Image by OleksSH / Shutterstock.com

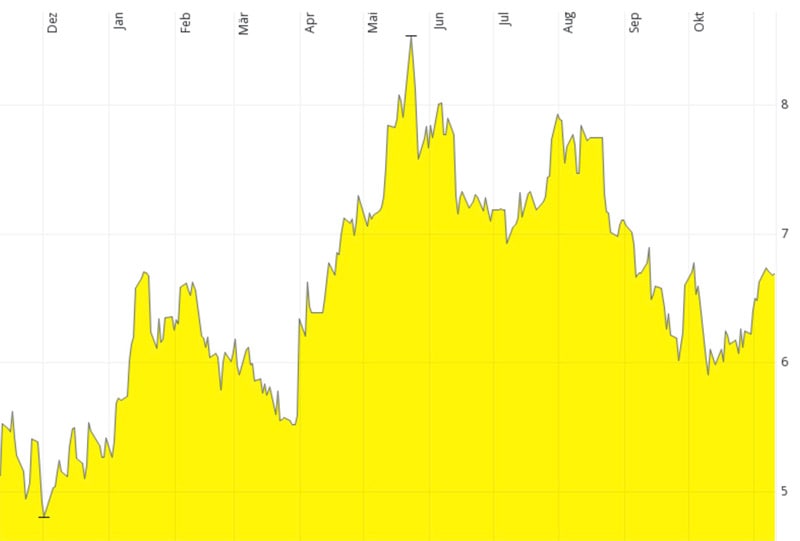

For the month of October, Poland was the world's best-performing equity market.

The WIG20 index soared an impressive 13%, even though it's made up of the country's heavyweight companies.

Election results made foreign observers believe that European Union funding for the country will soon be unfrozen. Strategists at global firms such as Morgan Stanley and Citigroup suddenly turned more positive, and a fund manager at Rockbridge TFI told Bloomberg: "The election was a game changer for Polish equities. Prices have just started to reflect that, and it may only be the beginning."

If that is so, which Polish stocks are worth a closer look?

It's not an easy question to answer. After all, something that hasn't changed is Poland's "curse of the Old Economy". The country's stock market is dominated by banks, industrial companies, and even coal companies.

However, there is also Allegro, the homegrown version of Amazon.

The stock of Allegro reached a high of EUR 21 in 2020, but it has since come down to less than EUR 7. All the while, the underlying business hasn't just grown by leaps and bounds, but it has also evolved in other (sometimes surprising) ways.

It's high time to check in on the company.

Allegro.EU.

Hope first – then despair

Poland has long been a bit of an odd case among the world's stock markets.

On the one hand, the country delivered nearly 30 years of consecutive economic growth, which only a handful of other countries achieved during the last 100 years. It became the first former Eastern Bloc country to get its status upgraded from emerging to developed market. Poland became a successful hub for computer game development, and it has long been strong in healthcare-related sectors. Poles are famously well-educated.

On the other hand, Poland's stock market has seemingly forever suffered from an anaemic performance. Since most of the 20 WIG20 stocks hail from Old Economy sectors, the market's performance during the 2010s has been a meagre 6% compared to 194% for world markets. For many years, the Polish market has been one of the world's cheapest in terms of price/earnings ratio – but seemingly stuck in a value trap.

That's why the IPO of Allegro.EU (ISIN LU2237380790, WA:ALE) brought so much excitement and hope.

This was Poland's domestic e-commerce giant, i.e. the country's reply to Amazon. When it went public in late 2020, its market cap of then USD 11bn made it both the country's largest ever IPO and the largest publicly listed company by market cap. As the Financial Times wrote at the time: "Allegro's listing brings new energy to sluggish capital markets and an underperforming stock exchange."

The public's interest was massive and the placement heavily oversubscribed. It helped that the IPO came at a time of booming retail investor participation. These were the days of pandemic lockdowns, after all. Consumers spent many hours at home glued to newly launched stock trading apps, and ordered their daily needs online for delivery. Allegro hit a sweet spot in more ways than one.

It didn't last long, though. The lockdown boom ended and the retail trading bubble popped, followed by the stock falling as low as EUR 4. Within two years, Polish investors who had placed a bet on long-term growth were down a painful 80%.

Just what led to the steep fall of the stock of such a high-quality company?

Competitors moved in

Eastern European countries tend to have relatively small populations, and they have long had relatively low purchasing power. They lack economies of scale and are not often paid much attention to, if not even outright sneered at.

Even Poland, with its 38m people and relatively advanced economy, did not ordinarily appear on the radar of international tech companies. It was only in early 2021 that Amazon decided to set up an outpost in the country. Up until then, Amazon had served Poland only indirectly through its German website.

The eventual launch of Amazon in Poland sent shivers down the spine of Allegro shareholders. They had already seen the Chinese e-commerce giant, Alibaba (ISIN US01609W1027, NYSE:BABA), set up shop in Poland in 2016. However, even four years later, Alibaba had less than a 4% market share. It was no major threat to Allegro, which commanded 33% of the country's e-commerce sector.

Having Amazon enter the market was different altogether. Among retailers, it's an old rule never to underestimate the American e-commerce giant. When Amazon enters a new market, it tends to use its financial heft to lure customers with offers for free deliveries, and merchants with better margins. Besides, it can afford to play the long game. It was nearly certain that Allegro was going to lose at least some market share to its American counterpart.

All of this came at a time when the stellar growth driven by pandemic lockdowns started to slow down. Given that Allegro had already picked the market's low-hanging fruit, it also became clear that the company's further growth was going to need more capital investments.

In autumn 2021, Shopee, the Singaporean e-commerce company that is part of SEA (ISIN US81141R1005, NYSE:SEA), also announced that it was going to enter the Polish market.

Following nearly two decades of relatively limited competition in Poland, the country's e-commerce market turned into a battlefield of well-funded foreign entrants. Combined with falling growth rates following the end of lockdowns and consumers at least temporarily rediscovering their love for physical stores, Allegro's stock got abandoned by growth investors.

However, since reaching its record low of EUR 4 in October 2022, the stock has quietly crept up again. It temporarily doubled, and is currently at around EUR 6.70.

Allegro.EU.

When a stock advances without getting much attention, it's usually a sign of more gains to come.

What, though, could spark such an ongoing revival?

The recent normalisation

Investors were right to fear increased competition. Foreign new entrants usually throw around money to win market share, which eats not just into the incumbent's revenue but also margins.

Case in point, Shopee's strategy.

When the Singaporeans launched in Poland, they offered consumers free deliveries and free returns, irrespective of the order value. The company onboarded tens of thousands of local merchants by offering them 0% commissions for the first six months, which further helped to keep prices competitive. This made Shopee popular with consumers; within less than a year, the company's website reached over 10m monthly active users. Allegro had over 20m active users, but it had taken the company over 20 years to build up this user base. It did look like Shopee was about to eat Allegro's lunch, or at least a good part of it.

However, it all turned out to be a mere flash in the pan.

15 months after launching in Poland and despite seemingly strong metrics, Shopee *closed* its Polish operation.

As it turned out, there is a difference between throwing cash at a market to show fast growth, and building a sustainable, profitable business. Selling dollar notes for 80 pence makes you popular and leads to queues forming outside your shop, but it's just not a sustainable business.

In the meantime, it had also become apparent that Amazon was going to pursue a rather measured approach to expanding in Eastern Europe. The American giant doesn't simply throw money at a new market, but aims to grow incrementally instead.

Needless to say, Allegro did have it easier during the pre-Amazon days. However, its home market continues to benefit from the combination of growing disposable incomes and the increasing share of online purchases. It has now become clear that the Polish market is big enough for several players to succeed.

Following a dip in margins in 2022, the subsequent year has seen margins recover somewhat. Allegro recorded higher take rates (the percentage of sales that it charges to merchants) and strong growth in advertising revenue on its platform (+34% or 3x current group revenue growth). The percentage of EBITDA that converts to free cash flow recovered to 85% versus 62% a year ago, and capital expenditure reverted back to circa 5% of sales compared to 10% a year earlier.

The market has now reached a kind of new normal, and it's quite possibly the beginning of a longer-term new cycle. This could pave the way for observers to soon pay more attention to two other factors, which relatively few investors outside Poland will be even aware of – yet!

Pan-CEE rather than Polish

Even though Allegro is widely perceived as a Polish company, it has actually become a player that is active across a much larger part of the Central and Eastern European region.

In late 2021, the company took over Mall Group, an e-commerce and logistics businesses operating in the Czech Republic, Slovakia, Hungary, Slovenia, and Croatia. It operates:

- "Mall": a leading e-commerce site in the Czech Republic, Slovakia, Hungary, and Croatia.

- "CZC.CZ": a specialist consumer online electronics retailer in the Czech Republic.

- "mimovrste": Slovenia's most popular e-commerce portal.

- "WE DO", a courier service with over a thousand pick-up points and lockers.

Source: Bloomberg, 5 November 2021.

The EUR 925m acquisition required Allegro to issue new stock and take on some debt, but in return it got access to another 32m consumers across five countries, 4.7m of whom were already active users of the various sites. Suddenly, Allegro was the number #1 or #2 e-commerce player in not one but four countries of the region, and it got a less established but growing position in a further two countries. These new markets also came with a bigger catch-up potential than Allegro's home market: below 8% e-commerce market penetration, compared to 11% in Poland. Eventually, Central and Eastern European consumers will give in to the convenience and price advantages of online shopping to the same degree as consumers elsewhere (in the UK, 25% of all retail sales are done online).

Plus, there is the ongoing overall economic growth aspect. As readers of my recent feature about Hungary will know, Central and Eastern European countries are generally growing at a faster rate than their counterparts in the Western half of the European Union.

In summary, Allegro has the chance to grow its markets to two to three times the current size, and backed by faster underlying organic growth.

But there is more….

Allegro goes fintech

Added on top of the company's newfound potential in nearby countries is its newfound ability to provide financial services.

As a company with access to consumers and vast amounts of data about their shopping behaviour, it was only natural for Allegro to eventually expand. Its financial services offering is handled through Allegro Pay, a subsidiary that provides loans to consumers but also selected financial services to merchants.

At last count, this division grew at a rate of over 50% p.a. This is down from triple-digit growth rates the two prior years, but these were also due to a base effect. By now, Allegro Pay has grown to a size where it moves the needle on a group level.

The fintech division recently signed an agreement to launch further banking services. Just how fast such fintech services can carry an e-commerce company is best analysed by the example of MercadoLibre (ISIN US58733R1023, Nasdaq:MELI). The South American equivalent to Amazon is a stock that Undervalued-Shares.com Members will be familiar with, through my in-depth research report from December 2021 (and a Weekly Dispatch as far back as January 2019). MercadoLibre's fintech division has grown at such a blistering pace that it will make up half of the company's value before too long, even though it's primarily known for delivering parcels to consumers.

Banks in Central and Eastern Europe are famous for offering very competitive online platforms, mobile apps, and consumer services. These are often ahead of comparable services in Western Europe, meaning Allegro has serious competition to overcome.

However, without a doubt, Allegro Pay is another huge opportunity for Allegro shareholders. In the case of MercadoLibre, news about its fintech division has already become a diver for its share price. At Allegro, this has yet to happen.

A Polish stock worth checking out

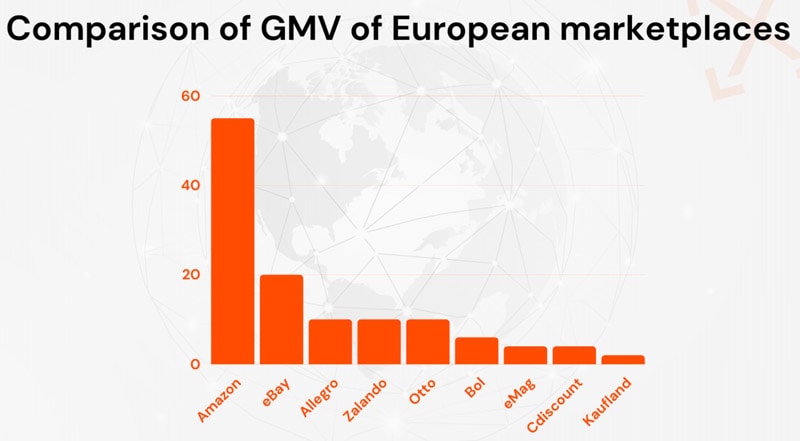

E-commerce penetration in Central and Eastern Europe varies a lot, but it's generally only about half that of Western Europe. The region has 90m consumers, and Allegro is now best-positioned to expand in the broader region, or act as a consolidator even. Meanwhile, it has captured a market share in its homeland that is somewhere between 40-50%, depending on which statistic you choose to believe. Over 70% of Poles view "Allegro" as the general term for buying things on the Internet. Within Europe, Allegro is the third-largest online marketplace besides Amazon and eBay. These are figures that should make investors take the company serious, and they make Allegro stock an interesting proxy for the growing consumer markets of the region.

Source: EXPANDO, 13 June 2023.

After the sudden rise in interest rate and the macro-economic shock caused by the war in Ukraine, Allegro decided to write down its investment in Mall Group by 25%. The jury is still out whether the company can make its new subsidiary perform as well as the operation it has back home. Following the chunky acquisition, it is also still in the midst of deleveraging financially.

Allegro is a fairly complex company to analyse – it has lots of moving parts.

For 2024 and heading into 2025, there may be a few surprises in store:

- Allegro's management has been coy to reveal overly many details about its plans for Allegro Pay, but there is an expectation to reveal products and services over the next couple of quarters, taking the market by surprise.

- Income from advertising is growing rapidly, and may become a bigger factor for Allegro than is currently anticipated.

- By 2026, Allegro could switch from being in debt to having net cash. This should start to become more apparent from next year.

Right now, it appears that not much of these prospects is priced in yet.

MercadoLibre is trading at a 2024 EV/EBITDA multiple of 20; in comparison, Allegro's 2024 EV/EBITDA multiple of 12 seems rather undemanding. Correspondingly, UBS currently puts a price target of PLN 48 onto the share, which is 54% above the current share price of PLN 31 on the Warsaw Stock Exchange. The stock is also easily tradeable through Frankfurt and other German exchanges (PLN 4.4 = 1 EUR).

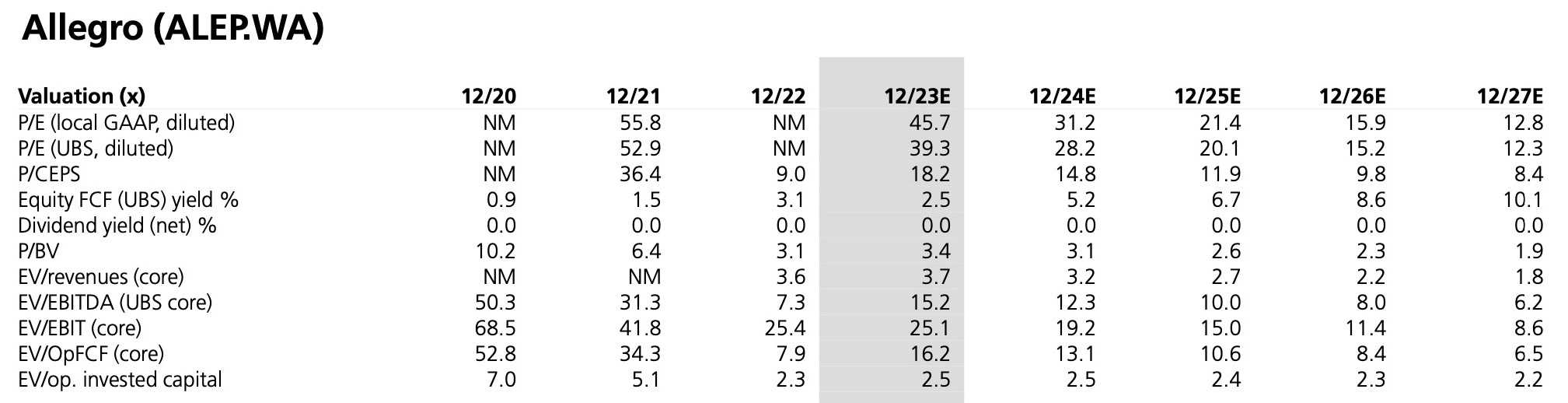

Source: UBS, 29 September 2023 (click on image to enlarge).

After taking a look at it from a 33,000-foot perspective, it appears like the combination of structural growth and a strong market position makes Allegro worth doing a bit more homework (which you should always do before deciding on an investment!). When I spend my New Year's holiday in Poland this year (Zakopane, here I come!), I may even try out the company's delivery services myself.

Hot off the press: new in-depth research report

My latest research report – published exclusively for Undervalued-Shares.com Lifetime Members last week – features a European bank stock.

"Yikes!", you might say.

Yikes indeed.

Don’t discard it just yet, though.

The company in question is in a market leading position and has a ≈EUR 5bn market cap. Its stock has daily trading volume in the millions, and a realistic chance of rising 50-100% over the coming 12-18 months.

Too compelling an investment case to disregard!

Hot off the press: new in-depth research report

My latest research report – published exclusively for Undervalued-Shares.com Lifetime Members last week – features a European bank stock.

"Yikes!", you might say.

Yikes indeed.

Don’t discard it just yet, though.

The company in question is in a market leading position and has a ≈EUR 5bn market cap. Its stock has daily trading volume in the millions, and a realistic chance of rising 50-100% over the coming 12-18 months.

Too compelling an investment case to disregard!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: