Goldman Sachs and the Chinese apparently are onto it already – though private investors from Western countries are currently prevented from doing so.

These considerations may yet yield more gains for investors. However, I am also wary of anything that has already made it into the wider public's conscience. Keep in mind that the entire situation could change quickly, and that the pendulum can also swing the other way. E.g., there may be a peace deal for Ukraine soon, or we could find that China buys Russian oil and re-sells it to elsewhere in the world which then helps alleviate energy shortages. Markets are not a one-way street, and every problem attracts entrepreneurs who will try to make the problem go away.

What I am terrifically interested in (and excited about), is the question which NON-OBVIOUS investment opportunities are coming out of all this. This could include questions such as:

- If this conflict were over tomorrow, could it be Indian shares rather than American (or European) shares that will benefit the most? Marc Faber discussed this question in The Economic Times.

- Will South American equity markets get re-rated as a kind of safe haven? Could the entire continent start a new long-term cycle benefitting from rising energy and commodity prices?

- Is the current period of brain-eating "woke" nonsense going to lead to a collapse of existing institutions and far-reaching societal change? If so, what will it likely look like and which asset classes, business sectors and companies are most likely to benefit?

Yours truly, on Sark.

There is a plethora of ways to position your portfolio for these new circumstances. E.g., will a growing number of private investors flock to investment newsletters for inspiration on how to position their portfolios? As it were, I recently published a report on the world's only publicly listed publisher of investment newsletters.

These are just examples off the top of my head. You get the idea… I am trying to be one step ahead of the crowd - and I'd like you to join me while I'm at it!

I've got a whole bunch of stories lined up to this end - as will be shown in the research that is coming the way of Undervalued-Shares.com Members and Lifetime Members.

I'll continue next week with an interview with someone I am very excited to be speaking to later today, and who is ideally suited to give us some very different perspectives and investment ideas.

On that note – stay safe, stay sane, and until next week!

Subscription cash machine

Readership grown in 18 of the past 20 years.

Profitable in 20 of the past 20 years.

A founder who invested just USD 50k - and is now worth several hundred million.

Meet the world's only publicly traded investment newsletter publishing company!

Subscription cash machine

Readership grown in 18 of the past 20 years.

Profitable in 20 of the past 20 years.

A founder who invested just USD 50k - and is now worth several hundred million.

Meet the world's only publicly traded investment newsletter publishing company!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: