People need to live somewhere, and all of Europe is experiencing a housing shortage that is unlikely to go away.

You'd think that buying German residential property at a 66% (!) discount to its market value would be a no-brainer.

Is it, though?

I had no preconceived idea and approached the question with an open mind.

Here is what I've learned.

Surprising facts about the German market

An excess of Old Economy companies, depressed valuation metrics, and companies moving their listing to the US market – these are some of the features you regularly get to read about in the context of the UK market: "Because, Brexit."

It actually also describes the German market:

- Of the 40 companies in the DAX index, 23 were set up before the year 1800.

- All DAX companies together are worth less than USD 2tr, i.e. you could purchase Germany's 40 leading public companies for less than the value of Apple or Microsoft. Even if you ascribe this fact to the unusual outlier role of a small number of US tech companies, the value ascribed to the leading companies of the world's third largest industrial nation is dire. Not a single German company is among the world's 100 most valuable companies anymore, compared to 2007 when there were seven such companies.

- Linde, the world's largest industrial gas company by market share and revenue, recently announced that it will delist from Frankfurt to focus on the New York Stock Exchange. And that's just one example.

If investors saw Germany as a great place to latch onto, it wouldn't show in the amount of money invested in DAX-based ETFs. Just EUR 13bn are invested in ETFs that track the leading German stock market indicator, compared to EUR 350bn invested in ETFs that follow the S&P 500 index.

There are manifold reasons for Germany's status as relative laggard in stock market terms. Even now, the country remains infamous for insufficient governance standards that give CEOs and boards way too much power. I described one of the more surprising reasons for this in my Weekly Dispatch from 1 May 2020. It's tremendously tricky to hold German boards to account for underperformance because the core of the German corporate framework was established by the Nazis and has corporations run on the basis of the "Fuehrer principle" (Führerprinzip).

As the Financial Times put it on 22 December 2022:

"In general, CEOs who underperform can resist shareholder pressure to quit or change strategy. Take Bayer, which was able to embark on its ill-fated $63bn acquisition of Monsanto in 2016 despite fierce shareholder opposition, and without putting the deal to a vote at its annual meeting. In 2019, Bayer chief executive Werner Baumann kept his job despite 55 per cent of the shareholders voting against ratifying the actions of management. He is still there despite shares in the company falling 43 per cent since the deal was announced. The €48bn market value of Bayer is still far less than what was paid for Monsanto. A lot more thinking needs to be done to rectify the German market's decline but improving corporate governance and shareholder rights would be a good place to start."

Fancy putting your money into a country that has such a lousy overall framework for public market investors?

In fairness, with very few exceptions, most countries come with flaws and imperfections.

From my perspective, it's all a matter of valuations and momentum.

If a stock has screamingly good valuation metrics and there is a catalyst for a revaluation, I get interested.

A seeming bargain among DAX stocks

Vonovia (ISIN DE000A1ML7J1, DE:VNA) is one of only two companies in the DAX that was set up this side of the year 2000. The company has its roots in the large-scale privatisation of government-owned housing that started in Germany in the 1990s, when also large enterprises such as Deutsche Bahn (German Railway) sold off its worker housing.

Through a series of mergers and acquisitions, Vonovia built a portfolio of 548,000 residential units. Of those, 85% are in Germany, with a further 11% in Sweden and 4% in Austria. The apartments are predominantly spread across cities and larger towns, with Berlin's 144,000 units representing by far the largest focus area.

At its peak, Vonovia's entire property portfolio was worth EUR 95bn. What is it worth today?

That's the question many investors argue about, or scratch their head over.

Mr. Market is currently taking a rather cautious stance.

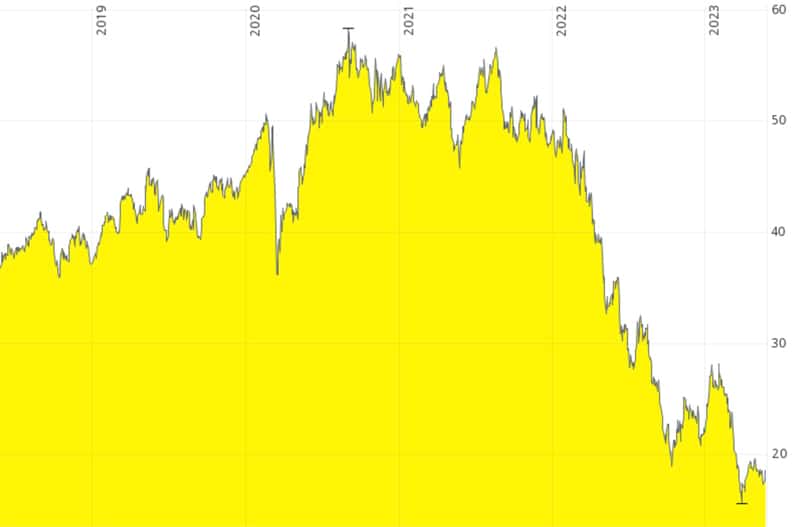

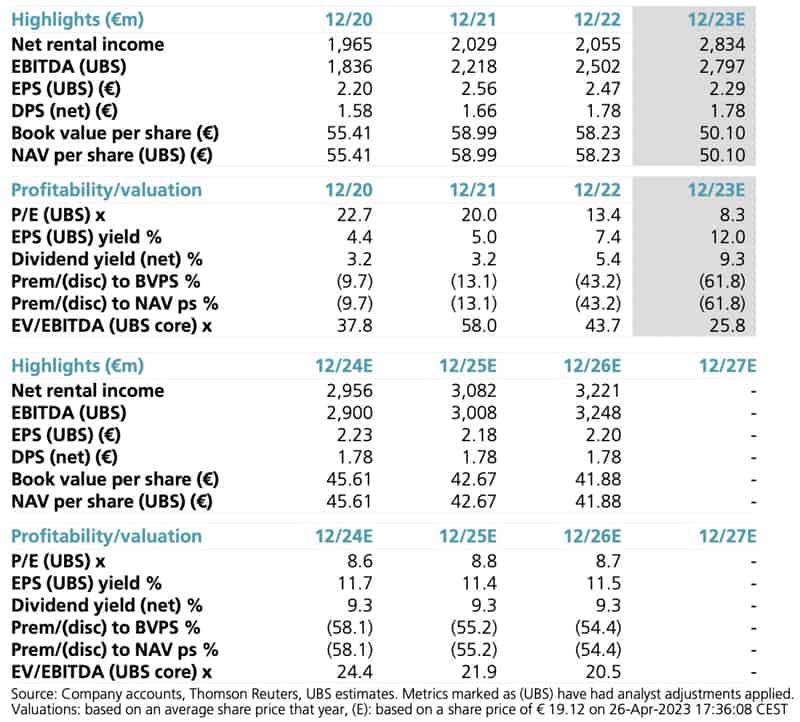

Following a steep drop from EUR 57 in August 2021 to just EUR 18 currently, Vonovia stock is trading at a 66% discount to its official net asset value. That's a higher discount than the average 34% discount to NAV that real estate stocks in Continental Europe are trading for. Even within the heavily discounted sector, Vonovia's current valuation is in a class of its own.

Vonovia.

Why the scepticism, and is it justified?

Renting out residential property is a simple business model and one that is not going to change.

However, following the recent rise in interest rates, two major factors have changed for Vonovia:

- Financing has not only just become more expensive, but it may not even be available at all. There is no clarity as to whether real estate companies will manage to refinance their obligations when they are due for repayment over the coming years.

- Now that there is a much higher risk-free return to be earned elsewhere, the valuation multiples paid for residential property are going to change. After benefitting from yield compression for over a decade, the pendulum has now swung the other way.

The following chart sums up the situation better than any other. It shows how interest rates have risen (purple line) and how they have affected the valuation of Vonovia stock (yellow line). The chart sends a clear message: at the end of the day, real estate valuations are a function of interest rates.

Predicting the future path of interest rates is difficult, to say the least.

Still, it's interesting to look at the current valuation and work your way backwards. The current discount at which Vonovia stock is trading implies a decrease in real estate prices of 35%. Will prices fall quite that far?

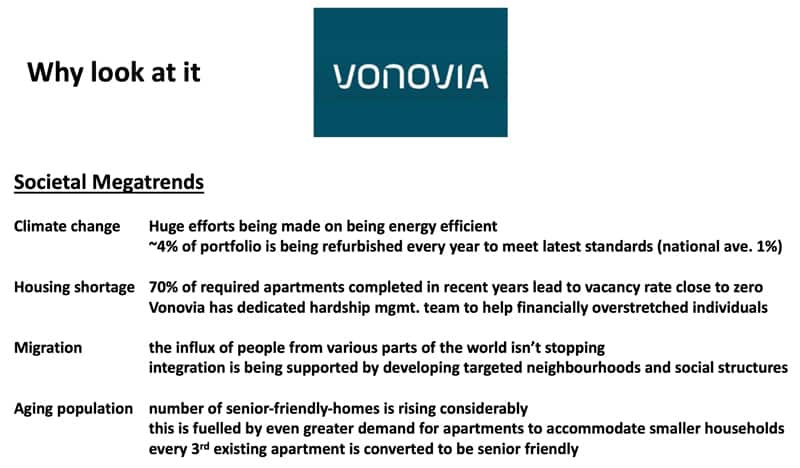

In a clear effort to show that it's currently priced for Armageddon, Vonovia recently sold a EUR 1bn portfolio to Apollo Global Management and other investors at a discount of just 5%. It's this kind of discrepancy that prompted Andreas Klainguti, principal of the Banyan Tree family office, to make a convincing pitch for the stock at Nordic Value 2023, an excellent invite-only event where value investors share their best ideas. As he put it, once you look beyond the short-term worries, Vonovia stands to benefit from a number of powerful secular trends.

Source: Andreas Klainguti, Banyan Tree family office.

There is a lot to argue in favour of the stock having room to recover, and Klainguti's presentation made me take a closer look myself. E.g., results released by Vonovia from its stress test scenarios show that all bond covenants screen safe even in highly adverse scenarios. The resulting line of thinking could be that even if interest rates remained higher for longer and German residential real estate experienced price weakness, the stock's drop in price is simply overdone and a recovery beckons.

Sceptics, however, will point towards more bad news on the horizon.

The sale of units to Apollo at a 5% discount to previous valuations may not be the last word. Word on the street is that most potential buyers are only willing to step in and take on German residential property for valuations that come at a 5-20% discount. Also, not all apartments and houses are alike. Germany is in a huge push for energy efficiency, and units with inferior energy efficiency credentials reportedly trade at a 30-33% discount.

Where are the chips likely going to fall?

Mid-year 2023 should yield some more clarity.

The path forward

Following the initial shock about the unexpected rise in interest rates, it's taken some time for most market participants to adjust to the new situation. Also, even highly-geared real estate companies could afford to simply stick to their portfolio for a while and observe the situation.

However, with bonds and loans coming closer to maturity with each day that passes, some portfolio owners will soon come under increasing pressure to sell. Even Vonovia, despite its stress testing and financial reserves, felt the pinch. The complex sale of the portfolio to Apollo allows the new owners to earn a return of up to 8% p.a. under one scenario, compared to Vonovia earning 3.4% across its portfolio. The 5% discount headline figure did not tell the entire story, and the underlying details showed that there is visible pressure on the system.

It's likely that from mid-year, we'll see more transactions in the market and at significantly lower valuations overall.

The bull case is, once there are more transactions showing a 5-20% drop in prices, Vonovia stock will start to recover because its current share price implies a drop of up to 35%. A liquidity crunch is a remote risk as all 2023 financial maturities and two thirds of 2024 financial maturities are already covered.

The bear case is that interest rates will stay higher for longer, leaving real estate stocks such as Vonovia out of favour with investors for years to come and with significant refinancing risks when bonds and loans come up for repayment. Vonovia's leverage is relatively high with a loan-to-value ratio of 45.4% and net debt/EBITDA of 16.0x.

Which side of the argument you take will be heavily influenced by your view of interest rates and inflation.

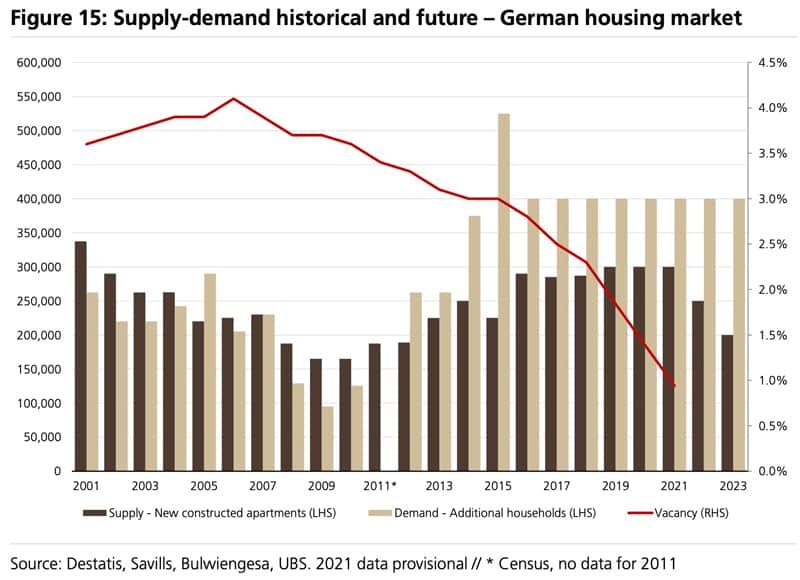

In any case, Vonovia is an investment case that is worth following in the longer term. Like just about anywhere else in Europe, the supply of new housing in Germany cannot keep up with demand.

It's become clear that Germany will continue its path of mass immigration, after the government announced that the country would lack 7m (!) workers by 2035 unless it attracted more immigrants. These additional residents will have to live somewhere.

Source: Financial Times, 2 May 2023.

Rents in Germany are famously controlled and there is a never-ending discussion about the role of large corporate landlords, but it's unlikely that rents will not continue to rise in the long run.

The risk of wealth taxes on property owners or a special "green" tax on real estate to pay for Germany's idiosyncratic energy strategy is a polarising issue. Political risk, in general, has risen considerably in Western Europe over the past years. Whereas many investors used to fret about potential expropriation when investing in emerging markets, they now have to fear so-called windfall taxes enacted at home – a euphemism for punishing those companies that allocated their capital wisely. Large corporate landlords will always be particularly vulnerable to such political shenanigans, and may continue to be subject to a special discount for that reason.

Source: Quartz, 28 September 2021.

What does it all mean in conclusion?

Personally, I'd stay clear of it all for now. I am hearing too many stories of extraordinarily lucrative deals offered in the market for bailing out real estate owners with refinancing issues – with yields as high as 15% p.a. even for high-quality real estate. This refinancing backlog is unlikely to work its way out of the system before the second half of 2024, meaning we'll probably see valuations under pressure for a lot longer while other investments offer better short-term potential.

However, this period will pass eventually, and I'll keep an eye on Vonovia, because stocks such as this one will at some point turn in mere anticipation of the situation easing up. And, for all its faults, Germany remains a country with incredible strengths. If or when we reach a point when no one will want to hear about German residential property anymore, I want to be ready to strike.

Better than real estate assets

When it comes to picking up quality European assets at bargain prices, I'd be much more inclined to look at European brand names rather than real estate assets.

Take Dr. Martens, for example, which is currently trading at an attractive valuation.

As early as next week, the starting gun should be fired for a turnaround of the iconic British brand.

Better than real estate assets

When it comes to picking up quality European assets at bargain prices, I'd be much more inclined to look at European brand names rather than real estate assets.

Take Dr. Martens, for example, which is currently trading at an attractive valuation.

As early as next week, the starting gun should be fired for a turnaround of the iconic British brand.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: